1. 調査手法および範囲

1.1. 調査手法

1.2. 調査目的およびレポートの範囲

2. 定義および概要

3. エグゼクティブサマリー

3.1. スニペットの種類別

3.2. スニペットの素材別

3.3. スニペットのエンドユーザー別

3.4. スニペットの地域別

4. 動向

4.1. 影響因子

4.1.1. 推進要因

4.1.1.1. 歯科疾患の発生率上昇

4.1.2. 抑制要因

4.1.2.1. 歯科治療費の高額さ

4.1.3. 機会

4.1.4. 影響分析

5. 業界分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 規制分析

5.5. 償還分析

5.6. 特許分析

5.7. SWOT分析

5.8. DMI意見

6. 種類別

6.1. はじめに

6.1.1. 市場規模分析および前年比成長率(%)、種類別

6.1.2. 市場魅力度指数、種類別

6.2. 歯科インプラント*

6.2.1. はじめに

6.2.2. 市場規模分析および前年比成長率(%)

6.2.3. 骨内インプラント

6.2.4. 骨膜下インプラント

6.2.5. All-on-4 インプラント

6.2.6. インプラントオーバーデンチャー

6.2.7. その他

6.3. 歯科補綴

6.4. 歯冠

6.4.1. 金属クラウン

6.4.2. ポーセレン・フュージド・メタル(PFM)クラウン

6.4.3. プレスセラミッククラウン

6.4.4. オールセラミックまたはポーセレンクラウン

6.4.5. 即日歯科用クラウン

6.4.6. オールレジンクラウン

6.5. 歯科ブリッジ

6.5.1. 従来型固定ブリッジ

6.5.2. カンチレバーブリッジ

6.5.3. メリーランド接着ブリッジ

6.6. 入れ歯

6.6.1. 総入れ歯

6.6.2. 部分入れ歯

6.6.3. その他

6.7. その他

7. 素材別

7.1. はじめに

7.1.1. 市場規模分析および前年比成長率分析(%)、素材別

7.1.2. 市場魅力度指数、素材別

7.2. 金属*

7.2.1. 市場概要

7.2.2. 市場規模分析および前年比成長率分析(%)

7.3. ポリマー

7.4. セラミック

7.5. 生体材料

7.6. その他

8. エンドユーザー別

8.1. はじめに

8.1.1. エンドユーザー別市場規模分析および前年比成長率(%)

8.1.2. エンドユーザー別市場魅力度指数

8.2. 歯科病院*

8.2.1. はじめに

8.2.2. 市場規模分析および前年比成長率分析(%)

8.3. 歯科クリニック

8.4. 学術機関

9. 地域別

9.1. はじめに

9.1.1. 地域別市場規模分析および前年比成長率分析(%)

9.1.2. 地域別市場魅力度指数

9.2. 北米

9.2.1. はじめに

9.2.2. 地域特有の主な動向

9.2.3. 市場規模分析および前年比成長率分析(%)種類別

9.2.4. 市場規模分析および前年比成長率分析(%)材料別

9.2.5. 市場規模分析および前年比成長率分析(%)エンドユーザー別

9.2.6. 市場規模の分析と前年比成長率の分析(%)、国別

9.2.6.1. 米国

9.2.6.2. カナダ

9.2.6.3. メキシコ

9.3. ヨーロッパ

9.3.1. はじめに

9.3.2. 主要地域特有の動向

9.3.3. 市場規模分析および前年比成長率分析(%)、種類別

9.3.4. 市場規模分析および前年比成長率分析(%)、材料別

9.3.5. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

9.3.6. 市場規模分析および前年比成長率分析(%)、国別

9.3.6.1. ドイツ

9.3.6.2. 英国

9.3.6.3. フランス

9.3.6.4. イタリア

9.3.6.5. スペイン

9.3.6.6. ヨーロッパのその他地域

9.4. 南アメリカ

9.4.1. はじめに

9.4.2. 主要地域特有の力学

9.4.3. 市場規模分析および前年比成長率(%)の種類別

9.4.4. 市場規模分析および前年比成長率(%)の素材別

9.4.5. 市場規模分析および前年比成長率(%)のエンドユーザー別

9.4.6. 市場規模分析および前年比成長率(%)の国別

9.4.6.1. ブラジル

9.4.6.2. アルゼンチン

9.4.6.3. 南米その他

9.5. アジア太平洋地域

9.5.1. はじめに

9.5.2. 主要地域特有の動向

9.5.3. 市場規模分析および前年比成長率分析(%)、種類別

9.5.4. 市場規模分析および前年比成長率分析(%)、材料別

9.5.5. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

9.5.6. 市場規模分析および前年比成長率分析(%)、国別

9.5.6.1. 中国

9.5.6.2. インド

9.5.6.3. 日本

9.5.6.4. 韓国

9.5.6.5. アジア太平洋地域その他

9.6. 中東およびアフリカ

9.6.1. はじめに

9.6.2. 主要地域特有の動向

9.6.3. 市場規模分析および前年比成長率分析(%)種類別

9.6.4. 市場規模分析および前年比成長率分析(%)、材料別

9.6.5. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

10. 競合状況

10.1. 競合シナリオ

10.2. 市場ポジショニング/シェア分析

10.3. 合併・買収分析

11. 企業プロフィール

Dentsply Sirona

ZimVie Inc.

Bicon

OSSTEM IMPLANT CO., LTD.

Nobel Biocare Services AG.

Glidewell

Institut Straumann AG

BioHorizons

Ivoclar Vivadent

MEGA’GEN IMPLANT CO., LTD.

リストは網羅的なものではありません

12. 付録

12.1. 当社およびサービスについて

12.2. お問い合わせ

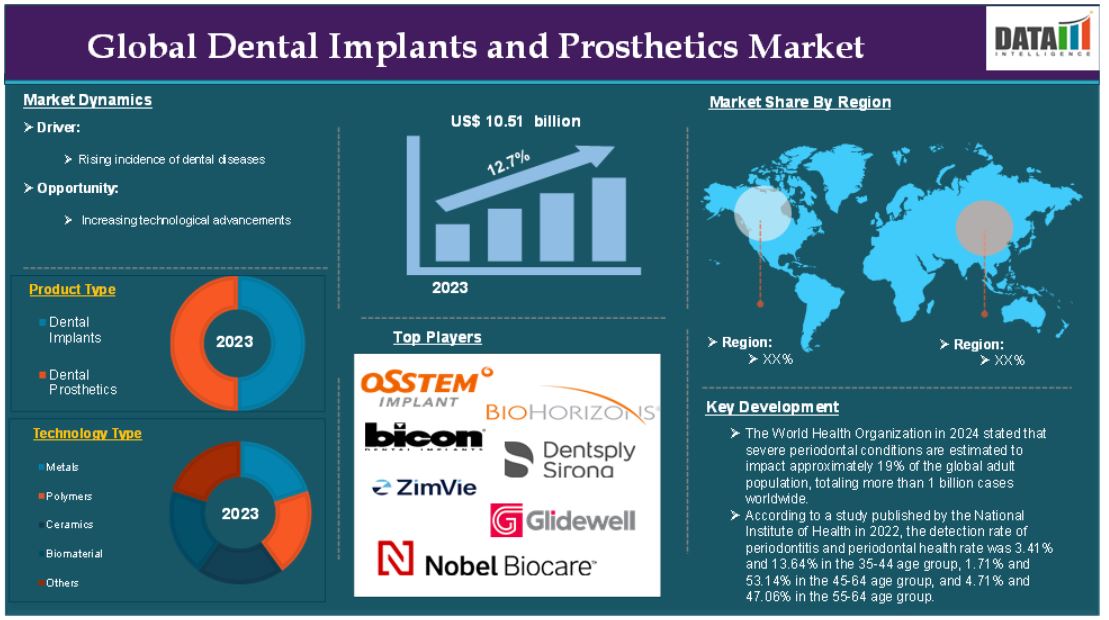

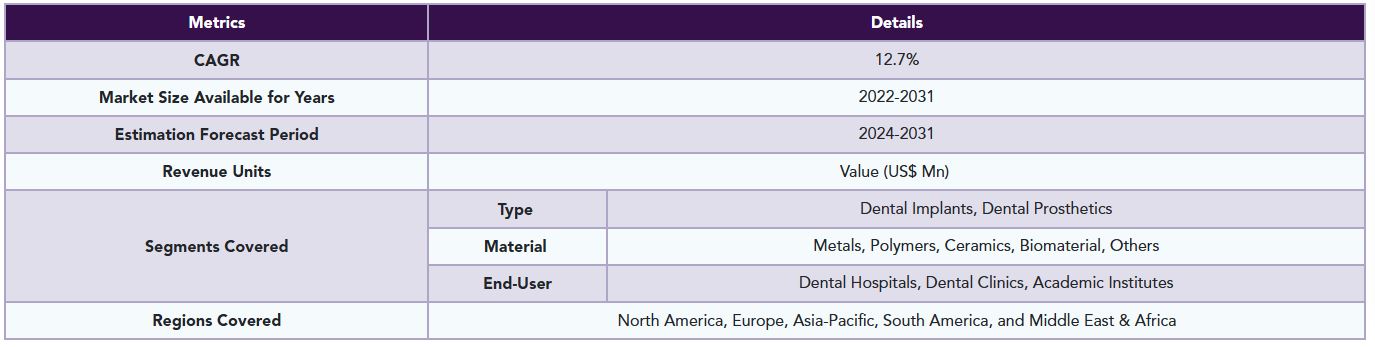

The global dental implants and prosthetics market reached US$ 10.51 billion in 2023 and is expected to reach US$ 27.15 billion by 2031, growing at a CAGR of 12.7% during the forecast period 2024-2031.

Dental implants are medical devices that are surgically implanted into the jaw to restore a person's chewing ability or appearance. They support prosthetic teeth like crowns, bridges, and dentures. The dental implant abutment is typically attached to the implant body through the abutment fixation screw and extends through the gums into the mouth to support the attached artificial teeth.

Dental prosthetics are dental devices that repair or replace missing or damaged teeth. Dental prostheses can do more than just improve the appearance, they can also minimize the risk of gum disease in the absence of a missing tooth, make biting easier, and keep the jawbone from deteriorating. There is a

Market Dynamics: Drivers & Restraints

Rising incidence of dental diseases

The increased prevalence of oral problems is significantly driving the dental implants and prosthetics market. The rise in dental disorders, such as dental caries and periodontal disease, significantly impacts the need for dental implants and prosthetics. As these disorders cause tooth loss, patients are increasingly seeking restorative options to maintain oral function and aesthetics. For instance, the World Health Organization in 2024 stated that severe periodontal conditions are estimated to impact approximately 19% of the global adult population, totaling more than 1 billion cases worldwide. Poor dental hygiene and tobacco use are the most significant risk factors for periodontal disease.

The global population is aging, and older people are more prone to dental problems that require implants and prosthetics. Age-related tooth loss is widespread, increasing demand for dental restoration treatments. For instance, according to a study published by the National Institute of Health in 2022, the detection rate of periodontitis and periodontal health rate was 3.41% and 13.64% in the 35-44 age group, 1.71% and 53.14% in the 45-64 age group, and 4.71% and 47.06% in the 55-64 age group.

High costs of dental procedures

The cost of dental implants and prosthetics is a significant obstacle for many patients. Implants, crowns, and bridges all require specific materials and cutting-edge technology, which contributes to their high cost. The financial burden can discourage patients from pursuing essential therapies, particularly in low- and middle-income countries where affordability is a key problem.

Segment Analysis

The global dental implants and prosthetics market is segmented based on type, material, end-user and region.

Type:

Dental implants segment is expected to dominate the dental implants and prosthetics market share

The dental implants segment is poised for dominance within the dental implants and prosthetics market due to a combination of rising dental disease prevalence, an aging population, technological advancements, increased aesthetic demands, and greater public awareness. For instance, according to the WHO Global Oral Health Status Report (2022), oral diseases impact about 3.5 billion people globally, with middle-income nations accounting for 3 out of every 4. An estimated 2 billion people worldwide suffer from permanent tooth decay, while 514 million children have primary tooth decay. These factors collectively contribute to robust growth for the dental implants segment, positioning it in the dominant position in the global dental implants and prosthetics market.

Dental technological innovations, such as improved implant materials (such as titanium), enhanced imaging techniques, and computer-aided design/manufacturing (CAD/CAM), improve the effectiveness and acceptability of dental implants among patients and practitioners. Companies are introducing advanced dental implant solutions in different regions. For instance, in March 2024, The With U Dental launched its advanced dental implant solution in Melbourne. With premium dental implants and skilled artisanal dentists, the team aims to provide patients with life-changing smiles and long-term oral health benefits. These innovations help to improve outcomes and promote patient satisfaction by contributing to the overall segment's growth.

Geographical Analysis

North America is expected to hold a significant position in the dental implants and prosthetics market share

North America is anticipated to maintain its leading position in the dental implants and prosthetics market, owing to several significant factors that contribute to its growth and dominance. The dominance of the region in the global market is contributed by the rising incidence of dental diseases, an increasing number of dental prosthetic procedures, rising technological advancements in the field of dentistry and the presence of major key players in the region.

There are large numbers of individuals in the region suffering from more than one dental disease each year. There is a growing number of incidences of serious dental conditions leading to the increasing demand for dental implantation and prosthetic restoration. For instance, according to the Centres for Disease Control and Prevention in 2024, 7 in 10 Mexican American children (70%) aged 6 to 9 years have had cavities in their primary (baby) or permanent teeth compared with 4 in 10 non-Hispanic White children (43%).

The companies are introducing advanced dental implants which could contribute to the market’s growth. For instance, in 2022, ZimVie Inc. launched the TSX Implant in the United States, the latest innovation in the company’s platform of surgical, restorative, and digital dentistry solutions. The growing emphasis on cosmetic improvements has resulted in a surge in demand for aesthetic dental treatments, including implants that have a natural appearance and feel, boosting the region's market expansion.

Asia-Pacific is growing at the fastest pace in the dental implants and prosthetics market

The Asia-Pacific (APAC) region is witnessing the fastest growth rate in the dental implants and prosthetics market, owing to a combination of factors such as high illness burden, improved healthcare access, low-cost generic medications, and government initiatives. Several emerging markets, including India, China, and Southeast Asian countries, are driving this expansion, which is transforming global market dynamics.

There is a growing number of older populations in the region which is one of the significant reasons for the rising dental diseases. For instance, according to the report by the ESCAP (Economic and Social Commission for Asia and the Pacific) in 2022, one in seven people were aged 60 years or older. By 2050, this age group is expected to represent one in every four persons. The region is experiencing exceptional growth in the number of older people compared to other parts of the world.

Competitive Landscape

The major global players in the dental implants and prosthetics market include Dentsply Sirona, ZimVie Inc., Bicon, OSSTEM IMPLANT CO., LTD., Nobel Biocare Services AG., Glidewell, Institut Straumann AG, BioHorizons, Ivoclar Vivadent, MEGA’GEN IMPLANT CO., LTD. among others.

Key Developments

• In July 2024, BioHorizons launched Tapered Pro Conical implants, the company’s first line of dental implants featuring a deep conical connection.

• In July 2024, ZimVie Inc. launched its GenTek Genuine Restorative Components product portfolio. The launch expands ZimVie’s portfolio of end-to-end prosthetic offerings and follows the recent receipt of FDA 510(k) clearance.

Why Purchase the Report?

• Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

• Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

• Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

• Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

• Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

• Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

• Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

• Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

• Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

• Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

• Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

• Post-market Surveillance: Uses post-market data to enhance product safety and access.

• Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global dental implants and prosthetics market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2023

• Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

• Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

• Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

• Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

• Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

• Supply Chain: Distribution and Supply Chain Managers.

• Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

• Academic & Research: Academic Institutions.

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Type

3.2. Snippet by Material

3.3. Snippet by End-User

3.4. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Rising incidence of dental diseases

4.1.2. Restraints

4.1.2.1. High costs of dental procedures

4.1.3. Opportunity

4.1.4. Impact Analysis

5. Industry Analysis

5.1. Porter's Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Regulatory Analysis

5.5. Reimbursement Analysis

5.6. Patent Analysis

5.7. SWOT Analysis

5.8. DMI Opinion

6. By Type

6.1. Introduction

6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

6.1.2. Market Attractiveness Index, By Type

6.2. Dental Implants*

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.2.3. Endosteal Implants

6.2.4. Subperiosteal Implants

6.2.5. All-on-4 Dental Implants

6.2.6. Implant Overdentures

6.2.7. Others

6.3. Dental Prosthetics

6.4. Dental Crowns

6.4.1. Metal Crowns

6.4.2. Porcelain-fused-to-metal (PFM) Crowns

6.4.3. Pressed Ceramic Crowns

6.4.4. All-ceramic or Porcelain Crowns

6.4.5. Same-day Dental Crowns

6.4.6. All-resin Crowns

6.5. Dental Bridges

6.5.1. Traditional Fixed Bridges

6.5.2. Cantilever Bridges

6.5.3. Maryland Bonded Bridges

6.6. Dentures

6.6.1. Complete Dentures

6.6.2. Partial Dentures

6.6.3. Others

6.7. Others

7. By Material

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

7.1.2. Market Attractiveness Index, By Material

7.2. Metals*

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.3. Polymers

7.4. Ceramics

7.5. Biomaterial

7.6. Others

8. By End-User

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

8.1.2. Market Attractiveness Index, By End-User

8.2. Dental Hospitals*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Dental Clinics

8.4. Academic Institutes

9. By Region

9.1. Introduction

9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

9.1.2. Market Attractiveness Index, By Region

9.2. North America

9.2.1. Introduction

9.2.2. Key Region-Specific Dynamics

9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.2.6.1. The U.S.

9.2.6.2. Canada

9.2.6.3. Mexico

9.3. Europe

9.3.1. Introduction

9.3.2. Key Region-Specific Dynamics

9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.3.6.1. Germany

9.3.6.2. UK

9.3.6.3. France

9.3.6.4. Italy

9.3.6.5. Spain

9.3.6.6. Rest of Europe

9.4. South America

9.4.1. Introduction

9.4.2. Key Region-Specific Dynamics

9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.4.6.1. Brazil

9.4.6.2. Argentina

9.4.6.3. Rest of South America

9.5. Asia-Pacific

9.5.1. Introduction

9.5.2. Key Region-Specific Dynamics

9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.5.6.1. China

9.5.6.2. India

9.5.6.3. Japan

9.5.6.4. South Korea

9.5.6.5. Rest of Asia-Pacific

9.6. Middle East and Africa

9.6.1. Introduction

9.6.2. Key Region-Specific Dynamics

9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

9.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10. Competitive Landscape

10.1. Competitive Scenario

10.2. Market Positioning/Share Analysis

10.3. Mergers and Acquisitions Analysis

11. Company Profiles

11.1. Dentsply Sirona*

11.1.1. Company Overview

11.1.2. Product Portfolio and Description

11.1.3. Financial Overview

11.1.4. Key Developments

11.2. ZimVie Inc.

11.3. Bicon

11.4. OSSTEM IMPLANT CO., LTD.

11.5. Nobel Biocare Services AG.

11.6. Glidewell

11.7. Institut Straumann AG

11.8. BioHorizons

11.9. Ivoclar Vivadent

11.10. MEGA’GEN IMPLANT CO., LTD.

LIST NOT EXHAUSTIVE

12. Appendix

12.1. About Us and Services

12.2. Contact Us

*** 歯科インプラント&補綴の世界市場に関するよくある質問(FAQ) ***

・歯科インプラント&補綴の世界市場規模は?

→DataM Intelligence社は2023年の歯科インプラント&補綴の世界市場規模を105.1億米ドルと推定しています。

・歯科インプラント&補綴の世界市場予測は?

→DataM Intelligence社は2031年の歯科インプラント&補綴の世界市場規模を271.5億米ドルと予測しています。

・歯科インプラント&補綴市場の成長率は?

→DataM Intelligence社は歯科インプラント&補綴の世界市場が2024年~2031年に年平均12.7%成長すると展望しています。

・世界の歯科インプラント&補綴市場における主要プレイヤーは?

→「Dentsply Sirona、ZimVie Inc.、Bicon、OSSTEM IMPLANT CO., LTD.、Nobel Biocare Services AG.、Glidewell、Institut Straumann AG、BioHorizons、Ivoclar Vivadent、MEGA’GEN IMPLANT CO., LTD.など ...」を歯科インプラント&補綴市場のグローバル主要プレイヤーとして判断しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、最終レポートの情報と少し異なる場合があります。

*** 免責事項 ***

https://www.globalresearch.co.jp/disclaimer/