1. 調査手法および対象範囲

1.1. 調査手法

1.2. 調査目的およびレポートの対象範囲

2. 定義および概要

3. エグゼクティブサマリー

3.1. 製品別抜粋

3.2. 種類別抜粋

3.3. 投与経路別抜粋

3.4. 用途別抜粋

3.5. 流通チャネル別抜粋

3.6. 地域別

4. ダイナミクス

4.1. 影響因子

4.1.1. 推進要因

4.1.1.1. 肥満および2型糖尿病の増加

4.1.1.2. XX

4.1.2. 阻害要因

4.1.2.1. 薬剤の高コスト

4.1.3. 機会

4.1.4. 影響分析

5. 産業分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 規制分析

6. 製品別

6.1. はじめに

6.1.1. 分析および前年比成長率(%)、製品別

6.1.2. 市場魅力度指数、製品別

6.2. オゼンピック*

6.2.1. 紹介

6.2.2. 市場規模分析および前年比成長率(%)

6.3. トルーリシティ

6.4. Mounjaro

6.5. Wegovy

6.6. Rybelsus

6.7. Saxenda

6.8. Victoza

6.9. Zepbound

6.10. その他

7. 種類別

7.1. はじめに

7.1.1. 種類別市場規模分析および前年比成長率分析(%)

7.1.2. 市場魅力度指数、種類別

7.2. 持効型GLP-1アゴニスト*

7.2.1. はじめに

7.2.2. 市場規模分析および前年比成長率分析(%)

7.3. 短時間作用型GLP-1アゴニスト

8. 投与経路別

8.1. はじめに

8.1.1. 市場規模分析および前年比成長率分析(%)、投与経路別

8.1.2. 市場魅力度指数、投与経路別

8.2. 皮下*

8.2.1. 市場概要

8.2.2. 市場規模分析および前年比成長率分析(%)

8.3. 経口

9. 用途別

9.1. はじめに

9.1.1. 市場規模分析および前年比成長率(%)、用途別

9.1.2. 市場魅力度指数、用途別

9.2. 2型糖尿病*

9.2.1. はじめに

9.2.2. 市場規模分析および前年比成長率(%)

9.3. 肥満症

9.4. その他

10. 用途別

10.1. はじめに

10.1.1. 用途別市場規模および前年比成長率(%)

10.1.2. 用途別市場魅力度指数

10.2. 病院薬局*

10.2.1. はじめに

10.2.2. 市場規模分析および前年比成長率分析(%)

10.3. 薬局

10.4. オンライン薬局

11. 地域別

11.1. はじめに

11.1.1. 市場規模分析および前年比成長率分析(%)、地域別

11.1.2. 市場魅力度指数、地域別

11.2. 北米

11.2.1. はじめに

11.2.2. 地域特有の主な動向

11.2.3. 製品別市場規模分析および前年比成長率(%)

11.2.4. 種類別市場規模分析および前年比成長率(%)

11.2.5. 投与経路別市場規模分析および前年比成長率(%)

11.2.6. 用途別市場規模分析および前年比成長率(%)

11.2.7. 流通チャネル別市場規模分析および前年比成長率(%)

11.2.8. 国別市場規模分析および前年比成長率(%)

11.2.8.1. 米国

11.2.8.2. カナダ

11.2.8.3. メキシコ

11.3. ヨーロッパ

11.3.1. はじめに

11.3.2. 主要地域別の動向

11.3.3. 市場規模分析および前年比成長率分析(%)、製品別

11.3.4. 市場規模分析および前年比成長率(%)、種類別

11.3.5. 市場規模分析および前年比成長率(%)、投与経路別

11.3.6. 市場規模分析および前年比成長率(%)、用途別

11.3.7. 市場規模分析および前年比成長率(%)、流通チャネル別

11.3.8. 国別の市場規模分析および前年比成長率分析(%)

11.3.8.1. ドイツ

11.3.8.2. 英国

11.3.8.3. フランス

11.3.8.4. スペイン

11.3.8.5. イタリア

11.3.8.6. ヨーロッパのその他地域

11.4. 南アメリカ

11.4.1. はじめに

11.4.2. 地域特有の主な動向

11.4.3. 製品別市場規模分析および前年比成長率(%)

11.4.4. 種類別市場規模分析および前年比成長率(%)

11.4.5. 市場規模および前年比成長率(%)、投与経路別

11.4.6. 市場規模および前年比成長率(%)、用途別

11.4.7. 市場規模および前年比成長率(%)、流通チャネル別

11.4.8. 市場規模および前年比成長率(%)、国別

11.4.8.1. ブラジル

11.4.8.2. アルゼンチン

11.4.8.3. 南米その他

11.5. アジア太平洋

11.5.1. はじめに

11.5.2. 主要地域特有の動向

11.5.3. 市場規模分析および前年比成長率分析(%)、製品別

11.5.4. 市場規模分析および前年比成長率(%)、種類別

11.5.5. 市場規模分析および前年比成長率(%)、投与経路別

11.5.6. 市場規模分析および前年比成長率(%)、用途別

11.5.7. 市場規模分析および前年比成長率(%)、流通チャネル別

11.5.8. 国別の市場規模分析および前年比成長率分析(%)

11.5.8.1. 中国

11.5.8.2. インド

11.5.8.3. 日本

11.5.8.4. 韓国

11.5.8.5. アジア太平洋地域その他

11.6. 中東およびアフリカ

11.6.1. はじめに

11.6.2. 主要地域別の動向

11.6.3. 製品別市場規模分析および前年比成長率(%)

11.6.4. 種類別市場規模分析および前年比成長率(%)

11.6.5. 投与経路別市場規模分析および前年比成長率(%)

11.6.6. 市場規模分析および前年比成長率分析(%)、用途別

11.6.7. 市場規模分析および前年比成長率分析(%)、流通チャネル別

12. 競合状況

12.1. 競合シナリオ

12.2. 市場ポジショニング/シェア分析

12.3. 合併・買収分析

13. 企業プロフィール

Eli Lilly and Company

Novo Nordisk A/S.

Sanofi

AstraZeneca

Boehringer Ingelheim, Inc.

Glenmark Pharmaceuticals Ltd.

Hanmi Pharm.Co., Ltd.

Amgen Inc.

Gmax Biopharm.

Sciwind Biosciences Co., Ltd.

リストは網羅的なものではありません。

14. 付録

14.1. 当社およびサービスについて

14.2. お問い合わせ

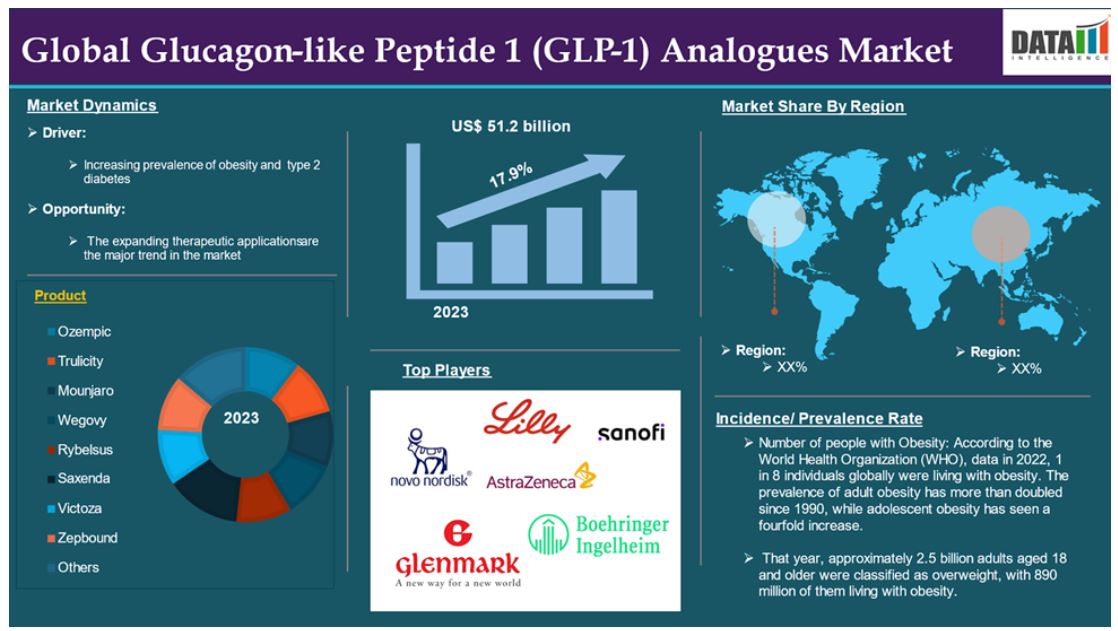

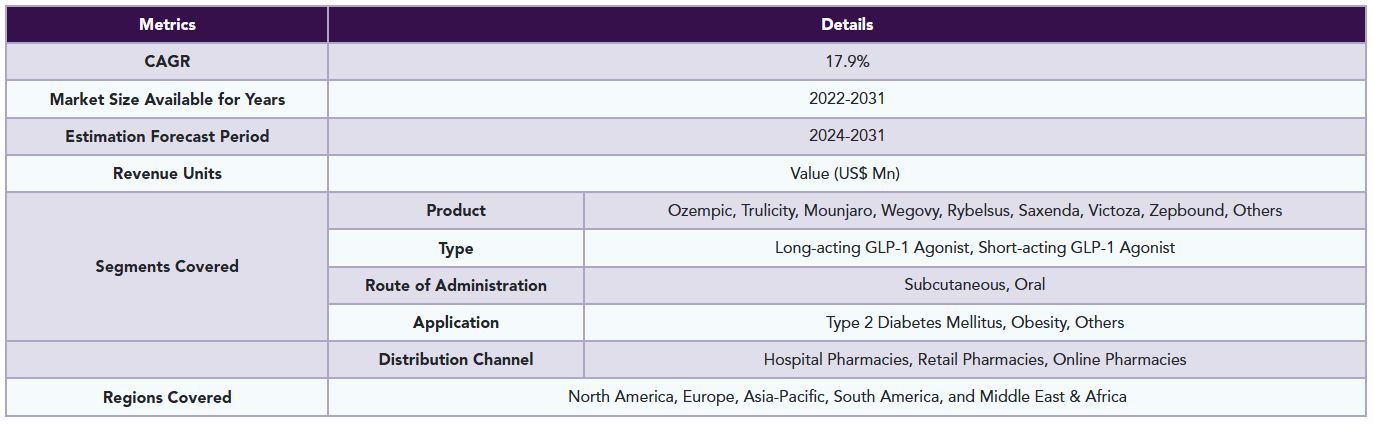

The global glucagon-like peptide 1 (GLP-1) analogues market reached US$51.2 billion in 2023 and is expected to reach US$190.48 billion by 2031, growing at a CAGR of 17.9 % during the forecast period 2024-2031.

Glucagon-like peptide-1 (GLP-1) analogues, commonly known as GLP-1 receptor agonists or incretin mimetics, are a category of medications that replicate the actions of the naturally occurring hormone GLP-1. The intestines secrete this hormone after food consumption which is essential for glucose regulation. It enhances insulin secretion, inhibits glucagon release, and promotes feelings of fullness. These medications are mainly utilised to treat type 2 diabetes and obesity, as they effectively lower blood sugar levels and assist in weight loss by reducing appetite and caloric intake. These factors have driven the global glucagon-like peptide 1 (GLP-1) analogues market expansion.

Market Dynamics: Drivers & Restraints

Increasing Prevalence of Obesity and Type 2 Diabetes

The increasing prevalence of obesity and type 2 diabetes is significantly driving the growth of the global glucagon-like peptide 1 (GLP-1) analogues market and is expected to drive throughout the market forecast period.

Obesity is a chronic and multifaceted disease characterized by an accumulation of excessive fat that can negatively impact health. It is associated with a heightened risk of developing type 2 diabetes and heart disease, and it can also affect bone health and reproductive functions. Additionally, obesity increases the likelihood of certain cancers. It can significantly influence the quality of life, affecting aspects such as sleep and mobility.

The rising rates of type 2 diabetes and obesity present a major public health challenge. Both conditions are linked to serious health complications, such as cardiovascular diseases, hypertension, and metabolic syndrome. As lifestyle changes, including poor dietary habits and decreased physical activity, lead to higher rates of these conditions, the demand for effective treatment options has glucagon-like peptide 1 (GLP-1) analogues.

According to the World Health Organization (WHO), obesity has nearly tripled since 1975, emphasizing the urgent need for effective management strategies such as glucagon-like peptide 1 (GLP-1) analogues. In 2022, 1 in 8 individuals globally were living with obesity. The prevalence of adult obesity has more than doubled since 1990, while adolescent obesity has seen a fourfold increase. That year, approximately 2.5 billion adults aged 18 and older were classified as overweight, with 890 million of them living with obesity. Among adults over 18, 43% were overweight and 16% were considered obese. Additionally, 37 million children under the age of 5 were overweight, and over 390 million children and adolescents aged 5 to 19 were overweight in 2022, including 160 million who were living with obesity.

Furthermore, key players' strategies such as partnerships & collaborations and the rising number of clinical trials and positive results would drive these glucagon-like peptide 1 (GLP-1) analogues market growth. For instance, in November 2023, AstraZeneca announced its strategic approach to the cardiometabolic market, particularly focusing on treating obesity and its associated co-morbidities. This strategy involves combining the recently acquired GLP-1 receptor agonist therapy from Eccogene, known as ECC5004, with their existing cardiometabolic therapies, specifically the sodium-glucose co-transporter-2 (SGLT2) inhibitor Farxiga (dapagliflozin).

Also, in August 2024, Eli Lilly and Company announced positive topline results from the SURMOUNT-1 trial, a three-year study evaluating the effectiveness and safety of tirzepatide (marketed as Zepbound and Mounjaro) administered once weekly for long-term weight management and delaying the progression to diabetes in adults with pre-diabetes and obesity or overweight. All these factors demand the global glucagon-like peptide 1 (GLP-1) analogues market.

Moreover, the expanding therapeutic applications contribute to the global glucagon-like peptide 1 (GLP-1) analogues market expansion.

High Cost of Medications

The high cost of medications will hinder the growth of the global glucagon-like peptide 1 (GLP-1) analogues market.

The high cost of glucagon-like peptide 1 (GLP-1) analogues serves as a significant constraint in the global market for these medications. With monthly treatment expenses reaching about $1,000, many patients find these drugs prohibitively expensive, particularly those without comprehensive insurance coverage. This financial strain results in limited access for a large segment of the population, as numerous insurance providers are reluctant to cover these costly medications.

According to the Yale School of Medicine data in April 2024, research has revealed that biosimilar manufacturers could sell insulin at prices 97% lower than current U.S. market rates, while GLP-1 agonist drugs like semaglutide (Ozempic and Wegovy), which cost Americans up to $1,000 per month, could potentially be produced for less than $1.

The estimated cost-based prices for insulin ranged from $61 to $111 annually, in stark contrast to the current market prices, which vary between $98 and $1,300 across 13 countries with different income levels. Similarly, the estimated monthly prices for GLP-1 agonists were calculated to be between $0.75 and $72.49, whereas the actual monthly price in the U.S. is approximately $968.52. Thus, the above factors could be limiting the global glucagon-like peptide 1 (GLP-1) analogues market's potential growth.

Segment Analysis

The global glucagon-like peptide 1 (GLP-1) analogues market is segmented based on product, type, route of administration, application, distribution channel, and region.

Product:

The Ozempic segment is expected to dominate the global glucagon-like peptide 1 (GLP-1) analogues market share

The Ozempic segment holds a major portion of the global glucagon-like peptide 1 (GLP-1) analogues market share and is expected to continue to hold a significant portion of the global glucagon-like peptide 1 (GLP-1) analogues market share during the forecast period.

Glucagon-like peptide-1 (GLP-1) is a physiological hormone that plays a crucial role in glucose metabolism. It exerts its effects through the GLP-1 receptor (GLP-1R), which is found in various cell types, including pancreatic beta cells. Ozempic, a GLP-1 receptor agonist, selectively binds to and activates the GLP-1 receptor, mimicking the action of native GLP-1.

Ozempic is a modified form of GLP-1 with approximately 94% sequence homology to human GLP-1. Structural modifications enhance its pharmacological properties. These modifications result in a longer half-life, allowing for once-weekly dosing rather than daily administration. The alterations make Ozempic resistant to enzymatic breakdown by dipeptidyl peptidase IV (DPP-IV), which normally degrades native GLP-1 rapidly.

Furthermore, key players in the industry product launches and approvals would drive this segment's growth in the global glucagon-like peptide 1 (GLP-1) analogues market. For instance, in March 2022, Novo Nordisk announced that the U.S. Food and Drug Administration (FDA) has approved a new 2.0 mg dose of Ozempic (semaglutide), a glucagon-like peptide-1 (GLP-1) analogue, for the treatment of adults with type 2 diabetes. This approval expands the available dosing options for Ozempic, which now includes 0.5 mg, 1.0 mg, and the newly approved 2.0 mg doses.

These factors have solidified the segment's position in the global glucagon-like peptide 1 (GLP-1) analogues market.

Geographical Analysis

North America is expected to hold a significant position in the global glucagon-like peptide 1 (GLP-1) analogues market share

North America holds a substantial position in the global glucagon-like peptide 1 (GLP-1) analogues market and is expected to hold most of the market share.

The rising rates of obesity and type 2 diabetes in North America are driving the demand for effective treatment options. As more individuals are diagnosed with these conditions, the need for glucagon-like peptide 1 (GLP-1) analogues therapies continues to grow.

North America benefits from a well-established healthcare system that supports the adoption of advanced therapies. This infrastructure facilitates patient access to glucagon-like peptide 1 (GLP-1) analogues, ensuring that healthcare providers can effectively prescribe and monitor these treatments. The presence of favourable reimbursement frameworks in the U.S. encourages healthcare providers to prescribe glucagon-like peptide 1 (GLP-1) analogues.

Moreover, in this region, a major number of key players present, government initiatives & regulatory support, technological advancements, & investments and product launches & approvals that would propel this glucagon-like peptide 1 (GLP-1) analogues market growth. For instance, in November 2023, the U.S. Food and Drug Administration (FDA) approved Eli Lilly and Company's Zepbound (tirzepatide) injection, marking it as the first and only obesity treatment that activates both GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 (glucagon-like peptide-1) hormone receptors.

Also, in May 2022, the U.S. Food and Drug Administration (FDA) approved Mounjaro (tirzepatide) injection, developed by Eli Lilly and Company, as a once-weekly treatment for adults with type 2 diabetes. Mounjaro acts as a dual receptor agonist, targeting both GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 (glucagon-like peptide-1) receptors. This medication is intended to be used in conjunction with diet and exercise to enhance glycemic control. Thus, the above factors are consolidating the region's position as a dominant force in the global glucagon-like peptide 1 (GLP-1) analogues market.

Asia Pacific is growing at the fastest pace in the global glucagon-like peptide 1 (GLP-1) analogues market

Asia Pacific holds the fastest pace in the global glucagon-like peptide 1 (GLP-1) analogues market and is expected to hold most of the market share.

The Asia-Pacific glucagon-like peptide 1 (GLP-1) analogues market is experiencing significant growth, driven by various factors that address the increasing prevalence of diabetes and obesity in the region.

The Asia-Pacific region is seeing a notable increase in cases of type 2 diabetes and obesity, primarily due to lifestyle changes, urbanization, and unhealthy dietary habits. This surge in diagnoses is fueling the demand for effective treatment options like glucagon-like peptide 1 (GLP-1) analogues. The ageing demographic in Asia-Pacific is projected to grow significantly, with individuals aged 60 and above expected to nearly double by 2050. Older adults are more susceptible to developing type 2 diabetes, which will drive the demand for GLP-1 therapies designed to manage their health effectively.

Furthermore, key players in the region product launches and approvals that would drive this glucagon-like peptide 1 (GLP-1) analogues market. For instance, in January 2024, Glenmark Pharmaceuticals Ltd. made a significant entry into the Indian pharmaceutical market by launching Lirafit, a biosimilar of the widely used anti-diabetic drug liraglutide. This marks the first time a biosimilar of liraglutide has been introduced in India, following approval from the Drug Controller General of India (DCGI).

Also, in November 2023, semaglutide, marketed under the brand name Wegovy, received regulatory approval for chronic weight management in Japan. This marks a significant milestone as it is the first GLP-1 receptor agonist approved for obesity treatment in Japan, and indeed the first such approval for chronic weight management in any Asian country.

Thus, the above factors are consolidating the region's position as the fastest-growing force in the global glucagon-like peptide 1 (GLP-1) analogues market.

Competitive Landscape

The major global players in the glucagon-like peptide 1 (GLP-1) analogues market include Eli Lilly and Company, Novo Nordisk A/S., Sanofi, AstraZeneca, Boehringer Ingelheim, Inc., Glenmark Pharmaceuticals Ltd., Hanmi Pharm.Co., Ltd., Amgen Inc., Gmax Biopharm., and Sciwind Biosciences Co., Ltd. among others.

Key Developments

• In August 2024, Metsera, a newly launched clinical-stage biopharmaceutical company, emerged with a significant $290 million in funding to develop innovative treatments for obesity and metabolic diseases, particularly focusing on GLP-1 receptor agonists.

• In June 2024, Teva Pharmaceuticals announced the launch of the first generic version of a GLP-1 receptor agonist in the United States, specifically liraglutide 1.8 mg. This marks a significant milestone in the diabetes treatment landscape as it introduces a more affordable option for patients managing type 2 diabetes.

Why Purchase the Report?

• Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

• Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

• Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

• Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

• Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

• Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

• Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

• Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

• Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

• Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

• Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

• Post-market Surveillance: Uses post-market data to enhance product safety and access.

• Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global glucagon-like peptide 1 (GLP-1) analogues market report would provide approximately 78 tables, 76 figures, and 183 pages.

Target Audience 2023

• Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

• Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

• Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

• Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

• Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

• Supply Chain: Distribution and Supply Chain Managers.

• Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

• Academic & Research: Academic Institutions.

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Product

3.2. Snippet by Type

3.3. Snippet by Route of Administration

3.4. Snippet by Application

3.5. Snippet by Distribution Channel

3.6. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Increasing Prevalence of Obesity and Type 2 Diabetes

4.1.1.2. XX

4.1.2. Restraints

4.1.2.1. High Cost of Medications

4.1.3. Opportunity

4.1.4. Impact Analysis

5. Industry Analysis

5.1. Porter’s Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Regulatory Analysis

6. By Product

6.1. Introduction

6.1.1. Analysis and Y-o-Y Growth Analysis (%), By Product

6.1.2. Market Attractiveness Index, By Product

6.2. Ozempic*

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.3. Trulicity

6.4. Mounjaro

6.5. Wegovy

6.6. Rybelsus

6.7. Saxenda

6.8. Victoza

6.9. Zepbound

6.10. Others

7. By Type

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

7.1.2. Market Attractiveness Index, By Type

7.2. Long-acting GLP-1 Agonist*

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.3. Short-acting GLP-1 Agonist

8. By Route of Administration

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

8.1.2. Market Attractiveness Index, By Route of Administration

8.2. Subcutaneous*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Oral

9. By Application

9.1. Introduction

9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.1.2. Market Attractiveness Index, By Application

9.2. Type 2 Diabetes Mellitus*

9.2.1. Introduction

9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

9.3. Obesity

9.4. Others

10. By Application

10.1. Introduction

10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.1.2. Market Attractiveness Index, By Application

10.2. Hospital Pharmacies*

10.2.1. Introduction

10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

10.3. Retail Pharmacies

10.4. Online Pharmacies

11. By Region

11.1. Introduction

11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

11.1.2. Market Attractiveness Index, By Region

11.2. North America

11.2.1. Introduction

11.2.2. Key Region-Specific Dynamics

11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

11.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

11.2.8.1. U.S.

11.2.8.2. Canada

11.2.8.3. Mexico

11.3. Europe

11.3.1. Introduction

11.3.2. Key Region-Specific Dynamics

11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

11.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

11.3.8.1. Germany

11.3.8.2. U.K.

11.3.8.3. France

11.3.8.4. Spain

11.3.8.5. Italy

11.3.8.6. Rest of Europe

11.4. South America

11.4.1. Introduction

11.4.2. Key Region-Specific Dynamics

11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

11.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

11.4.8.1. Brazil

11.4.8.2. Argentina

11.4.8.3. Rest of South America

11.5. Asia-Pacific

11.5.1. Introduction

11.5.2. Key Region-Specific Dynamics

11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

11.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

11.5.8.1. China

11.5.8.2. India

11.5.8.3. Japan

11.5.8.4. South Korea

11.5.8.5. Rest of Asia-Pacific

11.6. Middle East and Africa

11.6.1. Introduction

11.6.2. Key Region-Specific Dynamics

11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

12. Competitive Landscape

12.1. Competitive Scenario

12.2. Market Positioning/Share Analysis

12.3. Mergers and Acquisitions Analysis

13. Company Profiles

13.1. Eli Lilly and Company*

13.1.1. Company Overview

13.1.2. Product Portfolio and Description

13.1.3. Financial Overview

13.1.4. Key Developments

13.2. Novo Nordisk A/S.

13.3. Sanofi

13.4. AstraZeneca

13.5. Boehringer Ingelheim, Inc.

13.6. Glenmark Pharmaceuticals Ltd.

13.7. Hanmi Pharm.Co., Ltd.

13.8. Amgen Inc.

13.9. Gmax Biopharm.

13.10. Sciwind Biosciences Co., Ltd.

LIST NOT EXHAUSTIVE

14. Appendix

14.1. About Us and Services

14.2. Contact Us

*** グルカゴン様ペプチド-1(GLP-1)アナログの世界市場に関するよくある質問(FAQ) ***

・グルカゴン様ペプチド-1(GLP-1)アナログの世界市場規模は?

→DataM Intelligence社は2023年のグルカゴン様ペプチド-1(GLP-1)アナログの世界市場規模を512億米ドルと推定しています。

・グルカゴン様ペプチド-1(GLP-1)アナログの世界市場予測は?

→DataM Intelligence社は2031年のグルカゴン様ペプチド-1(GLP-1)アナログの世界市場規模を1904.8億米ドルと予測しています。

・グルカゴン様ペプチド-1(GLP-1)アナログ市場の成長率は?

→DataM Intelligence社はグルカゴン様ペプチド-1(GLP-1)アナログの世界市場が2024年~2031年に年平均17.9%成長すると展望しています。

・世界のグルカゴン様ペプチド-1(GLP-1)アナログ市場における主要プレイヤーは?

→「Eli Lilly and Company、Novo Nordisk A/S.、Sanofi、AstraZeneca、Boehringer Ingelheim, Inc.、Glenmark Pharmaceuticals Ltd.、Hanmi Pharm.Co., Ltd.、Amgen Inc.、Gmax Biopharm.、Sciwind Biosciences Co., Ltd. など ...」をグルカゴン様ペプチド-1(GLP-1)アナログ市場のグローバル主要プレイヤーとして判断しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、最終レポートの情報と少し異なる場合があります。

*** 免責事項 ***

https://www.globalresearch.co.jp/disclaimer/