1. 調査手法および範囲

1.1. 調査手法

1.2. 調査目的およびレポートの範囲

2. 定義および概要

3. エグゼクティブサマリー

3.1. 製品種類別抜粋

3.2. 素材別抜粋

3.3. 用途別抜粋

3.4. エンドユーザー別抜粋

3.5. 地域別抜粋

4. 力学

4.1. 影響因子

4.1.1. 推進要因

4.1.1.1. 生体材料の進歩

4.1.2. 抑制要因

4.1.2.1. 規制上の課題

4.1.3. 機会

4.1.4. 影響分析

5. 業界分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 特許分析

5.5. 規制分析

5.6. SWOT分析

5.7. 未充足ニーズ

6. 製品種類別

6.1. はじめに

6.1.1. 製品種類別分析および前年比成長率(%)

6.1.2. 製品種類別市場魅力度指数

6.2. 整形外科インプラント*

6.2.1. はじめに

6.2.2. 市場規模分析および前年比成長率分析(%)

6.3. 心血管インプラント

6.4. 歯科インプラント

6.5. その他

7. 素材別

7.1. はじめに

7.1.1. 市場規模分析および前年比成長率分析(%)、素材別

7.1.2. 市場魅力度指数、素材別

7.2. ポリマー*

7.2.1. はじめに

7.2.2. 市場規模分析および前年比成長率分析(%)

7.2.3. ポリグリコール酸(PGA)

7.2.4. ポリ乳酸(PLA)

7.2.5. ポリ-β-ヒドロキシ酪酸(PHB)

7.2.6. ポリ(乳酸-co-グリコール酸)(PLGA)

7.2.7. ポリ-ε-カプロラクトン(PCL)

7.3. 金属

7.3.1. マグネシウム

7.3.2. 亜鉛

7.3.3. 鉄

7.4. セラミック

8. 用途別

8.1. はじめに

8.1.1. 用途別市場規模分析および前年比成長率(%)

8.1.2. 用途別市場魅力度指数

8.2. 整形外科手術*

8.2.1. はじめに

8.2.2. 市場規模分析および前年比成長率分析(%)

8.3. 心血管処置

8.4. 歯科処置

8.5. その他

9. エンドユーザー別

9.1. はじめに

9.1.1. エンドユーザー別市場規模分析および前年比成長率分析(%)

9.1.2. エンドユーザー別市場魅力度指数

9.2. 病院 *

9.2.1. はじめに

9.2.2. 市場規模分析および前年比成長率分析(%)

9.3. 外来外科センター

9.4. 専門クリニック

10. 地域別

10.1. はじめに

10.1.1. 市場規模分析および前年比成長率分析(%)、地域別

10.1.2. 市場魅力度指数、地域別

10.2. 北米

10.2.1. はじめに

10.2.2. 主な地域特有の動向

10.2.3. 市場規模分析および前年比成長率分析(%)、製品種類別

10.2.4. 市場規模分析および前年比成長率(%)、材料別

10.2.5. 市場規模分析および前年比成長率(%)、用途別

10.2.6. 市場規模分析および前年比成長率(%)、エンドユーザー別

10.2.7. 市場規模分析および前年比成長率(%)、国別

10.2.7.1. 米国

10.2.7.2. カナダ

10.2.7.3. メキシコ

10.3. ヨーロッパ

10.3.1. はじめに

10.3.2. 主要地域別の動向

10.3.3. 市場規模分析および前年比成長率分析(%)、製品種類別

10.3.4. 市場規模分析および前年比成長率(%)、材料別

10.3.5. 市場規模分析および前年比成長率(%)、用途別

10.3.6. 市場規模分析および前年比成長率(%)、エンドユーザー別

10.3.7. 市場規模分析および前年比成長率(%)、国別

10.3.7.1. ドイツ

10.3.7.2. 英国

10.3.7.3. フランス

10.3.7.4. スペイン

10.3.7.5. イタリア

10.3.7.6. ヨーロッパのその他地域

10.4. 南アメリカ

10.4.1. はじめに

10.4.2. 主要地域別の動向

10.4.3. 市場規模分析および前年比成長率分析(%)、製品種類別

10.4.4. 市場規模分析および前年比成長率分析(%)、材料別

10.4.5. 市場規模分析および前年比成長率分析(%)、用途別

10.4.6. エンドユーザー別市場規模分析および前年比成長率分析(%)

10.4.7. 国別市場規模分析および前年比成長率分析(%)

10.4.7.1. ブラジル

10.4.7.2. アルゼンチン

10.4.7.3. 南米その他

10.5. アジア太平洋

10.5.1. はじめに

10.5.2. 主要地域別の動向

10.5.3. 製品種類別市場規模分析および前年比成長率(%)

10.5.4. 材料別市場規模分析および前年比成長率(%)

10.5.5. 用途別市場規模分析および前年比成長率(%)

10.5.6. エンドユーザー別市場規模分析および前年比成長率分析(%)

10.5.7. 国別市場規模分析および前年比成長率分析(%)

10.5.7.1. 中国

10.5.7.2. インド

10.5.7.3. 日本

10.5.7.4. 韓国

10.5.7.5. アジア太平洋地域その他

10.6. 中東およびアフリカ

10.6.1. はじめに

10.6.2. 地域特有の主な動向

10.6.3. 製品種類別市場規模分析および前年比成長率分析(%)

10.6.4. 市場規模分析および前年比成長率分析(%)、材料別

10.6.5. 市場規模分析および前年比成長率分析(%)、用途別

10.6.6. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

11. 競合状況

11.1. 競合シナリオ

11.2. 市場ポジショニング/シェア分析

11.3. 合併・買収分析

12. 企業プロフィール

Evonik

Johnson & Johnson

Medtronic

Stryker

Smith+Nephew

Boston Scientific Corporation

Inion

Bioretec

Arthrex, Inc

Syntellix

リストは網羅的ではありません

13. 付録

13.1. 当社およびサービスについて

13.2. お問い合わせ

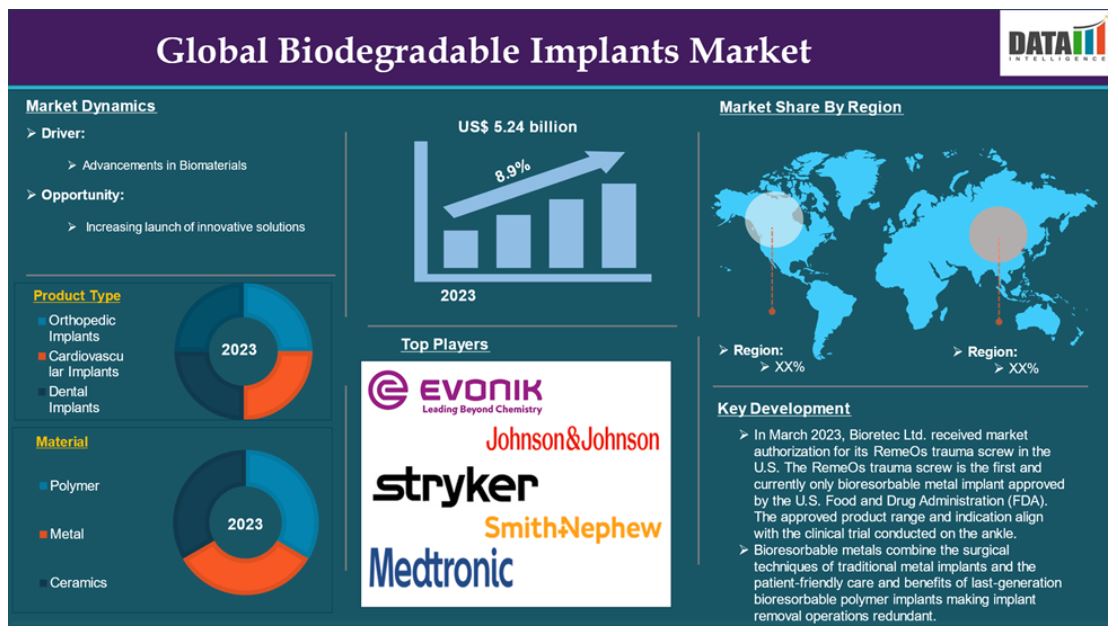

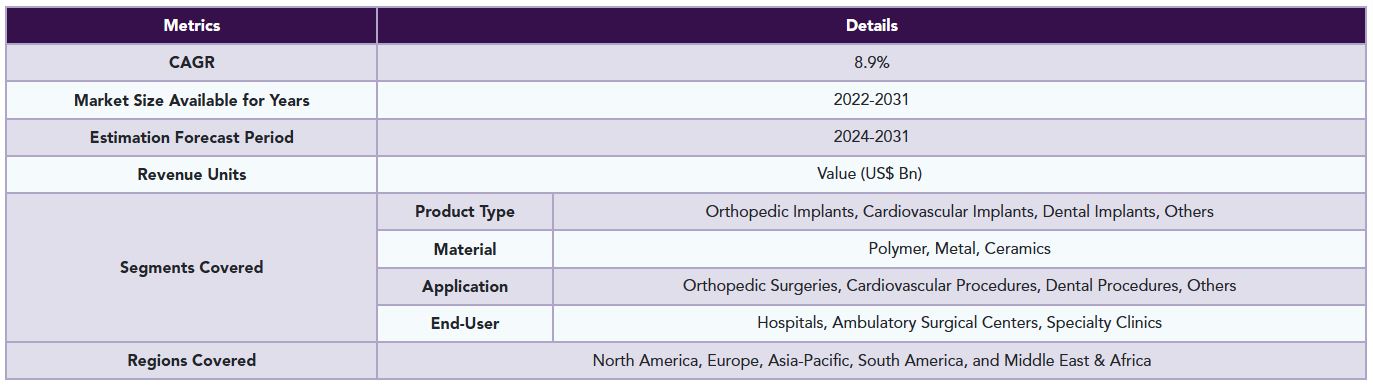

The global biodegradable implants market reached US$ 5.24 billion in 2023 and is expected to reach US$ 10.31 billion by 2031, growing at a CAGR of 8.9% during the forecast period 2024-2031.

Biodegradable implants are specialized medical devices intended to provide temporary support and stabilization for damaged or diseased tissues, particularly in orthopedic settings. These biodegradable implants gradually break down and are absorbed by the body, which eliminates the need for subsequent surgical removal once they have fulfilled their function.

Biodegradable implants are typically constructed from biocompatible materials, including polymers like polylactic acid (PLA) and polyglycolic acid (PGA), which mimic the mechanical properties of natural bone. This unique characteristic allows them to support the healing process while minimizing complications associated with permanent implants, such as infection, implant loosening, and stress shielding.

Polymers, like polylactic acid (PLA), polyglycolic acid (PGA), and polycaprolactone (PCL), create biocompatible scaffolds that degrade over time, supporting tissue growth and being replaced by new bone.

Market Dynamics: Drivers & Restraints

Advancements in biomaterials

Advancements in biomaterials are anticipated to propel the growth of the global biodegradable implants market significantly. Biomaterials are crucial in the development of medical devices, and the evolution of biodegradable materials has opened new avenues for applications across various fields, including orthopedics, cardiovascular, and dental implants. These biodegradable biomaterials are engineered to naturally decompose within the body over time without causing adverse reactions. Companies are manufacturing biodegradable implants using advanced solutions.

The companies are gaining approvals for implants and solutions that use a variety of biodegradable materials. For instance, in March 2023, Bioretec Ltd. received market authorization for its RemeOs trauma screw in the U.S. The RemeOs trauma screw is the first and currently only bioresorbable metal implant approved by the U.S. Food and Drug Administration (FDA). The approved product range and indication align with the clinical trial conducted on the ankle.

Innovations such as polylactic acid (PLA), polyglycolic acid (PGA), and polycaprolactone (PCL) have enhanced the safety and effectiveness of implants. These materials exhibit excellent biocompatibility, reducing the likelihood of rejection or inflammation which is a common issue associated with permanent implants. As biocompatibility improves, biodegradable implants are gaining wider acceptance in clinical settings, especially among patients seeking temporary solutions that integrate seamlessly with their bodies.

Furthermore, advancements in biodegradable biomaterials are enhancing their efficiency in drug delivery systems, which is expected to improve treatment outcomes and broaden their applications in areas such as oncology, chronic disease management, and tissue engineering. Companies are developing polymers that can be implantable. For instance, in March 2023, Invibio Biomaterial Solutions, part of Victrex, a developer of PEEK biomaterial solutions, launched PEEK-OPTIMA AM Filament, an implantable PEEK polymer that is optimized for additive manufacturing.

Biodegradable materials are also considered more environmentally friendly compared to traditional non-degradable implants, aligning with the growing demand for sustainable medical solutions.

Regulatory bodies like the FDA and the European Medicines Agency (EMA) have approved various biodegradable implants, encouraging further investment in this market and driving growth in both developed and emerging economies. For instance, in March 2021, Inion received the Food and Drug Administration approval for the Inion CompressOn bioabsorbable compression screw. These bioabsorbable screws were developed to meet the needs of surgeons and patients around the world. As these trends continue to develop, the biodegradable implants market is poised for substantial expansion.

Regulatory challenges

The stringent regulatory landscape is expected to hinder market growth. While the regulatory landscape in certain regions may be supportive, navigating the approval processes for new biodegradable implant technologies remains a significant challenge. Manufacturers often face lengthy approval timelines and stringent requirements, which can reduce investment in the development of innovative products. For instance, in the United States, although there are clear guidelines for bioabsorbable implants, the extensive testing required to demonstrate safety and efficacy can prolong the time it takes to bring new devices to market.

In Europe, the Medical Device Regulation (MDR) has introduced more rigorous standards that manufacturers must meet, further complicating the approval process. These regulations require comprehensive clinical evaluations and post-market surveillance, which can be resource-intensive and time-consuming.

Segment Analysis

The global biodegradable implants market is segmented based on product type, material, application, end-user, and region.

Product Type:

Orthopedic implants segment is expected to dominate the global biodegradable implants market share

Due to several factors, the orthopedic implants segment is expected to hold a significant position in the market for biodegradable medical implant devices. The rising demand for advanced solutions in bone healing, the inherent advantages of biodegradable materials, and an increasing preference among patients for minimally invasive treatments are driving this growth.

As the global population ages, there has been a marked increase in bone-related conditions such as osteoporosis, osteoarthritis, and fractures. The elderly demographic, in particular, faces heightened risks of bone fractures and degenerative joint diseases, which fuels the demand for orthopedic implants. For instance, Worldwide, up to 37 million fragility fractures occur annually in individuals aged over 55, the equivalent of 70 fractures per minute.

Worldwide, 1 in 3 women over age 50 will experience osteoporosis fractures, as will 1 in 5 men aged over 50. Osteoporosis affects approximately 6.3% of men over the age of 50 and 21.2% of women over the same age range globally. Based on the world population of men and women, this suggests that approximately 500 million men and women worldwide may be affected.

Biodegradable implants, such as screws, pins, and plates offer a temporary solution that provides essential support during the healing process while eliminating the need for future surgeries to remove permanent implants.

Unlike traditional permanent implants, biodegradable options naturally degrade as bone heals, which is especially beneficial for elderly patients or those with compromised health. This feature reduces the overall healthcare burden by minimizing the risk of complications and lowering healthcare costs associated with additional surgeries.

Moreover, because biodegradable orthopedic implants break down over time, patients often experience shorter recovery periods and reduced hospital stays compared to those with permanent implants that may require follow-up procedures. This contributes to an overall improved patient experience and encourages greater adoption of biodegradable implants in orthopedic surgeries. With faster recovery times and fewer complications, these implants can lead to better surgical outcomes and decreased hospitalization durations, ultimately alleviating the healthcare burden on both patients and healthcare systems.

As awareness of these benefits continues to grow among healthcare providers and patients alike, the biodegradable orthopedic implants segment is expected to expand significantly in the coming years.

Geographical Analysis

North America is expected to hold a significant position in the global biodegradable implants market share

North America holds a dominant position in the global biodegradable implants market and is expected to hold the major portion of the market during the forecast period. This dominance is governed by the rising advanced medical infrastructure and the increasing research and development of innovative solutions in the region.

The increasing research and development of innovative solutions in the region also contributes to the region’s market growth. For instance, in June 2021, researchers at Northwestern and George Washington Universities (GW) developed the first-ever transient pacemaker which is a wireless, battery-free, fully implantable pacing device that disappears after it’s no longer needed.

The prevalence of chronic diseases, particularly cardiovascular conditions and orthopedic issues, is significantly impacting the demand for biodegradable implants in the United States. For instance, ankle fractures are one of the most frequently occurring fracture types among the adult patient population. There are 3.4 million patients treated each year in the U.S. for ankle fractures. Single-isolated ankle (malleolar) fractures are the most common type, accounting for 70% of the yearly incidence of all ankle fractures. This rising incidence of fractures increases the demand for biodegradable implants as patients are interested particularly in innovative solutions which do not require further surgeries.

The National Institute of Health in 2024 stated that, after reviewing data from more than 29 million adults receiving hospital care in California, researchers found that 2 million adults (6.8%) had atrial fibrillation, an irregular heart rhythm. When they extrapolated these data to statewide data and the U.S. population, they found that at least 10.55 million American adults (4.48%) are predicted to have atrial fibrillation. As these health concerns escalate, there is an increasing need for bioabsorbable implants that can enhance patient outcomes while minimizing complications associated with traditional permanent implants.

Unlike their non-biodegradable counterparts, biodegradable implants are designed to gradually dissolve in the body, which helps to reduce risks such as inflammation and infection. As the aging population continues to grow, the demand for these innovative solutions is expected to rise, making biodegradable implants a vital component of advanced treatments.

Companies are innovating advanced implant solutions by utilizing advanced biodegradable materials which is expected to increase the demand for these implants. For instance, in July 2021, Stryker received the FDA clearance of the first balloon implant for arthroscopic treatment of massive irreparable rotator cuff tears (MIRCTs). Market players in the region are collaborating with the established players to expand the biodegradable implants portfolio.

Asia Pacific is growing at the fastest pace in the global biodegradable implants market

The Asia-Pacific (APAC) region is emerging as one of the fastest-growing markets in the global biodegradable implants, which is governed by several critical factors. Countries such as China, India, Japan, and South Korea are making substantial investments in healthcare infrastructure, leading to hospitals and clinics becoming increasingly equipped with advanced technologies. These advancements allow for a greater adoption of innovative treatments and implants.

Additionally, the aging population in countries like Japan, China, and South Korea significantly contributes to market growth. As the elderly demographic expands, there is a heightened incidence of bone fractures, joint diseases, and dental issues, which escalates the demand for both orthopedic and dental implants. For instance, the National Institute of Health in 2023 reported that osteoporosis affects 10–30% of women aged above 40, and up to 10% of men in 7 developed economies in Asia Pacific. Fractures affect 500–1000 adults aged above 50 per 100,000 person-years.

Thus, increasing orthopedic conditions increase the demand for biodegradable implants as more patients are seeking for sustainable medical solutions.

Competitive Landscape

The major global players in the biodegradable implants market include Evonik, Johnson & Johnson, Medtronic, Stryker, Smith+Nephew, Boston Scientific Corporation, Inion, Bioretec, Arthrex, Inc, Syntellix among others.

Why Purchase the Report?

• Pipeline & Innovations: Insights into clinical trials, product pipelines, and upcoming advancements.

• Market Positioning: Analysis of product performance and growth potential for optimized strategies.

• Real-World Evidence: Integration of patient feedback for enhanced product outcomes.

• Physician Preferences: Insights into healthcare provider behaviors and adoption strategies.

• Regulatory & Market Updates: Coverage of recent regulations, policies, and emerging technologies.

• Competitive Insights: Analysis of market share, competitor strategies, and new entrants.

• Pricing & Market Access: Review of pricing models, reimbursement trends, and access strategies.

• Market Expansion: Strategies for entering new markets and forming partnerships.

• Regional Opportunities: Identification of high-growth regions and investment prospects.

• Supply Chain Optimization: Assessment of risks and distribution strategies.

• Sustainability & Regulation: Focus on eco-friendly practices and regulatory changes.

• Post-Market Surveillance: Enhanced safety and access through post-market data.

• Value-Based Pricing: Insights into pharmacoeconomics and data-driven R&D decisions.

The Global Biodegradable Implants market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2023

• Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

• Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

• Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

• Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

• Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

• Supply Chain: Distribution and Supply Chain Managers.

• Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

• Academic & Research: Academic Institutions.

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Product Type

3.2. Snippet by Material

3.3. Snippet by Application

3.4. Snippet by End-User

3.5. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Advancements in biomaterials

4.1.2. Restraints

4.1.2.1. Regulatory challenges

4.1.3. Opportunity

4.1.4. Impact Analysis

5. Industry Analysis

5.1. Porter’s Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Patent Analysis

5.5. Regulatory Analysis

5.6. SWOT Analysis

5.7. Unmet Needs

6. By Product Type

6.1. Introduction

6.1.1. Analysis and Y-o-Y Growth Analysis (%), By Product Type

6.1.2. Market Attractiveness Index, By Product Type

6.2. Orthopedic Implants*

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.3. Cardiovascular Implants

6.4. Dental Implants

6.5. Others

7. By Material

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

7.1.2. Market Attractiveness Index, By Material

7.2. Polymer*

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.2.3. Polyglycolic Acid (PGA)

7.2.4. Polylactic Acid (PLA)

7.2.5. Poly-β-hydroxybutyrate (PHB)

7.2.6. Poly (lactic acid-co-glycolic acid) (PLGA)

7.2.7. Poly-ε-caprolactone (PCL)

7.3. Metal

7.3.1. Magnesium

7.3.2. Zinc

7.3.3. Iron

7.4. Ceramics

8. By Application

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

8.1.2. Market Attractiveness Index, By Application

8.2. Orthopedic Surgeries*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Cardiovascular Procedures

8.4. Dental Procedures

8.5. Others

9. By End-User

9.1. Introduction

9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.1.2. Market Attractiveness Index, By End-User

9.2. Hospitals *

9.2.1. Introduction

9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

9.3. Ambulatory Surgical Centers

9.4. Specialty Clinics

10. By Region

10.1. Introduction

10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

10.1.2. Market Attractiveness Index, By Region

10.2. North America

10.2.1. Introduction

10.2.2. Key Region-Specific Dynamics

10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

10.2.7.1. U.S.

10.2.7.2. Canada

10.2.7.3. Mexico

10.3. Europe

10.3.1. Introduction

10.3.2. Key Region-Specific Dynamics

10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

10.3.7.1. Germany

10.3.7.2. U.K.

10.3.7.3. France

10.3.7.4. Spain

10.3.7.5. Italy

10.3.7.6. Rest of Europe

10.4. South America

10.4.1. Introduction

10.4.2. Key Region-Specific Dynamics

10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

10.4.7.1. Brazil

10.4.7.2. Argentina

10.4.7.3. Rest of South America

10.5. Asia-Pacific

10.5.1. Introduction

10.5.2. Key Region-Specific Dynamics

10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

10.5.7.1. China

10.5.7.2. India

10.5.7.3. Japan

10.5.7.4. South Korea

10.5.7.5. Rest of Asia-Pacific

10.6. Middle East and Africa

10.6.1. Introduction

10.6.2. Key Region-Specific Dynamics

10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

11.1. Competitive Scenario

11.2. Market Positioning/Share Analysis

11.3. Mergers and Acquisitions Analysis

12. Company Profiles

12.1. Johnson & Johnson*

12.1.1. Company Overview

12.1.2. Product Portfolio and Description

12.1.3. Financial Overview

12.1.4. Key Developments

12.2. Evonik

12.3. Medtronic

12.4. Stryker

12.5. Smith+Nephew

12.6. Boston Scientific Corporation

12.7. Inion

12.8. Bioretec

12.9. Arthrex, Inc

12.10. Syntellix

LIST NOT EXHAUSTIVE

13. Appendix

13.1. About Us and Services

13.2. Contact Us

*** 生分解性インプラントの世界市場に関するよくある質問(FAQ) ***

・生分解性インプラントの世界市場規模は?

→DataM Intelligence社は2023年の生分解性インプラントの世界市場規模を52億4000万米ドルと推定しています。

・生分解性インプラントの世界市場予測は?

→DataM Intelligence社は2031年の生分解性インプラントの世界市場規模を103億1000万米ドルと予測しています。

・生分解性インプラント市場の成長率は?

→DataM Intelligence社は生分解性インプラントの世界市場が2024年~2031年に年平均8.9%成長すると展望しています。

・世界の生分解性インプラント市場における主要プレイヤーは?

→「Evonik、Johnson & Johnson、Medtronic、Stryker、Smith+Nephew、Boston Scientific Corporation、Inion、Bioretec、Arthrex, Inc、Syntellixなど ...」を生分解性インプラント市場のグローバル主要プレイヤーとして判断しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、最終レポートの情報と少し異なる場合があります。

*** 免責事項 ***

https://www.globalresearch.co.jp/disclaimer/