1. 調査手法および範囲

1.1. 調査手法

1.2. 調査目的およびレポートの範囲

2. 定義および概要

3. エグゼクティブサマリー

3.1. 製品種類別抜粋

3.2. 疾患状態別抜粋

3.3. エンドユーザー別抜粋

4. 動向

4.1. 影響を与える要因

4.1.1. 推進要因

4.1.1.1. 技術的進歩の進展

4.1.1.2. XX

4.2. 阻害要因

4.2.1.1. 機器の高コスト

4.3. 機会

4.3.1. 影響分析

5. 業界分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 規制分析

6. 製品種類別

6.1. はじめに

6.1.1. 市場規模分析および前年比成長率(%) 製品種類別

6.1.2. 市場魅力度指数 製品種類別

6.2. 血液透析装置*

6.2.1. はじめに

6.2.2. 市場規模分析および前年比成長率分析(%)

6.3. 腹膜透析装置

6.4. その他

7. 病状別

7.1. はじめに

7.1.1. 市場規模分析および前年比成長率分析(%)、病状別

7.1.2. 市場魅力度指数、疾患別

7.2. 慢性*

7.2.1. はじめに

7.2.2. 市場規模分析および前年比成長率分析(%)

7.3. 急性

8. エンドユーザー別

8.1. はじめに

8.1.1. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

8.1.2. 市場魅力度指数、エンドユーザー別

8.2. 病院*

8.2.1. 概要

8.2.2. 市場規模分析および前年比成長率分析(%)

8.3. 診療所

8.4. 透析センター

8.5. 外来外科センター

8.6. 在宅医療

9. 競合状況

9.1. 競合シナリオ

9.2. 市場ポジショニング/シェア分析

9.3. 合併・買収分析

10. 企業プロフィール

T Nikkiso Co., Ltd

Fresenius Medical Care Japan K.K

Kawasumi Laboratories, Inc

Asahi Kasei Medical Co., Ltd

Toray Medical Co., Ltd

Terumo Corporation

Nipro Corporation

JMS Co., Ltd

リストは網羅的なものではありません。

13. 付録

13.1 当社およびサービスについて

13.2 お問い合わせ

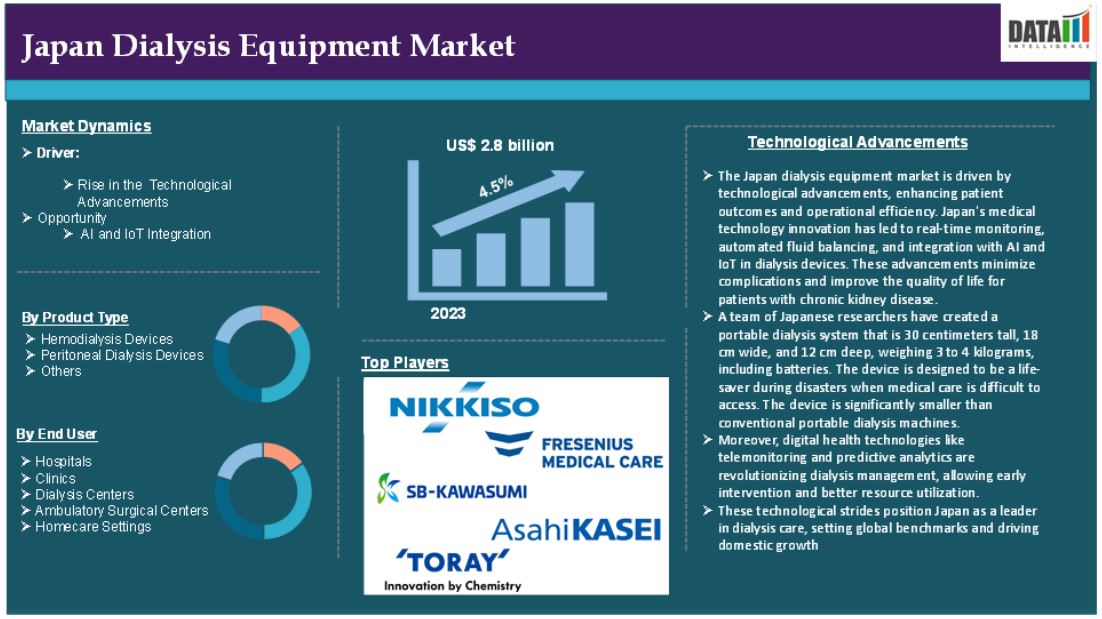

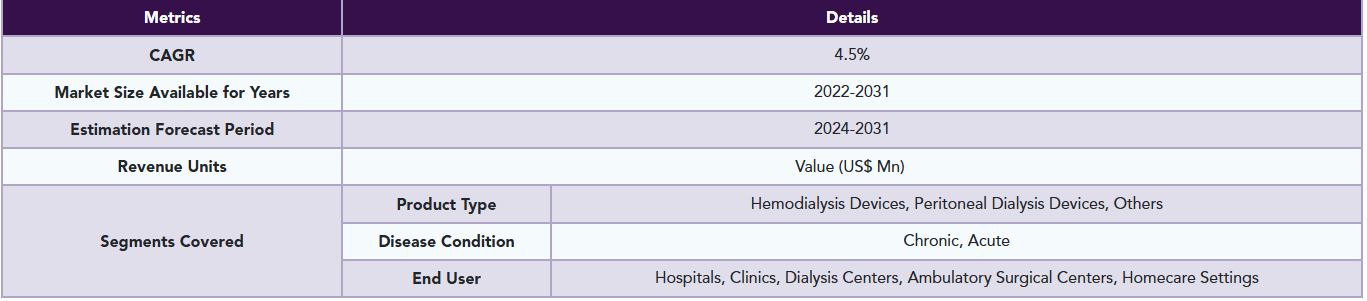

The Japan dialysis equipment market reached US$ 2.8 billion in 2023 and is expected to reach US$ 4.06 billion by 2031, growing at a CAGR of 4.5% during the forecast period 2024-2031.

A dialysis machine is a medical device that filters blood during hemodialysis procedures, maintaining electrolyte balance and temperature. The dialysis machine is a device that mixes and monitors the fluid called dialysate, which removes waste products from the blood and maintains proper levels of electrolytes and minerals. It also monitors blood flow outside the body and may sound an alarm to alert the user of any necessary checks.

Market Dynamics: Drivers & Restraints

Rise in the Technological Advancements

The Japan dialysis equipment market is driven by technological advancements, enhancing patient outcomes and operational efficiency. Japan's medical technology innovation has led to real-time monitoring, automated fluid balancing, and integration with AI and IoT in dialysis devices. These advancements minimize complications and improve the quality of life for patients with chronic kidney disease.

Portable and home-based dialysis systems are also gaining traction. Biocompatible dialyzers and high-performance membranes have improved filtration efficiency and reduced adverse reactions. Japanese manufacturers, collaborating with academic institutions, develop reliable systems tailored to local healthcare needs.

For instance, a team of Japanese researchers have created a portable dialysis system that is 30 centimeters tall, 18 cm wide, and 12 cm deep, weighing 3 to 4 kilograms, including batteries. The device is designed to be a life-saver during disasters when medical care is difficult to access. The device is significantly smaller than conventional portable dialysis machines.

Moreover, digital health technologies like telemonitoring and predictive analytics are revolutionizing dialysis management, allowing early intervention and better resource utilization. These technological strides position Japan as a leader in dialysis care, setting global benchmarks and driving domestic growth.

High Cost of the Equipment

Japan's dialysis equipment market faces significant restraint due to the high cost of equipment, despite the country's advanced healthcare infrastructure and high demand for renal care services. Initial investments and ongoing maintenance expenses pose financial challenges for healthcare providers, especially smaller clinics and rural facilities. Japan's universal healthcare system and reimbursement policies alleviate some financial strain for patients, but operational expenses remain a barrier. Addressing this restraint through cost-effective innovations, government subsidies, or partnerships could ensure broader accessibility and market growth in Japan's dialysis sector.

For instance, A Nipro dialysis machine is a medical device used in hospitals, clinics, and diagnostic centers to filter blood when kidneys cannot purify it. The average price in India is between 1223995-1500000 Japan Yen, depending on machine type, throughput, capacity, advanced features, accessories, and models. These machines can be purchased online from hospital stores.

Segment Analysis

The Japan dialysis equipment market is segmented based on product type, disease condition and end user.

Product Type:

Hemodialysis Devices segment is expected to dominate the dialysis equipment market share

The hemodialysis devices segment holds a major portion of the dialysis equipment market share and is expected to continue to hold a significant portion of the dialysis equipment market share during the forecast period.

Japan has seen a significant growth in the end-stage renal disease hemodialysis devices market due to innovative dialyzing systems. The country has one of the highest per capita dialysis patients globally, emphasizing the importance of efficient devices for the elderly population. Hemodialysis devices help patients clean blood from harmful substances like toxins, waste, and excess water due to kidney failure.

The Japan market is characterized by high-tech machines with accuracy, reliability, and patient safety.

Advancements in real-time monitoring, automatic functions, and easy navigation have driven the adoption of hemodialysis equipment. Local players understand local market demands, dominating the market, while international players bring better technologies and quality. The use of AI and IoT devices in hemodialysis machines is also increasing due to improved treatment protocols and results. Government policies and reimbursement systems also contribute to the market for hemodialysis devices in Japan.

Hospitals segment is the fastest-growing segment in the dialysis equipment market share

The hospitals segment is the fastest-growing segment in the dialysis equipment market share and is expected to hold the market share over the forecast period.

Japan's hospitals are key providers of hemodialysis services, offering comprehensive services like patient monitoring, emergency care, and individualized treatment plans. With a universal healthcare system and specialized nephrology departments, hospitals are central to delivering dialysis treatments to the growing patient population.

They provide state-of-the-art equipment, support cutting-edge technologies, and facilitate research and clinical trials. Japan's hospitals maintain rigorous standards for infection control and patient safety, ensuring the dialysis process adheres to the highest quality benchmarks. Urban hospitals house larger dialysis centers, while rural hospitals work towards expanding accessibility. Government funding and insurance coverage encourage patients to seek care from these well-equipped facilities. As chronic kidney disease burdens rise, hospitals will continue to drive the growth and evolution of the dialysis equipment market in Japan.

Competitive Landscape

The major Japan players in the dialysis equipment market include T Nikkiso Co., Ltd, Fresenius Medical Care Japan K.K, Kawasumi Laboratories, Inc, Asahi Kasei Medical Co., Ltd., Toray Medical Co., Ltd., Terumo Corporation,Nipro Corporation, JMS Co., Ltd among others.

Emerging Players

The emerging players in the dialysis equipment market include Medikit Co., Ltd, Sanritsu Corporation, Hitachi Healthcare Systems, Kyowa Hakko Kirin Co., Ltd and among others.

Key Developments

• In September 2022, WEGO Terumo, a joint venture between WEGO and Terumo, has received regulatory approval from the National Medical Products Administration to manufacture and market a new neutral peritoneal dialysis solution.

Why Purchase the Report?

• To visualize the Japan dialysis equipment market segmentation based on product type, disease condition, end user and understand key commercial assets and players.

• Identify commercial opportunities by analyzing trends and co-development.

• Excel data sheet with numerous data points of the dialysis equipment market with all segments.

• PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

• Product mapping is available in excel consisting of key products of all the major players.

The Japan dialysis equipment market report would provide approximately 70 tables, 65 figures, and 184 pages.

Target Audience 2023

• Manufacturers/ Buyers

• Industry Investors/Investment Bankers

• Research Professionals

• Emerging Companies

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Product Type

3.2. Snippet by Disease Condition

3.3. Snippet by End User

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Rise in the Technological Advancements

4.1.1.2. XX

4.2. Restraints

4.2.1.1. High Cost of the Equipment

4.3. Opportunity

4.3.1. Impact Analysis

5. Industry Analysis

5.1. Porter’s Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Regulatory Analysis

6. By Product Type

6.1. Introduction

6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

6.1.2. Market Attractiveness Index, By Product Type

6.2. Hemodialysis Devices*

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.3. Peritoneal Dialysis Devices

6.4. Others

7. By Disease Condition

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Condition

7.1.2. Market Attractiveness Index, By Disease Condition

7.2. Chronic*

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.3. Acute

8. By End User

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

8.1.2. Market Attractiveness Index, By End User

8.2. Hospitals*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Clinics

8.4. Dialysis Centers

8.5. Ambulatory Surgical Centers

8.6. Homecare Settings

9. Competitive Landscape

9.1. Competitive Scenario

9.2. Market Positioning/Share Analysis

9.3. Mergers and Acquisitions Analysis

10. Company Profiles

10.1. Nikkiso Co., Ltd.*

10.1.1. Company Overview

10.1.2. Product Portfolio and Description

10.1.3. Financial Overview

10.1.4. Key Developments

10.2. Fresenius Medical Care Japan K.K.

10.3. Kawasumi Laboratories, Inc.

10.4. Asahi Kasei Medical Co., Ltd.

10.5. Toray Medical Co., Ltd.

10.6. Terumo Corporation

10.7. Nipro Corporation

10.8. JMS Co., Ltd.

LIST NOT EXHAUSTIVE

13. Appendix

13.1 About Us and Services

13.2 Contact Us

*** 免責事項 ***

https://www.globalresearch.co.jp/disclaimer/