1. 調査手法および対象範囲

1.1. 調査手法

1.2. 調査目的およびレポートの対象範囲

2. 定義および概要

3. エグゼクティブサマリー

3.1. スニペットの種類別

3.2. スニペットの素材別

3.3. スニペットのエンドユーザー別

3.4. スニペットの地域別

4. 動向

4.1. 影響因子

4.1.1. 推進要因

4.1.1.1. 歯科疾患の増加

4.1.1.2. 歯科技術の進歩

4.1.2. 抑制要因

4.1.2.1. 歯冠に関連する高コスト

4.1.3. 機会

4.1.4. 影響分析

5. 産業分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 特許分析

5.5. 規制分析

5.6. SWOT分析

5.7. 未充足ニーズ

6. 種類別

6.1. はじめに

6.1.1. 市場規模分析および前年比成長率分析(%)、種類別

6.1.2. 市場魅力度指数、種類別

6.2. 仮歯*

6.2.1. はじめに

6.2.2. 市場規模分析および前年比成長率分析(%)

6.3. 固定歯

7. 材料別

7.1. 概要

7.1.1. 市場規模分析および前年比成長率(%)、素材別

7.1.2. 市場魅力度指数、素材別

7.2. セラミック/ポーセレン*

7.2.1. 概要

7.2.2. 市場規模分析および前年比成長率(%)

7.3. 金属

7.4. ポーセレン・フュージド・トゥ・メタル

7.5. ジルコニア

7.6. その他

8. エンドユーザー別

8.1. はじめに

8.1.1. エンドユーザー別市場規模分析および前年比成長率(%)

8.1.2. エンドユーザー別市場魅力度指数

8.2. 病院*

8.2.1. 概要

8.2.2. 市場規模分析および前年比成長率分析(%)

8.3. 歯科クリニック

8.4. 歯科技工所

8.5. その他

9. 地域別

9.1. 概要

9.1.1. 市場規模分析および前年比成長率分析(%)、地域別

9.1.2. 市場魅力度指数、地域別

9.2. 北米

9.2.1. はじめに

9.2.2. 主な地域特有の力学

9.2.3. 市場規模分析および前年比成長率分析(%)、種類別

9.2.4. 市場規模分析および前年比成長率(%)、材料別

9.2.5. 市場規模分析および前年比成長率(%)、エンドユーザー別

9.2.6. 市場規模分析および前年比成長率(%)、国別

9.2.6.1. 米国

9.2.6.2. カナダ

9.2.6.3. メキシコ

9.3. ヨーロッパ

9.3.1. はじめに

9.3.2. 主要地域別の動向

9.3.3. 市場規模分析および前年比成長率分析(%)種類別

9.3.4. 市場規模分析および前年比成長率分析(%)素材別

9.3.5. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

9.3.6. 市場規模分析および前年比成長率分析(%)、国別

9.3.6.1. ドイツ

9.3.6.2. 英国

9.3.6.3. フランス

9.3.6.4. スペイン

9.3.6.5. イタリア

9.3.6.6. ヨーロッパのその他地域

9.4. 南アメリカ

9.4.1. はじめに

9.4.2. 主な地域特有の動向

9.4.3. 市場規模分析および前年比成長率(%)、種類別

9.4.4. 市場規模分析および前年比成長率(%)、素材別

9.4.5. エンドユーザー別市場規模分析および前年比成長率分析(%)

9.4.6. 国別市場規模分析および前年比成長率分析(%)

9.4.6.1. ブラジル

9.4.6.2. アルゼンチン

9.4.6.3. 南米その他

9.5. アジア太平洋

9.5.1. はじめに

9.5.2. 主要地域別の動向

9.5.3. 市場規模分析および前年比成長率分析(%)、種類別

9.5.4. 市場規模分析および前年比成長率分析(%)、材料別

9.5.5. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

9.5.6. 国別の市場規模分析および前年比成長率分析(%)

9.5.6.1. 中国

9.5.6.2. インド

9.5.6.3. 日本

9.5.6.4. 韓国

9.5.6.5. アジア太平洋地域その他

9.6. 中東およびアフリカ

9.6.1. はじめに

9.6.2. 主要地域別の動向

9.6.3. 市場規模分析および前年比成長率分析(%)、種類別

9.6.4. 市場規模分析および前年比成長率分析(%)、材料別

9.6.5. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

10. 競合状況

10.1. 競合シナリオ

10.2. 市場ポジショニング/シェア分析

10.3. 合併・買収分析

11. 企業プロフィール

Straumann Group

Dentsply Sirona

Nobel Biocare Services AG

Avinent Science and Technology

3M

Glidewell

Illusion Dental Lab

DDS Lab

Ivoclar Vivadent

Cheng Crowns

リストは網羅的ではありません

12. 付録

12.1. 当社およびサービスについて

12.2. お問い合わせ

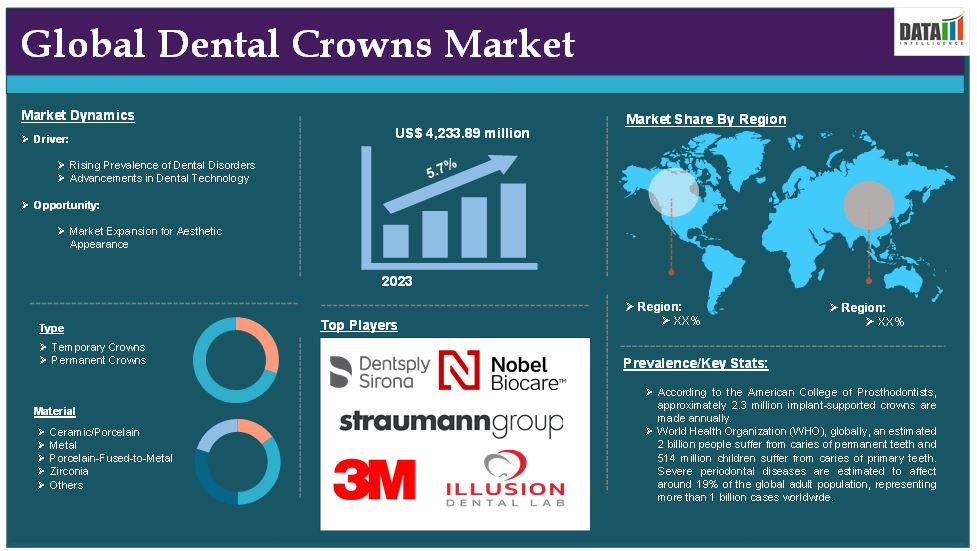

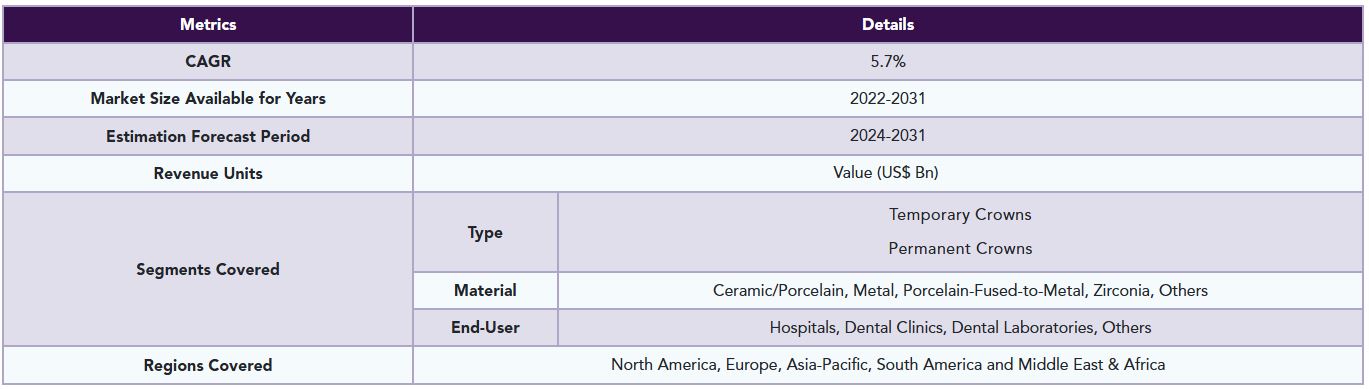

The global dental crowns market reached US$ 4,233.89 million in 2023 and is expected to reach US$ 6,534.40 million by 2031, growing at a CAGR of 5.7% during the forecast period 2024-2031.

A dental crown is a tooth-shaped cap placed over a tooth to restore its shape, size, strength and appearance. It fully encases the visible portion of the tooth above the gum line. Dental crowns are used in both restorative and cosmetic dentistry. They are typically recommended for damaged or decayed teeth that cannot be restored with a filling or other less invasive treatments. Made from a variety of materials, including metal, resin and porcelain, crowns last between five and 15 years with proper care.

According to the American College of Prosthodontists, approximately 2.3 million implant-supported crowns are made annually, further propelling the growth of the dental crowns market. The market demand for dental crowns is driven by increasing oral health awareness, aesthetic preferences and the prevalence of dental disorders worldwide. For instance, according to a study conducted by the International Journal of Dental and Medical Sciences Research, 87.6% of participants like their teeth when they see them in the mirror or photograph and are not socially withdrawn because of their dental appearance. 53.3% of participants are not satisfied, thus this may increase the demand for dental aesthetics including dental crowns.

Market Dynamics: Drivers & Restraints

Rising prevalence of dental disorders

The rising prevalence of dental disorders is significantly driving the growth of the dental crowns market and is expected to drive the market over the forecast period. The rising prevalence of dental disorders, particularly dental caries (tooth decay) and periodontal diseases often lead to tooth damage, crowns are increasingly needed for restoration and protection.

According to the World Health Organization (WHO), globally, an estimated 2 billion people suffer from caries of permanent teeth and 514 million children suffer from caries of primary teeth. As cavities and decay progress, the affected tooth often needs a crown for restoration, especially when fillings are no longer effective. Additionally, according to the WHO, severe periodontal diseases are estimated to affect around 19% of the global adult population, representing more than 1 billion cases worldwide, which can lead to tooth loss if untreated. Crowns are commonly used to restore damaged or lost teeth caused by such conditions.

High cost associated with dental crowns

The high cost associated with dental crowns is a significant barrier hampering the growth of the dental crowns market, especially in lower-income regions and among individuals without dental insurance coverage.

The price of dental crowns can vary widely, ranging from USD 500 to USD 3,000 per crown depending on the material. Premium materials like zirconia and porcelain tend to be the most expensive. For instance, According to Ocean Breeze Prosthodontics, porcelain crowns and zirconia crowns prices ranging from $800 to $3,000, porcelain-fused-to-metal prices ranging from $500 to $1,500 and gold crowns prices ranging from $600 to $2,500.

In emerging economies, the high cost of crowns makes them out of reach for a large portion of the population. Even with dental tourism in countries like Mexico and India, where prices can be significantly lower than in developed countries, the initial costs may still pose a barrier for local residents.

Segment Analysis

The global dental crowns market is segmented based on type, material, end-user and region.

Material:

The ceramic/porcelain segment is expected to dominate the global dental crowns market share

The ceramic/porcelain segment holds a major portion of the dental crowns market share and is expected to continue to hold a significant portion of the market share over the forecast period. Ceramic and porcelain crowns are highly valued for their ability to mimic the natural appearance of teeth within less time. They are translucent and reflect light similarly to natural enamel, making them the preferred choice for anterior (front) teeth, which are highly visible.

For instance, in February 2023, SprintRay Inc. cleared the U.S. commercial launch of their Ceramic Crown 3D Printing Ecosystem, a complete solution set to transform same-day, chairside delivery of ceramic dental restorations. This is part of a fully integrated, streamlined 3D printing chairside workflow optimized for design to delivery in less than 45 minutes.

Ceramic and porcelain crowns are hypoallergenic, making them a favorable option for patients who are sensitive to metals. This biocompatibility reduces the risk of adverse reactions, particularly in individuals with metal allergies. For instance, according to the Genesis Scientific Publication, porcelain is a biocompatible material, reducing the risk of allergic reactions and irritation in patients. For those who have metal allergies or sensitivities, this is especially advantageous, making all-porcelain crowns a safer choice. Furthermore, the lack of metal removes the possibility of negative side effects commonly linked to crowns made of metal, like inflammation and discolored gums. Patients who have sensitive oral tissues or a history of metal allergies may benefit most from this biocompatibility in terms of their long-term comfort and health.

North America is expected to hold a significant position in the global dental crowns market

North America region is expected to hold the largest share in the global dental crowns market over the forecast period owing to the rising prevalence of dental disorders especially in the United States, rising dental-related aesthetic concerns and strong economic conditions that make dental procedures more accessible.

For instance, according to the NIH, tooth decay, affecting 90% of adults aged 20 to 64 years, and gum disease, affecting almost 50% of adults aged 45 to 64 years, remain two of the most prevalent oral diseases. Thus, this increasing prevalence of dental disorders in North America especially in the United States is increasing the demand for dental crowns.

The demand for cosmetic dental procedures in North America is substantial, driven by patient desire for aesthetic improvements and enhanced smiles. Crowns, particularly porcelain crowns, are popular for their ability to provide a natural look and restore the function of damaged teeth.

Asia Pacific is growing at the fastest pace in the dental crowns market

The Asia Pacific region is experiencing the fastest growth in the dental crowns market driven by a combination of factors including growing healthcare infrastructure, rising prevalence of dental disorders in major Asia Pacific countries like India, China and Japan, increasing dental awareness and expanding access to cosmetic dentistry.

With growing urbanization, there has been a rise in awareness about oral hygiene and the importance of dental care across the region. Government initiatives and increased public health campaigns about the importance of oral health are encouraging more people to seek dental care. For instance, the Indian Dental Association (IDA) drafted the National Oral Health Programme to address the burden of dental disease in an effective manner for bringing about 'optimal oral health' for all. Networking for the optimal oral health of the nation contributes to leading a healthy and satisfying life.

Competitive Landscape

The major global players in the dental crowns market include Straumann Group, Dentsply Sirona, Nobel Biocare Services AG, Avinent Science and Technology, 3M, Glidewell, Illusion Dental Lab, DDS Lab, Ivoclar Vivadent, Cheng Crowns and among others.

Why Purchase the Report?

• To visualize the global dental crowns market segmentation based on type, material, end-user and region and understand key commercial assets and players.

• Identify commercial opportunities by analyzing trends and co-development.

• Excel data sheet with numerous data points of the dental crowns market with all segments.

• PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

• Product mapping is available in excel consisting of key products of all the major players.

The global dental crowns market report would provide approximately 62 tables, 54 figures and 195 pages.

Target Audience 2023

• Manufacturers/ Buyers

• Industry Investors/Investment Bankers

• Research Professionals

• Emerging Companies

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Type

3.2. Snippet by Material

3.3. Snippet by End-User

3.4. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Rising Prevalence of Dental Disorders

4.1.1.2. Advancements in Dental Technology

4.1.2. Restraints

4.1.2.1. High Cost Associated with Dental Crowns

4.1.3. Opportunity

4.1.4. Impact Analysis

5. Industry Analysis

5.1. Porter’s Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Patent Analysis

5.5. Regulatory Analysis

5.6. SWOT Analysis

5.7. Unmet Needs

6. By Type

6.1. Introduction

6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

6.1.2. Market Attractiveness Index, By Type

6.2. Temporary Crowns*

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.3. Permanent Crowns

7. By Material

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

7.1.2. Market Attractiveness Index, By Material

7.2. Ceramic/Porcelain*

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.3. Metal

7.4. Porcelain-Fused-to-Metal

7.5. Zirconia

7.6. Others

8. By End-User

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

8.1.2. Market Attractiveness Index, By End-User

8.2. Hospitals*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Dental Clinics

8.4. Dental Laboratories

8.5. Others

9. By Region

9.1. Introduction

9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

9.1.2. Market Attractiveness Index, By Region

9.2. North America

9.2.1. Introduction

9.2.2. Key Region-Specific Dynamics

9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.2.6.1. U.S.

9.2.6.2. Canada

9.2.6.3. Mexico

9.3. Europe

9.3.1. Introduction

9.3.2. Key Region-Specific Dynamics

9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.3.6.1. Germany

9.3.6.2. U.K.

9.3.6.3. France

9.3.6.4. Spain

9.3.6.5. Italy

9.3.6.6. Rest of Europe

9.4. South America

9.4.1. Introduction

9.4.2. Key Region-Specific Dynamics

9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.4.6.1. Brazil

9.4.6.2. Argentina

9.4.6.3. Rest of South America

9.5. Asia-Pacific

9.5.1. Introduction

9.5.2. Key Region-Specific Dynamics

9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.5.6.1. China

9.5.6.2. India

9.5.6.3. Japan

9.5.6.4. South Korea

9.5.6.5. Rest of Asia-Pacific

9.6. Middle East and Africa

9.6.1. Introduction

9.6.2. Key Region-Specific Dynamics

9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

9.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10. Competitive Landscape

10.1. Competitive Scenario

10.2. Market Positioning/Share Analysis

10.3. Mergers and Acquisitions Analysis

11. Company Profiles

11.1. Straumann Group*

11.1.1. Company Overview

11.1.2. Product Portfolio and Description

11.1.3. Financial Overview

11.1.4. Key Developments

11.2. Dentsply Sirona

11.3. Nobel Biocare Services AG

11.4. Avinent Science and Technology

11.5. 3M

11.6. Glidewell

11.7. Illusion Dental Lab

11.8. DDS Lab

11.9. Ivoclar Vivadent

11.10. Cheng Crowns

LIST NOT EXHAUSTIVE

12. Appendix

12.1. About Us and Services

12.2. Contact Us

*** 歯科用クラウンの世界市場に関するよくある質問(FAQ) ***

・歯科用クラウンの世界市場規模は?

→DataM Intelligence社は2023年の歯科用クラウンの世界市場規模を42億3389万米ドルと推定しています。

・歯科用クラウンの世界市場予測は?

→DataM Intelligence社は2031年の歯科用クラウンの世界市場規模を65億3440万米ドルと予測しています。

・歯科用クラウン市場の成長率は?

→DataM Intelligence社は歯科用クラウンの世界市場が2024年~2031年に年平均5.7%成長すると展望しています。

・世界の歯科用クラウン市場における主要プレイヤーは?

→「Straumann Group、Dentsply Sirona、Nobel Biocare Services AG、Avinent Science and Technology、3M、Glidewell、Illusion Dental Lab、DDS Lab、Ivoclar Vivadent、Cheng Crownsなど ...」を歯科用クラウン市場のグローバル主要プレイヤーとして判断しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、最終レポートの情報と少し異なる場合があります。

*** 免責事項 ***

https://www.globalresearch.co.jp/disclaimer/