1. 調査手法および範囲

1.1. 調査手法

1.2. 調査目的およびレポートの範囲

2. 定義および概要

3. エグゼクティブサマリー

3.1. 製品種類別抜粋

3.2. 技術別抜粋

3.3. 用途別抜粋

3.4. エンドユーザー別抜粋

3.5. 地域別抜粋

4. ダイナミクス

4.1. 影響因子

4.1.1. 推進要因

4.1.1.1. 医療機器へのAIの統合

4.1.1.2. XX

4.1.2. 抑制要因

4.1.2.1. 厳格な規制認可

4.1.3. 機会

4.1.4. 影響分析

5. 産業分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 規制分析

6. 製品種類別

6.1. はじめに

6.1.1. 製品種類別分析および前年比成長率(%)

6.1.2. 製品種類別市場魅力度指数

6.2. ハードウェア *

6.2.1. はじめに

6.2.2. 市場規模分析および前年比成長率分析(%)

6.3. ソフトウェア

6.4. サービス

7. テクノロジー別

7.1. はじめに

7.1.1. 市場規模分析および前年比成長率分析(%)、技術別

7.1.2. 市場魅力度指数、技術別

7.2. 機械学習 *

7.2.1. はじめに

7.2.2. 市場規模分析および前年比成長率分析(%)

7.3. ディープラーニング

7.4. 自然言語処理(NLP)

7.5. コンピュータビジョン

7.6. その他

8. 用途別

8.1. はじめに

8.1.1. 用途別市場規模分析および前年比成長率(%)

8.1.2. 用途別市場魅力度指数

8.2. 放射線医学*

8.2.1. はじめに

8.2.2. 市場規模分析および前年比成長率分析(%)

8.3. 循環器学

8.4. 血液学

8.5. 腫瘍学

8.6. 整形外科画像

8.7. その他

9. エンドユーザー別

9.1. はじめに

9.1.1. エンドユーザー別市場規模分析および前年比成長率(%)

9.1.2. エンドユーザー別市場魅力度指数

9.2. 病院および医療サービスプロバイダー*

9.2.1. イントロダクション

9.2.2. 市場規模分析および前年比成長率(%)

9.3. 製薬会社およびバイオテクノロジー企業

9.4. 医療保険者

9.5. その他

10. 地域別

10.1. はじめに

10.1.1. 市場規模分析および前年比成長率分析(%)、地域別

10.1.2. 市場魅力度指数、地域別

10.2. 北米

10.2.1. はじめに

10.2.2. 主要地域別の動向

10.2.3. 市場規模および前年比成長率(%)製品種類別

10.2.4. 市場規模および前年比成長率(%)技術別

10.2.5. 市場規模および前年比成長率(%)用途別

10.2.6. エンドユーザー別市場規模分析および前年比成長率分析(%)

10.2.7. 国別市場規模分析および前年比成長率分析(%)

10.2.7.1. 米国

10.2.7.2. カナダ

10.2.7.3. メキシコ

10.3. ヨーロッパ

10.3.1. はじめに

10.3.2. 主要地域別の動向

10.3.3. 製品種類別市場規模分析および前年比成長率(%)

10.3.4. 技術別市場規模分析および前年比成長率(%)

10.3.5. 用途別市場規模分析および前年比成長率(%)

10.3.6. エンドユーザー別市場規模分析および前年比成長率分析(%)

10.3.7. 国別市場規模分析および前年比成長率分析(%)

10.3.7.1. ドイツ

10.3.7.2. 英国

10.3.7.3. フランス

10.3.7.4. スペイン

10.3.7.5. イタリア

10.3.7.6. ヨーロッパのその他地域

10.4. 南アメリカ

10.4.1. はじめに

10.4.2. 主要地域別の動向

10.4.3. 市場規模分析および前年比成長率分析(%)、製品種類別

10.4.4. 市場規模分析および前年比成長率(%)、技術別

10.4.5. 市場規模分析および前年比成長率(%)、用途別

10.4.6. 市場規模分析および前年比成長率(%)、エンドユーザー別

10.4.7. 市場規模分析および前年比成長率(%)、国別

10.4.7.1. ブラジル

10.4.7.2. アルゼンチン

10.4.7.3. 南米その他

10.5. アジア太平洋地域

10.5.1. はじめに

10.5.2. 地域特有の主な動向

10.5.3. 市場規模分析および前年比成長率分析(%)、製品種類別

10.5.4. 市場規模分析および前年比成長率分析(%)、技術別

10.5.5. 市場規模分析および前年比成長率分析(%)、用途別

10.5.6. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

10.5.7. 市場規模分析および前年比成長率分析(%)、国別

10.5.7.1. 中国

10.5.7.2. インド

10.5.7.3. 日本

10.5.7.4. 韓国

10.5.7.5. アジア太平洋地域その他

10.6. 中東およびアフリカ

10.6.1. はじめに

10.6.2. 主要地域特有の動向

10.6.3. 市場規模分析および前年比成長率分析(%)、製品種類別

10.6.4. 市場規模分析および前年比成長率分析(%)、技術別

10.6.5. 市場規模分析および前年比成長率分析(%)、用途別

10.6.6. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

11. 競合状況

11.1. 競合シナリオ

11.2. 市場ポジショニング/シェア分析

11.3. 合併・買収分析

12. 企業プロフィール

GE HealthCare.

Medtronic, Siemens Healthineers AG

NVIDIA Corporation

Koninklijke Philips N.V.

Canon Medical Systems

USA, Inc.

Aidoc

IBM

Apple Inc.

Google DeepMind

HYPERFINE, INC.

Clarius

リストは網羅的なものではありません。

13. 付録

13.1. 当社およびサービスについて

13.2. お問い合わせ

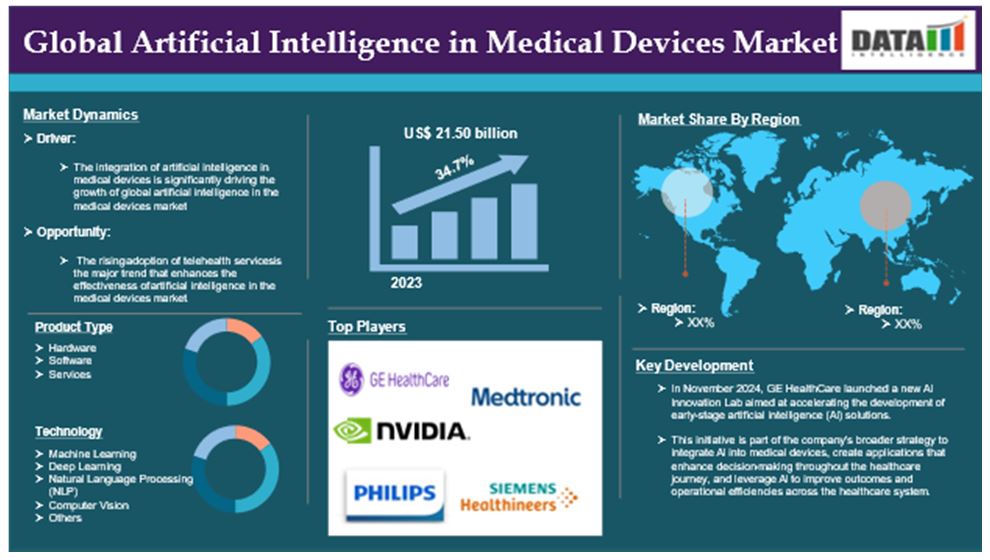

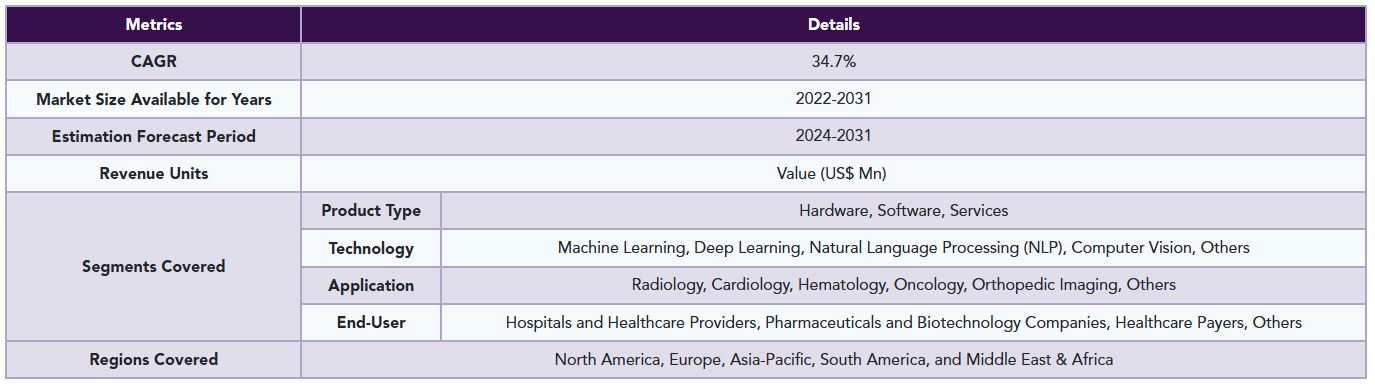

The global artificial intelligence in medical devices market reached US$ 21.50 billion in 2023 and is expected to reach US$ 228.98 billion by 2031, growing at a CAGR of 34.7% during the forecast period 2024-2031.

Artificial intelligence in medical devices transforming the industry by fostering innovation and enhancing efficiency. Its applications range from data management and diagnostic support to improving patient experiences and ensuring regulatory compliance. AI is poised to be a key player in the future of healthcare. As the industry progresses, the transformative capabilities of AI will undoubtedly influence the development of the next generation of medical devices, making healthcare more efficient, accessible, and effective.

AI technologies, particularly machine learning algorithms, are increasingly being integrated into diagnostic tools to boost accuracy. For instance, AI can analyze medical images such as X-rays, MRIs, and CT scans more swiftly and accurately than traditional methods. This capability helps to lower the rates of misdiagnosis, which is a major concern in healthcare. These factors have driven the global artificial intelligence in medical devices market expansion.

Executive Summary

Market Dynamics: Drivers & Restraints

Integration of AI in Medical Devices

The integration of artificial intelligence in medical devices is significantly driving the growth of global artificial intelligence in the medical devices market and is expected to drive throughout the market forecast period.

Artificial intelligence (AI) is significantly transforming the medical devices industry by introducing innovative solutions and improving operational efficiency across various healthcare applications.

The integration of artificial intelligence (AI) in medical devices involves incorporating advanced technologies such as machine learning, deep learning, natural language processing, and computer vision into medical tools and equipment. This integration enables these devices to analyze complex medical data, assist healthcare professionals in making informed decisions, and automate various processes within clinical environments. All these factors drive global artificial intelligence in medical devices market.

Furthermore, key players in the industry strategies such as partnerships & collaborations, innovative launches, and product approvals would drive this global artificial intelligence in medical devices market. For instance, in March 2023, NVIDIA announced a collaboration with Medtronic, the world’s largest healthcare technology provider, to accelerate the integration of artificial intelligence (AI) into the healthcare system and enhance patient care through new AI-based solutions. This partnership aims to incorporate NVIDIA’s advanced healthcare and edge AI technologies into Medtronic's GI Genius intelligent endoscopy module, which is developed and manufactured by Cosmo Pharmaceuticals.

Similarly, in November 2024, GE HealthCare launched a new AI Innovation Lab aimed at accelerating the development of early-stage artificial intelligence (AI) solutions. This initiative is part of the company's broader strategy to integrate AI into medical devices, create applications that enhance decision-making throughout the healthcare journey, and leverage AI to improve outcomes and operational efficiencies across the healthcare system. All these factors demand global artificial intelligence in medical devices market.

Moreover, the rising adoption of telehealth services contributes to the global artificial intelligence in medical devices market expansion.

Stringent Regulatory Approvals

The stringent regulatory approvals will hinder the growth of global artificial intelligence in medical devices. The regulatory environment for medical devices that incorporate artificial intelligence (AI) presents considerable complexities that can hinder the timely introduction of new products to artificial intelligence in medical devices market.

The regulation of AI-enabled medical devices is intricate and varies significantly across different regions. For instance, regulatory bodies like the FDA in the United States and the MHRA in the UK have distinct frameworks governing the safety, efficacy, and compliance of these devices. This complexity can lead to delays in product development and artificial intelligence in medical devices market entry.

According to a ScienceDirect research publication in 2024, numerous generative and non-generative AI tools have been developed for various applications in healthcare, with many medical device manufacturers leveraging AI and machine learning (ML) to innovate their products. Regulating AI tools not only facilitates the safe and effective integration of these technologies into healthcare but also fosters public trust.

Regulators must possess a solid understanding of AI and the challenges associated with its development, deployment, and monitoring in healthcare. Thus, the above factors could be limiting the global artificial intelligence in medical devices market's potential growth.

Segment Analysis

The global artificial intelligence in medical devices market is segmented based on product type, technology, application, end-user, and region.

Product Type:

The software segment is expected to dominate the global artificial intelligence in medical devices market share

The software segment holds a major portion of the global artificial intelligence in medical devices market share and is expected to continue to hold a significant portion of the global artificial intelligence in medical devices market share during the forecast period.

The software segment is expected to capture the largest share of the AI in medical devices market, outpacing both hardware and services. This growth is fueled by a rising demand for advanced AI solutions that improve diagnostic accuracy and enhance operational efficiency. For instance, advancements in natural language processing (NLP) have resulted in the creation of software tools that convert physician notes into electronic health records (EHRs), thereby streamlining workflow efficiency.

Furthermore, key players in the industry product launches and approvals would drive this segment's growth in the global artificial intelligence in medical devices market. For instance, in July 2024, Hyperfine announced the clearance of its ninth generation of AI-powered software. This advanced software significantly reduces scan times across various MRI sequences without compromising image quality. The recent FDA clearance further establishes Hyperfine's leadership in AI-driven health technology.

Also, in May 2023, Formus Labs announced that it had received 510(k) clearance from the United States Food and Drug Administration (FDA) for its product, Formus Hip, which is recognized as the first "automated radiological image processing software" specifically designed for pre-operative planning in hip replacement surgeries. This clearance marks a significant milestone for the New Zealand-based company as it prepares to expand its presence in the U.S. market. These factors have solidified the segment's position in the global artificial intelligence in medical devices market.

Geographical Analysis

North America is expected to hold a significant position in the global artificial intelligence in medical devices market share

North America holds a substantial position in the global artificial intelligence in medical devices market and is expected to hold most of the market share.

The growing adoption of healthcare IT solutions is driving the expansion of AI in medical devices. Healthcare providers are increasingly utilizing AI technologies to boost operational efficiency, enhance patient outcomes, and streamline administrative tasks. The rapid increase in healthcare data generated from various sources such as electronic health records (EHRs), medical imaging, and wearable devices creates a need for advanced analytical tools.

AI can effectively process and analyze this vast amount of data, leading to improved diagnostics and personalized treatment plans. The increasing popularity of wearable health monitoring devices is driving demand for AI-enabled solutions that can analyze real-time data and provide actionable insights for both patients and healthcare providers.

Furthermore, in this region, a major number of key players' presence, well-advanced healthcare infrastructure, government initiatives & regulatory support, investments, and product launches & approvals would propel the artificial intelligence in medical devices market growth. For instance, in June 2022, Hyperfine, Inc. made a significant impact in the field of medical imaging with its Swoop system, which is recognized as the first FDA-cleared portable magnetic resonance imaging (MRI) device designed for point-of-care applications. The Swoop system is designed to be portable, allowing it to be brought directly to a patient's bedside.

Also, in March 2024, Clarius Mobile Health received Health Canada approval for its innovative Clarius Bladder AI, a non-invasive tool designed to automatically measure bladder volume in just seconds. This technology is now available in Canada alongside the Clarius PAL HD3, Clarius PA HD3, and Clarius C3 HD3 wireless handheld ultrasound scanners.

Thus, the above factors are consolidating the region's position as a dominant force in the global artificial intelligence in medical devices market.

Asia Pacific is growing at the fastest pace in the global artificial intelligence in medical devices market

Asia Pacific holds the fastest pace in the global artificial intelligence in medical devices market and is expected to hold most of the market share.

The rising rates of chronic illnesses such as diabetes, cardiovascular diseases, and respiratory disorders are driving the demand for advanced medical devices that utilize AI technologies for improved diagnosis and management.

The Asia-Pacific region is increasing the need for healthcare services and technologies that address age-related health issues, thereby boosting the market for artificial intelligence in medical devices investments in healthcare infrastructure across Asia-Pacific countries are facilitating the adoption of AI technologies. Enhanced infrastructure supports the integration of AI into medical devices, improving their functionality and effectiveness.

Furthermore, key players in the region's initiatives such as product launches would drive this artificial intelligence in medical devices market growth. For instance, in April 2024, Singapore's National University Hospital (NUH) launched an AI-driven digestive center that integrates three advanced artificial intelligence systems to enhance the early detection and diagnosis of stomach cancers. This initiative aims to improve clinical outcomes by leveraging AI technologies in the diagnostic process.

Also, in November 2023, Meihua International Medical Technologies Co. (MHUA) announced the launch of Speed Fox, an innovative artificial intelligence (AI)-powered warehouse management and medical device logistics platform. This initiative represents a significant advancement in the field of medical device logistics, aiming to streamline operations and enhance efficiency. Thus, the above factors are consolidating the region's position as the fastest-growing force in the global artificial intelligence in medical devices market.

Competitive Landscape

The major global players in the artificial intelligence in medical devices market include GE HealthCare., Medtronic, Siemens Healthineers AG, NVIDIA Corporation, Koninklijke Philips N.V., Canon Medical Systems, USA, Inc., Aidoc, IBM, Apple Inc., Google DeepMind, HYPERFINE, INC., and Clarius among others.

Emerging Players

The emerging players in the global artificial intelligence in medical devices market include Mediwhale Inc., xCures, Inc., and Formus Labs Ltd among others.

Key Developments

• In May 2024, The Medicines and Healthcare Products Regulatory Agency (MHRA) launched AI Airlock, a new regulatory sandbox designed to address the challenges associated with regulating medical devices that utilize artificial intelligence (AI). This initiative aims to facilitate the safe development and deployment of AI as a Medical Device (AIaMD). AI Airlock serves as a controlled environment where developers can test their AI medical devices under regulatory supervision.

• In March 2024, Clarius Mobile Health, received approval from Health Canada for its innovative Clarius PAL HD3 wireless handheld whole-body ultrasound scanner. This device is notable for its ability to provide high-definition imaging of both superficial and deep anatomical structures using a single dual-array scanner. The Clarius PAL HD3 operates seamlessly with an app on both iPhone and Android smart devices, making it highly accessible for healthcare professionals.

Why Purchase the Report?

• To visualize the global artificial intelligence in medical devices market segmentation based on product type, technology, application, end-user, and region and understand key commercial assets and players.

• Identify commercial opportunities by analyzing trends and co-development.

• Excel data sheet with numerous data points of the artificial intelligence in medical devices market with all segments.

• PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

• Product mapping is available in excel consisting of key products of all the major players.

The global artificial intelligence in medical devices market report would provide approximately 76 tables, 70 figures, and 183 pages.

Target Audience 2023

• Manufacturers/ Buyers

• Industry Investors/Investment Bankers

• Research Professionals

• Emerging Companies

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Product Type

3.2. Snippet by Technology

3.3. Snippet by Application

3.4. Snippet by End-User

3.5. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Integration of AI in Medical Devices

4.1.1.2. XX

4.1.2. Restraints

4.1.2.1. Stringent Regulatory Approvals

4.1.3. Opportunity

4.1.4. Impact Analysis

5. Industry Analysis

5.1. Porter’s Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Regulatory Analysis

6. By Product Type

6.1. Introduction

6.1.1. Analysis and Y-o-Y Growth Analysis (%), By Product Type

6.1.2. Market Attractiveness Index, By Product Type

6.2. Hardware *

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.3. Software

6.4. Services

7. By Technology

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

7.1.2. Market Attractiveness Index, By Technology

7.2. Machine Learning *

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.3. Deep Learning

7.4. Natural Language Processing (NLP)

7.5. Computer Vision

7.6. Others

8. By Application

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

8.1.2. Market Attractiveness Index, By Application

8.2. Radiology*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Cardiology

8.4. Hematology

8.5. Oncology

8.6. Orthopedic Imaging

8.7. Others

9. By End-User

9.1. Introduction

9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.1.2. Market Attractiveness Index, By End-User

9.2. Hospitals and Healthcare Providers*

9.2.1. Introduction

9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

9.3. Pharmaceuticals and Biotechnology Companies

9.4. Healthcare Payers

9.5. Others

10. By Region

10.1. Introduction

10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

10.1.2. Market Attractiveness Index, By Region

10.2. North America

10.2.1. Introduction

10.2.2. Key Region-Specific Dynamics

10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

10.2.7.1. U.S.

10.2.7.2. Canada

10.2.7.3. Mexico

10.3. Europe

10.3.1. Introduction

10.3.2. Key Region-Specific Dynamics

10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

10.3.7.1. Germany

10.3.7.2. U.K.

10.3.7.3. France

10.3.7.4. Spain

10.3.7.5. Italy

10.3.7.6. Rest of Europe

10.4. South America

10.4.1. Introduction

10.4.2. Key Region-Specific Dynamics

10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

10.4.7.1. Brazil

10.4.7.2. Argentina

10.4.7.3. Rest of South America

10.5. Asia-Pacific

10.5.1. Introduction

10.5.2. Key Region-Specific Dynamics

10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

10.5.7.1. China

10.5.7.2. India

10.5.7.3. Japan

10.5.7.4. South Korea

10.5.7.5. Rest of Asia-Pacific

10.6. Middle East and Africa

10.6.1. Introduction

10.6.2. Key Region-Specific Dynamics

10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

11.1. Competitive Scenario

11.2. Market Positioning/Share Analysis

11.3. Mergers and Acquisitions Analysis

12. Company Profiles

12.1. GE HealthCare. *

12.1.1. Company Overview

12.1.2. Product Portfolio and Description

12.1.3. Financial Overview

12.1.4. Key Developments

12.2. Medtronic

12.3. Siemens Healthineers AG

12.4. NVIDIA Corporation

12.5. Koninklijke Philips N.V.

12.6. Canon Medical Systems, USA, Inc.

12.7. Aidoc

12.8. IBM

12.9. Apple Inc.

12.10. Google DeepMind

12.11. HYPERFINE, INC.,

12.12. Clarius

LIST NOT EXHAUSTIVE

13. Appendix

13.1. About Us and Services

13.2. Contact Us

*** 医療機器における人工知能の世界市場に関するよくある質問(FAQ) ***

・医療機器における人工知能の世界市場規模は?

→DataM Intelligence社は2023年の医療機器における人工知能の世界市場規模を215億米ドルと推定しています。

・医療機器における人工知能の世界市場予測は?

→DataM Intelligence社は2031年の医療機器における人工知能の世界市場規模を2289億8000万米ドルと予測しています。

・医療機器における人工知能市場の成長率は?

→DataM Intelligence社は医療機器における人工知能の世界市場が2024年~2031年に年平均34.7%成長すると展望しています。

・世界の医療機器における人工知能市場における主要プレイヤーは?

→「GE HealthCare.、Medtronic, Siemens Healthineers AG、NVIDIA Corporation、Koninklijke Philips N.V.、Canon Medical Systems、USA, Inc.、Aidoc、IBM、Apple Inc.、Google DeepMind、HYPERFINE, INC.、Clariusなど ...」を医療機器における人工知能市場のグローバル主要プレイヤーとして判断しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、最終レポートの情報と少し異なる場合があります。

*** 免責事項 ***

https://www.globalresearch.co.jp/disclaimer/