1. 調査手法および範囲

1.1. 調査手法

1.2. 調査目的およびレポートの範囲

2. 定義および概要

3. エグゼクティブサマリー

3.1. 製品種類別抜粋

3.2. 用途別抜粋

3.3. エンドユーザー別抜粋

3.4. 地域別抜粋

4. ダイナミクス

4.1. 影響因子

4.1.1. 推進要因

4.1.1.1. 低侵襲手術に対する需要の高まり

4.1.1.2. 手術器具の技術的進歩

4.1.2. 抑制要因

4.1.2.1. 器具および技術の高コスト

4.1.3. 機会

4.1.4. 影響分析

5. 産業分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 特許分析

5.5. 規制分析

5.6. SWOT分析

5.7. 未充足ニーズ

6. 製品種類別

6.1. はじめに

6.1.1. 市場規模分析および前年比成長率(%) 種類別

6.1.2. 市場魅力度指数 種類別

6.2. 鉗子および鉗子*

6.2.1. はじめに

6.2.2. 市場規模分析および前年比成長率(%)

6.3. 針ホルダー

6.4. メスおよび解剖器具

6.5. 鉗子

6.6. はさみ

6.7. その他

7. 用途別

7.1. はじめに

7.1.1. 用途別市場規模および前年比成長率(%)

7.1.2. 用途別市場魅力度指数

7.2. 腹腔鏡*

7.2.1. イントロダクション

7.2.2. 市場規模分析および前年比成長率分析(%)

7.3. 関節鏡

7.4. 内視鏡

7.5. その他

8. エンドユーザー別

8.1. イントロダクション

8.1.1. エンドユーザー別市場規模分析および前年比成長率分析(%)

8.1.2. エンドユーザー別市場魅力度指数

8.2. 病院*

8.2.1. 概要

8.2.2. 市場規模分析および前年比成長率分析(%)

8.3. 外来外科センター

8.4. 専門クリニック

8.5. その他

9. 地域別

9.1. 概要

9.1.1. 市場規模分析および前年比成長率分析(%)、地域別

9.1.2. 市場魅力度指数、地域別

9.2. 北米

9.2.1. はじめに

9.2.2. 主な地域特有の要因

9.2.3. 市場規模分析および前年比成長率分析(%)、製品種類別

9.2.4. 用途別市場規模分析および前年比成長率(%)

9.2.5. エンドユーザー別市場規模分析および前年比成長率(%)

9.2.6. 国別市場規模分析および前年比成長率(%)

9.2.6.1. 米国

9.2.6.2. カナダ

9.2.6.3. メキシコ

9.3. ヨーロッパ

9.3.1. はじめに

9.3.2. 主要地域別の動向

9.3.3. 市場規模分析および前年比成長率分析(%)、製品種類別

9.3.4. 市場規模分析および前年比成長率分析(%)、用途別

9.3.5. エンドユーザー別市場規模分析および前年比成長率(%)

9.3.6. 国別市場規模分析および前年比成長率(%)

9.3.6.1. ドイツ

9.3.6.2. 英国

9.3.6.3. フランス

9.3.6.4. スペイン

9.3.6.5. イタリア

9.3.6.6. ヨーロッパのその他地域

9.4. 南アメリカ

9.4.1. はじめに

9.4.2. 主要地域特有の動向

9.4.3. 市場規模分析および前年比成長率分析(%)、製品種類別

9.4.4. 用途別市場規模分析および前年比成長率(%)

9.4.5. エンドユーザー別市場規模分析および前年比成長率(%)

9.4.6. 国別市場規模分析および前年比成長率(%)

9.4.6.1. ブラジル

9.4.6.2. アルゼンチン

9.4.6.3. 南米その他

9.5. アジア太平洋地域

9.5.1. はじめに

9.5.2. 主要地域特有の動向

9.5.3. 市場規模分析および前年比成長率分析(%)、製品種類別

9.5.4. 市場規模分析および前年比成長率分析(%)、用途別

9.5.5. エンドユーザー別市場規模分析および前年比成長率分析(%)

9.5.6. 国別市場規模分析および前年比成長率分析(%)

9.5.6.1. 中国

9.5.6.2. インド

9.5.6.3. 日本

9.5.6.4. 韓国

9.5.6.5. アジア太平洋地域その他

9.6. 中東およびアフリカ

9.6.1. はじめに

9.6.2. 主要地域特有の動向

9.6.3. 市場規模分析および前年比成長率(%)、製品種類別

9.6.4. 市場規模分析および前年比成長率(%)、用途別

9.6.5. エンドユーザー別市場規模分析および前年比成長率分析(%)

10. 競合状況

10.1. 競合シナリオ

10.2. 市場ポジショニング/シェア分析

10.3. 合併・買収分析

11. 企業プロフィール

Medtronic plc

オリンパス株式会社

Stryker Corporation

Meril Life Sciences Pvt. Ltd.

Boston Scientific Corporation

Wexler Surgical

CONMED Corporation

Smith+Nephew

CooperSurgical Inc.

Johnson & Johnson

リストは網羅的なものではありません。

12. 付録

12.1. 当社およびサービスについて

12.2. お問い合わせ

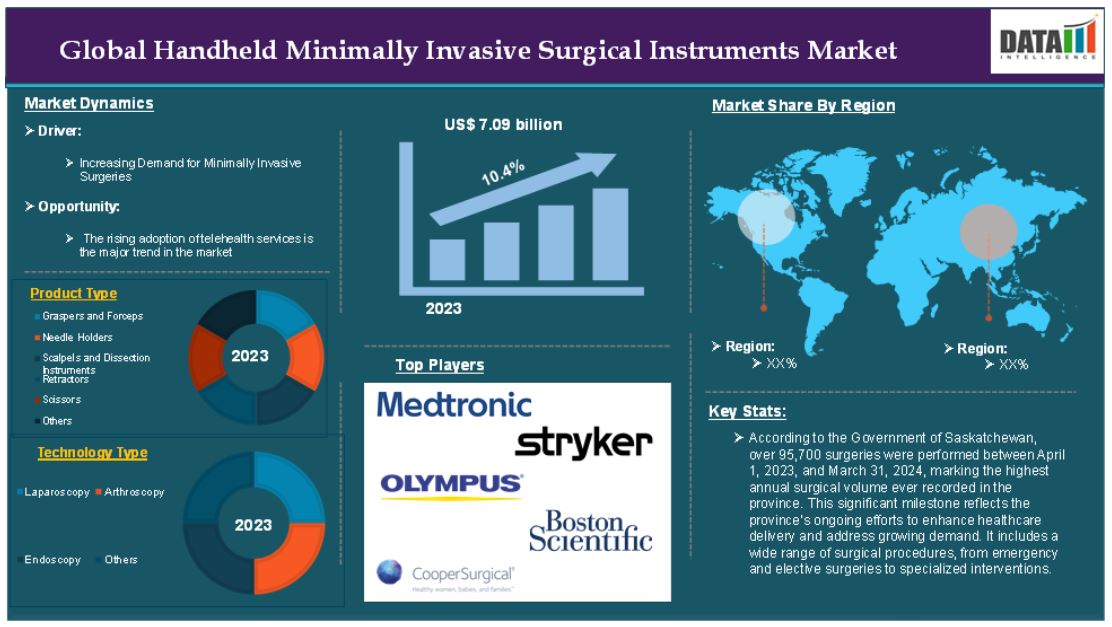

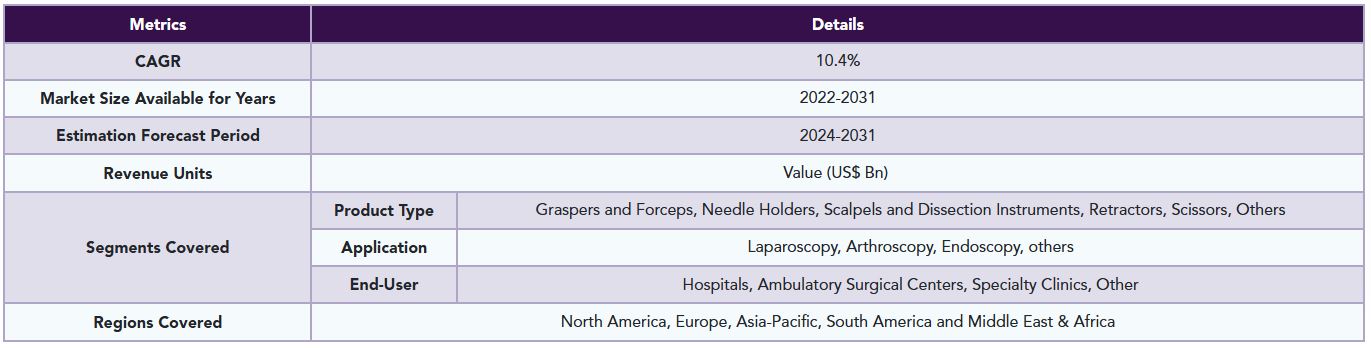

The global handheld minimally invasive surgical instruments market reached US$ 7.09 billion in 2023 and is expected to reach US$ 15.64 billion by 2031, growing at a CAGR of 10.4% during the forecast period 2024-2031.

Handheld minimally invasive surgical instruments refer to a category of surgical tools designed for use in minimally invasive surgical procedures, where smaller incisions are made in the body compared to traditional open surgery. These instruments are specifically designed to facilitate precise, controlled and efficient surgery with minimal trauma to surrounding tissues, leading to faster recovery times, reduced risk of infection and less scarring for patients. These instruments are typically smaller, lighter and more ergonomically designed than traditional surgical tools. Their compact size allows them to fit through smaller incisions, often as small as a few millimeters, without causing significant damage to the surrounding tissues.

The handheld minimally invasive surgical instruments market is experiencing robust growth, fueled by advancements in surgical technology, an increasing preference for minimally invasive procedures, and patient-centered care. With the rising number of surgeries, the demand for these instruments is expected to continue to rise globally. For instance, according to the Government of Saskatchewan, more than 95,700 surgeries were performed between April 1, 2023, and March 31, 2024, the highest annual surgical volume ever recorded.

Market Dynamics: Drivers & Restraints

Increasing demand for minimally invasive surgeries

Increasing demand for minimally invasive surgeries is significantly driving the growth of the handheld minimally invasive surgical instruments market and is expected to drive the market over the forecast period. Minimally invasive surgery, characterized by smaller incisions, reduced blood loss, faster recovery and fewer complications, is gaining widespread adoption among both patients and healthcare providers. This shift in surgical practices is increasing the demand for advanced, precision-driven tools such as handheld minimally invasive surgical instruments, which play a critical role in performing these procedures.

According to the American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS), 83 percent of the total number of procedures performed in 2023 were minimally invasive. Additionally, according to the procedures at the ISAPS World Congress in Cartagena, there is a higher increase of 5.5% in surgical procedures, with more than 15.8 million procedures performed by plastic surgeons. Over the last four years, the overall increase is 40%. This increasing number of surgeries and minimally invasive surgeries driving the growth of handheld minimally invasive surgical instruments.

Smaller incisions reduce the risk of infection, bleeding, and scarring. This is particularly attractive to patients who prefer procedures with minimal post-surgical complications. For instance, a study published in by Lancet found that patients who underwent laparoscopic surgery experienced 50% fewer complications compared to those who had traditional open surgery.

High cost of instruments and technologies

The high cost of instruments and technologies is significantly hampering the growth of the handheld minimally invasive surgical instruments market and is expected to hamper the market growth over the forecast period. While minimally invasive surgeries offer numerous advantages, such as reduced recovery times, fewer complications and enhanced patient satisfaction, the associated costs of advanced surgical tools and technologies can be a barrier, particularly for healthcare systems, hospitals and patients in lower-income regions or those with budget constraints.

Many handheld instruments used in minimally invasive procedures, such as laparoscopic scissors, endoscopic forceps and robotic-assisted tools, come with high upfront costs. These tools often feature advanced materials, precision engineering and specialized functionalities, all of which contribute to their high price. For instance, according to ScienceDirect, direct instrument costs for handheld robotic devices in general surgery were $310 vs $973 when comparing HandX with the DaVinci, respectively.

Many handheld instruments are used alongside imaging technologies, such as laparoscopes and endoscopes which provide real-time visualization. While these technologies improve surgical precision, they also come with high costs. For instance, a high-definition endoscopic system can cost between $25,000 and $50,000, while advanced systems integrated with 3D imaging or real-time data processing can push costs even higher.

Segment Analysis

The global handheld minimally invasive surgical instruments market is segmented based on product type, application, end-user and region.

Application:

The laparoscopy segment is expected to dominate the global handheld minimally invasive surgical instruments market share

The laparoscopy segment holds a major portion of the handheld minimally invasive surgical instruments market share and is expected to continue to hold a significant portion of the market share over the forecast period. This surgical technique, which uses small incisions and specialized tools to perform surgeries, has seen widespread adoption in a variety of medical fields due to its numerous advantages.

For instance, the Lancet study included 97,234 surgical procedures across 676 public hospitals. In total, 16,061 (16.5%) were performed using laparoscopic approaches, which were less common across all procedure categories. The growing preference for laparoscopic surgery is driving the demand for handheld instruments specifically designed for these procedures, which is a major factor contributing to its dominance.

Laparoscopy has become the gold standard for many types of minimally invasive surgeries because it offers faster recovery times, less postoperative pain and smaller scars. These advantages are particularly appealing to patients, leading to the growing preference for laparoscopic techniques. For instance, HandX is a lightweight, FDA-cleared and CE-marked device that combines the benefits of robotics and handheld instruments. HandX allows the surgeon to perform complex minimally invasive surgeries using a device that combines the benefits of a surgical robotic-based platform with the simplicity and affordability of traditional laparoscopic surgery.

Geographical Analysis

North America is expected to hold a significant position in the global handheld minimally invasive surgical instruments market

North America region is expected to hold the largest share in the handheld minimally invasive surgical instruments market over the forecast period. Hospitals and surgical centers in North America, especially in the United States are among the most advanced globally, with a high penetration of minimally invasive surgery tools, including laparoscopic and robotic-assisted instruments.

For instance, in the United States, major hospitals like the Cleveland Clinic and Mayo Clinic are recognized globally for their adoption of robot-assisted and laparoscopic surgeries, which require a wide range of handheld minimally invasive surgical instruments.

Specialized centers for procedures such as cardiac surgery, bariatric surgery, orthopedic surgery and gastrointestinal surgeries often use advanced handheld minimally invasive instruments, further driving demand in the region. A report by IBISWorld indicated that the U.S. healthcare sector was valued at approximately $4.8 trillion in 2023, with a significant portion allocated to surgical services and procedures that use minimally invasive techniques.

Asia Pacific is growing at the fastest pace in the Handheld Minimally Invasive Surgical Instruments market

The Asia Pacific region is experiencing the fastest growth in the handheld minimally invasive surgical instruments market. Many countries in the Asia-Pacific, particularly China, India and Japan, are significantly improving their healthcare infrastructure and investing in modern medical technologies. This is facilitating the adoption of advanced surgical techniques, including minimally invasive surgeries, which require handheld instruments.

As healthcare costs rise and patients seek faster recovery times with fewer complications, there is a strong demand for minimally invasive surgeries in Asia Pacific. Patients in countries like Japan, South Korea and India are increasingly opting for these procedures due to their benefits, such as shorter hospital stays, less postoperative pain and smaller scars. For instance, according to the NIH, more than 570 da Vinci (uses hand-held, long-shafted instruments) units were operational in Japan in 2023, highlighting the growing acceptance of robotic surgery despite the challenges.

Competitive Landscape

The major global players in the handheld minimally invasive surgical instruments market include Medtronic plc, Olympus Corporation, Stryker Corporation, Meril Life Sciences Pvt. Ltd., Boston Scientific Corporation, Wexler Surgical, CONMED Corporation, Smith+Nephew, CooperSurgical Inc., Johnson & Johnson and among others.

Why Purchase the Report?

• Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

• Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

• Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

• Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

• Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

• Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

• Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

• Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

• Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

• Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

• Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

• Post-market Surveillance: Uses post-market data to enhance product safety and access.

• Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global handheld minimally invasive surgical instruments market report would provide approximately 62 tables, 57 figures and 197 pages.

Target Audience 2023

• Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

• Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

• Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

• Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

• Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

• Supply Chain: Distribution and Supply Chain Managers.

• Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

• Academic & Research: Academic Institutions.

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Product Type

3.2. Snippet by Application

3.3. Snippet by End-User

3.4. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Increasing Demand for Minimally Invasive Surgeries

4.1.1.2. Technological Advancements in Surgical Tools

4.1.2. Restraints

4.1.2.1. High Cost of Instruments and Technologies

4.1.3. Opportunity

4.1.4. Impact Analysis

5. Industry Analysis

5.1. Porter’s Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Patent Analysis

5.5. Regulatory Analysis

5.6. SWOT Analysis

5.7. Unmet Needs

6. By Product Type

6.1. Introduction

6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

6.1.2. Market Attractiveness Index, By Product Type

6.2. Graspers and Forceps*

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.3. Needle Holders

6.4. Scalpels and Dissection Instruments

6.5. Retractors

6.6. Scissors

6.7. Others

7. By Application

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

7.1.2. Market Attractiveness Index, By Application

7.2. Laparoscopy*

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.3. Arthroscopy

7.4. Endoscopy

7.5. Others

8. By End-User

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

8.1.2. Market Attractiveness Index, By End-User

8.2. Hospitals*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Ambulatory Surgical Centers

8.4. Specialty Clinics

8.5. Others

9. By Region

9.1. Introduction

9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

9.1.2. Market Attractiveness Index, By Region

9.2. North America

9.2.1. Introduction

9.2.2. Key Region-Specific Dynamics

9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.2.6.1. U.S.

9.2.6.2. Canada

9.2.6.3. Mexico

9.3. Europe

9.3.1. Introduction

9.3.2. Key Region-Specific Dynamics

9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.3.6.1. Germany

9.3.6.2. U.K.

9.3.6.3. France

9.3.6.4. Spain

9.3.6.5. Italy

9.3.6.6. Rest of Europe

9.4. South America

9.4.1. Introduction

9.4.2. Key Region-Specific Dynamics

9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.4.6.1. Brazil

9.4.6.2. Argentina

9.4.6.3. Rest of South America

9.5. Asia-Pacific

9.5.1. Introduction

9.5.2. Key Region-Specific Dynamics

9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.5.6.1. China

9.5.6.2. India

9.5.6.3. Japan

9.5.6.4. South Korea

9.5.6.5. Rest of Asia-Pacific

9.6. Middle East and Africa

9.6.1. Introduction

9.6.2. Key Region-Specific Dynamics

9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10. Competitive Landscape

10.1. Competitive Scenario

10.2. Market Positioning/Share Analysis

10.3. Mergers and Acquisitions Analysis

11. Company Profiles

11.1. Medtronic plc*

11.1.1. Company Overview

11.1.2. Product Portfolio and Description

11.1.3. Financial Overview

11.1.4. Key Developments

11.2. Olympus Corporation

11.3. Stryker Corporation

11.4. Meril Life Sciences Pvt. Ltd.

11.5. Boston Scientific Corporation

11.6. Wexler Surgical

11.7. CONMED Corporation

11.8. Smith+Nephew

11.9. CooperSurgical Inc.

11.10. Johnson & Johnson

LIST NOT EXHAUSTIVE

12. Appendix

12.1. About Us and Services

12.2. Contact Us

*** ハンドヘルド型低侵襲手術器具の世界市場に関するよくある質問(FAQ) ***

・ハンドヘルド型低侵襲手術器具の世界市場規模は?

→DataM Intelligence社は2023年のハンドヘルド型低侵襲手術器具の世界市場規模を70億9000万米ドルと推定しています。

・ハンドヘルド型低侵襲手術器具の世界市場予測は?

→DataM Intelligence社は2031年のハンドヘルド型低侵襲手術器具の世界市場規模を156億4000万米ドルと予測しています。

・ハンドヘルド型低侵襲手術器具市場の成長率は?

→DataM Intelligence社はハンドヘルド型低侵襲手術器具の世界市場が2024年~2031年に年平均10.4%成長すると展望しています。

・世界のハンドヘルド型低侵襲手術器具市場における主要プレイヤーは?

→「Medtronic plc、オリンパス株式会社、Stryker Corporation、Meril Life Sciences Pvt. Ltd.、Boston Scientific Corporation、Wexler Surgical、CONMED Corporation、Smith+Nephew、CooperSurgical Inc.、Johnson & Johnsonなど ...」をハンドヘルド型低侵襲手術器具市場のグローバル主要プレイヤーとして判断しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、最終レポートの情報と少し異なる場合があります。

*** 免責事項 ***

https://www.globalresearch.co.jp/disclaimer/