1. 調査手法および範囲

1.1. 調査手法

1.2. 調査目的およびレポートの範囲

2. 定義および概要

3. エグゼクティブサマリー

3.1. 製品・サービス別抜粋

3.2. 技術別抜粋

3.3. 標本別抜粋

3.4. 試験の種類別抜粋

3.5. 用途別

3.6. 地域別

4. 力学

4.1. 影響因子

4.1.1. 推進要因

4.1.1.1. 慢性疾患の増加

4.1.1.2.

4.1.2. 抑制要因

4.1.2.1. 厳しい規制要件

4.1.3. 機会

4.1.4. 影響分析

5. 産業分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 規制分析

5.5. 償還分析

5.6. 特許分析

5.7. SWOT分析

5.8. DMI 意見

6. 製品・サービス別

6.1. はじめに

6.1.1. 製品・サービス別市場規模分析および前年比成長率(%)

6.1.2. 製品・サービス別市場魅力度指数

6.2. 機器*

6.2.1. はじめに

6.2.2. 市場規模分析および前年比成長率分析(%)

6.3. キット

6.4. ソフトウェア

7. 技術別

7.1. はじめに

7.1.1. 技術別市場規模分析および前年比成長率分析(%)

7.1.2. 技術別市場魅力度指数

7.2. 免疫測定*

7.2.1. はじめに

7.2.2. 市場規模分析および前年比成長率分析(%)

7.3. 血液学

7.4. 尿検査

8. 検体別

8.1. はじめに

8.1.1. 市場規模分析および前年比成長率分析(%)、検体別

8.1.2. 市場魅力度指数、検体別

8.2. 血液*

8.2.1. はじめに

8.2.2. 市場規模分析および前年比成長率分析(%)

8.3. 唾液

8.4. 尿

8.5. その他

9. 検査種類別

9.1. はじめに

9.1.1. 市場規模分析および前年比成長率分析(%)、種類別

9.1.2. 市場魅力度指数、種類別

9.2. 臨床検査*

9.2.1. はじめに

9.2.2. 市場規模分析および前年比成長率分析(%)

9.3. ポイントオブケア検査

10. 用途別

10.1. 概要

10.1.1. 市場規模分析および前年比成長率分析(%)、用途別

10.1.2. 市場魅力度指数、用途別

10.2. 腫瘍学*

10.2.1. 概要

10.2.2. 市場規模分析および前年比成長率分析(%)

10.3. 自己免疫疾患

10.4. 感染症

10.5. その他

11. エンドユーザー別

11.1. はじめに

11.1.1. エンドユーザー別市場規模分析および前年比成長率(%)

11.1.2. エンドユーザー別市場魅力度指数

11.2. 病院および診療所*

11.2.1. はじめに

11.2.2. 市場規模分析および前年比成長率分析(%)

11.3. 診断センター

11.4. 学術・研究機関

12. 地域別

12.1. はじめに

12.1.1. 市場規模分析および前年比成長率分析(%)、地域別

12.1.2. 市場魅力度指数、地域別

12.2. 北米

12.2.1. はじめに

12.2.2. 主な地域特有の動向

12.2.3. 市場規模分析および前年比成長率分析(%)、製品・サービス別

12.2.4. 技術別市場規模分析および前年比成長率(%)

12.2.5. 検体別市場規模分析および前年比成長率(%)

12.2.6. 試験の種類別市場規模分析および前年比成長率(%)

12.2.7. 用途別市場規模分析および前年比成長率(%)

12.2.8. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

12.2.9. 市場規模分析および前年比成長率分析(%)、国別

12.2.9.1. 米国

12.2.9.2. カナダ

12.2.9.3. メキシコ

12.3. ヨーロッパ

12.3.1. はじめに

12.3.2. 主要地域別の動向

12.3.3. 技術別市場規模分析および前年比成長率(%)

12.3.4. 検体別市場規模分析および前年比成長率(%)

12.3.5. 検査種類別市場規模分析および前年比成長率(%)

12.3.6. 市場規模分析および前年比成長率分析(%)、用途別

12.3.7. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

12.3.8. 市場規模分析および前年比成長率分析(%)、国別

12.3.8.1. ドイツ

12.3.8.2. 英国

12.3.8.3. フランス

12.3.8.4. イタリア

12.3.8.5. スペイン

12.3.8.6. ヨーロッパのその他地域

12.4. 南アメリカ

12.4.1. はじめに

12.4.2. 主要地域特有の動向

12.4.3. 技術別市場規模分析および前年比成長率(%)

12.4.4. 検体別市場規模分析および前年比成長率(%)

12.4.5. 試験の種類別市場規模分析および前年比成長率(%)

12.4.6. 用途別市場規模分析および前年比成長率(%)

12.4.7. エンドユーザー別市場規模分析および前年比成長率分析(%)

12.4.8. 国別市場規模分析および前年比成長率分析(%)

12.4.8.1. ブラジル

12.4.8.2. アルゼンチン

12.4.8.3. 南米その他

12.5. アジア太平洋地域

12.5.1. はじめに

12.5.2. 主要地域別の動向

12.5.3. 市場規模分析および前年比成長率分析(%)、技術別

12.5.4. 市場規模分析および前年比成長率分析(%)、検体別

12.5.5. 市場規模分析および前年比成長率分析(%)、検査種類別

12.5.6. 市場規模分析および前年比成長率分析(%)、用途別

12.5.7. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

12.5.8. 市場規模分析および前年比成長率分析(%)、国別

12.5.8.1. 中国

12.5.8.2. インド

12.5.8.3. 日本

12.5.8.4. 韓国

12.5.8.5. アジア太平洋地域その他

12.6. 中東およびアフリカ

12.6.1. はじめに

12.6.2. 主要地域特有の動向

12.6.3. 市場規模分析および前年比成長率分析(技術別

12.6.4. 市場規模分析および前年比成長率(%)、検体別

12.6.5. 市場規模分析および前年比成長率(%)、検査種類別

12.6.6. 市場規模分析および前年比成長率(%)、用途別

12.6.7. 市場規模分析および前年比成長率(%)、エンドユーザー別

13. 競合状況

13.1. 競合シナリオ

13.2. 市場ポジショニング/シェア分析

13.3. 合併・買収分析

14. 企業プロフィール

F. Hoffmann-La Roche Ltd

Abbott

Hologic, Inc.

Danaher Corporation

Bio-Rad Laboratories, Inc.

Revvity

Siemens Healthcare Private Limited

Thermo Fisher Scientific Inc.

Illumina, Inc.

Sysmex Corporation

リストは網羅的なものではありません

15. 付録

15.1. 当社およびサービスについて

15.2. お問い合わせ

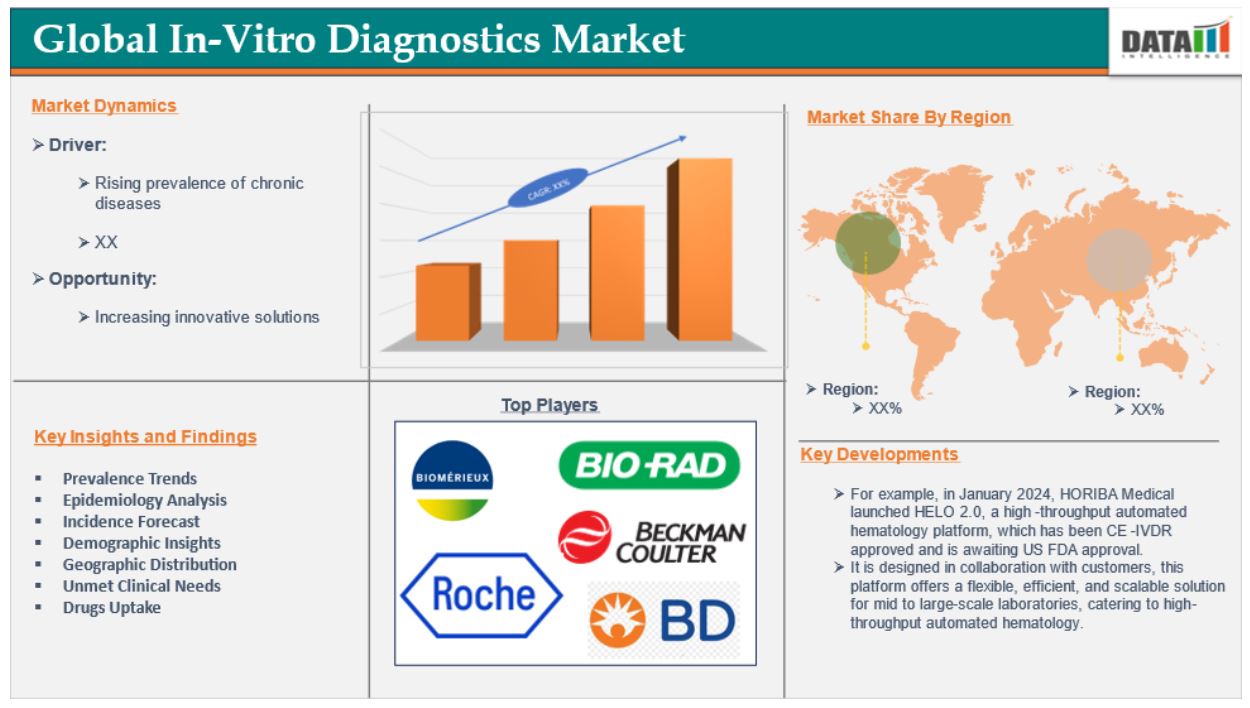

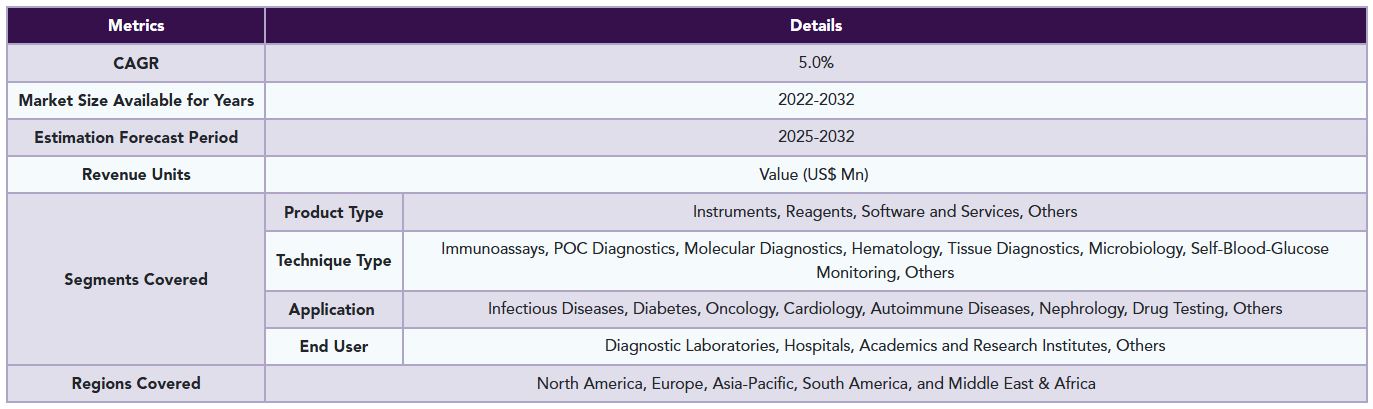

The global in-vitro diagnostics (IVDs) market reached US$ 86.2 billion in 2023 and is expected to reach US$ 139.83 billion by 2031, growing at a CAGR of 6.9% during the forecast period 2024-2031.

In vitro diagnostics (IVDs) is a broad term encompassing a variety of medical tests performed on human body samples such as blood, urine, and tissue. These tests are intended to help diagnose diseases, monitor health conditions, and guide treatment decisions. IVDs include a wide range of devices, such as reagents, tools, and software systems that make it easier to examine specimens and offer crucial information about a patient's health. According to the FDA, IVDs are vital tools in modern medicine, enabling healthcare practitioners to detect diseases early, assess the success of treatments, and better manage patient care.

The increasing prevalence of chronic diseases is the driving factor that drives the market over the forecast period. For instance, according to the Pan American Health Organization, globally, there were an expected 20 million new cancer diagnoses and 10 million cancer deaths. Over the next two decades, the cancer burden will rise by almost 60%, putting a further burden on healthcare systems, individuals, and communities.

Market Dynamics: Drivers & Restraints

Increasing prevalence of chronic diseases

The increasing prevalence of chronic diseases is expected to be a significant factor in the growth of the global in-vitro diagnostics (IVDs) market. The growing prevalence of chronic diseases is a significant driver driving the global in-vitro diagnostics (IVD) industry. Diabetes, cardiovascular disease, and cancer are growing increasingly prevalent, demanding better diagnostic technologies for early detection and management. As these disorders necessitate continual monitoring and treatment, the demand for IVD tests has increased. The aging population exacerbates this tendency, since older people are more susceptible to chronic illnesses, resulting in an increased demand for regular health checkups and diagnostic testing.

For instance, according to the National Institute of Health, in 2023, the United States is expected to see 1,958,310 new cancer cases and 609,820 cancer deaths. Prostate cancer incidence climbed by 3% every year from 2014 to 2019, after two decades of reduction, resulting in an additional 99,000 new cases. The annual cancer incidence rate is 440.5 per 100,000 men and women (based on cases from 2017 to 2021). The cancer death rate (cancer mortality) is 146.0 per 100,000 men and women annually (based on deaths from 2018-2022). In 2024, a projected 14,910 children and adolescents between the ages of 0 and 19 will be diagnosed with cancer, with 1,590 deaths from the condition.

Moreover, according to the National Institute of Health, approximately 462 million individuals were affected by type 2 diabetes corresponding to 6.28% of the world’s population. For instance, according to the Centers for Disease Control and Prevention, approximately 38.4 million individuals of all ages, representing 11.6% of the U.S. population, were diagnosed with diabetes. Among adults aged 18 and older, this figure rose to 38.1 million, accounting for 14.7% of all U.S. adults.

Stringent Regulatory Requirements

Factors such as stringent regulatory requirements associated are expected to hamper the global in-vitro diagnostics (IVDs) market. Stringent regulatory requirements are expected to severely impede the global in-vitro diagnostics (IVD) market, owing mostly to the complications brought by new legislation such as the In Vitro Diagnostic Medical Device Regulation (IVDR) in Europe. For instance, the IVDR, which went into effect in May 2022, changed the regulatory landscape for IVDs by establishing more stringent standards for performance evaluation and post-market surveillance. Many IVDs could previously self-declare compliance, however, the IVDR requires notified organizations to review a significant percentage of these devices.

Segment Analysis

The global in-vitro diagnostics (IVDs) market is segmented based on product and service, technology, specimen, test type, application, end-user, and region.

Oncology segment is expected to dominate the global in-vitro diagnostics (IVDs) market share

The oncology category is expected to dominate the global in-vitro diagnostics (IVDs) market due to a number of compelling factors, the most prominent of which is the global increase in cancer incidence. Cancer is still one of the top causes of illness and mortality worldwide, with millions of new cases diagnosed each year. This increased frequency has created a greater demand for reliable diagnostic techniques that can aid in early detection and treatment outcomes. One of the primary causes of this expansion is the emphasis on early cancer detection, which increases the likelihood of successful treatment. Healthcare providers and groups are becoming more vocal about frequent screening and diagnostic testing, especially among high-risk populations.

The increasing prevalence of cancer is one of the major reasons making oncology the dominant segment. For instance, according to the World Health Organization (WHO), cancer diagnoses are predicted to exceed 22 million by 2023 and in the case of breast cancer, 1 in 12 women will be diagnosed with breast cancer in their lifetime and 1 in 71 women die of it. underscoring the critical need for better therapeutic strategies.

Geographical Analysis

North America is expected to hold a significant position in the global in-vitro diagnostics (IVDs) market share

North America is expected to hold a significant portion of the global in-vitro diagnostics (IVDs) market. North America is expected to have a significant part in the worldwide in-vitro diagnostics (IVDs) market, owing to its advanced healthcare infrastructure, high prevalence of chronic diseases, and presence of major diagnostic businesses. The region's solid healthcare system, which includes vast laboratory networks and powerful diagnostic technology, makes it easier for breakthrough IVD solutions to be widely adopted. This infrastructure not only supports a large volume of diagnostic testing but also allows for the rapid introduction of new technologies into clinical practice.

The rising prevalence of chronic diseases such as diabetes, cardiovascular disease, and cancer is fueling the need for IVDs in North America. For instance, according to an article published by the National Institute of Health, in 2024, 2,001,140 new cancer cases and 611,720 cancer deaths are projected to occur in the United States. Cancer mortality continued to decline through 2021, averting over 4 million deaths since 1991 because of reductions in smoking, earlier detection for some cancers, and improved treatment options in both adjuvant and metastatic settings. However, these gains are threatened by increasing incidence for 6 of the top 10 cancers.

Asia Pacific is growing at the fastest pace in the global in-vitro diagnostics (IVDs) market

Asia Pacific is experiencing the fastest growth in global in-vitro diagnostics (IVDs) owing to the increasing incidence of chronic diseases and technological advancements in the region. For instance, according to the National Institute of Health, the expected number of cancer cases in India for 2022 is 14,61,427 (crude rate: 100.4 per 100,000). In India, one out of every nine people is likely to develop cancer over his or her lifetime. Males and females were most likely to develop lung and breast cancer, respectively.

Competitive Landscape

The major global players in the global in-vitro diagnostics (IVDs) market include F. Hoffmann-La Roche Ltd, Abbott, Hologic, Inc., Danaher Corporation, Bio-Rad Laboratories, Inc., Revvity, Siemens Healthcare Private Limited, Thermo Fisher Scientific Inc., Illumina, Inc., and Sysmex Corporation among others.

Emerging Players

Genomtec, QuantiLight, and GeneSys Bio among others

Key Developments

• In August 2024, InBios International Inc., a leading developer and manufacturer of diagnostic tests for emerging infectious diseases and biothreats announced the launching of a new in vitro serological ELISA kit for presumptive clinical laboratory diagnosis of Strongyloides infection that offers results in under 75 minutes.

• In December 2023, Thermo Fisher Scientific announced the launch of a nucleic acid purification instrument and kit for automated viral and bacterial respiratory testing. The KingFisher Apex Dx system automates the extraction of up to 24 or 96 DNA, RNA, protein, or cell samples and transitions from clinical research to diagnostics by offering research use only (RUO) and in vitro diagnostics (IVD) software modes.

Why Purchase the Report?

• Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

• Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

• Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

• Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

• Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

• Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

• Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

• Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

• Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

• Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

• Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

• Post-market Surveillance: Uses post-market data to enhance product safety and access.

• Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global in-vitro diagnostics (IVDs) market report would provide approximately 53 tables, 47 figures, and 176 pages.

Target Audience 2023

• Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

• Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

• Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

• Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

• Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

• Supply Chain: Distribution and Supply Chain Managers.

• Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

• Academic & Research: Academic Institutions.

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Product and Service

3.2. Snippet by Technology

3.3. Snippet by Specimen

3.4. Snippet by Test Type

3.5. Snippet by Application

3.6. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Increasing Prevalence of Chronic Diseases

4.1.1.2.

4.1.2. Restraints

4.1.2.1. Stringent Regulatory Requirements

4.1.3. Opportunity

4.1.4. Impact Analysis

5. Industry Analysis

5.1. Porter's Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Regulatory Analysis

5.5. Reimbursement Analysis

5.6. Patent Analysis

5.7. SWOT Analysis

5.8. DMI Opinion

6. By Product and Service

6.1. Introduction

6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product and Service

6.1.2. Market Attractiveness Index, By Product and Service

6.2. Instruments*

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.3. Kits

6.4. Software

7. By Technology

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

7.1.2. Market Attractiveness Index, By Technology

7.2. Immunoassay*

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.3. Hematology

7.4. Urinalysis

8. By Specimen

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Specimen

8.1.2. Market Attractiveness Index, By Specimen

8.2. Blood*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Saliva

8.4. Urine

8.5. Others

9. By Test Type

9.1. Introduction

9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Test Type

9.1.2. Market Attractiveness Index, By Test Type

9.2. Laboratory Tests*

9.2.1. Introduction

9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

9.3. Point-of-Care Tests

10. By Application

10.1. Introduction

10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.1.2. Market Attractiveness Index, By Application

10.2. Oncology*

10.2.1. Introduction

10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

10.3. Autoimmune Diseases

10.4. Infectious Diseases

10.5. Others

11. By End-User

11.1. Introduction

11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11.1.2. Market Attractiveness Index, By End-User

11.2. Hospitals and Clinics*

11.2.1. Introduction

11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

11.3. Diagnostic Centers

11.4. Academic and Research Institutes

12. By Region

12.1. Introduction

12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

12.1.2. Market Attractiveness Index, By Region

12.2. North America

12.2.1. Introduction

12.2.2. Key Region-Specific Dynamics

12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product and Service

12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Specimen

12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Test Type

12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12.2.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

12.2.9.1. The U.S.

12.2.9.2. Canada

12.2.9.3. Mexico

12.3. Europe

12.3.1. Introduction

12.3.2. Key Region-Specific Dynamics

12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Specimen

12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Test Type

12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

12.3.8.1. Germany

12.3.8.2. UK

12.3.8.3. France

12.3.8.4. Italy

12.3.8.5. Spain

12.3.8.6. Rest of Europe

12.4. South America

12.4.1. Introduction

12.4.2. Key Region-Specific Dynamics

12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Specimen

12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Test Type

12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

12.4.8.1. Brazil

12.4.8.2. Argentina

12.4.8.3. Rest of South America

12.5. Asia-Pacific

12.5.1. Introduction

12.5.2. Key Region-Specific Dynamics

12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Specimen

12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Test Type

12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

12.5.8.1. China

12.5.8.2. India

12.5.8.3. Japan

12.5.8.4. South Korea

12.5.8.5. Rest of Asia-Pacific

12.6. Middle East and Africa

12.6.1. Introduction

12.6.2. Key Region-Specific Dynamics

12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Specimen

12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Test Type

12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

13. Competitive Landscape

13.1. Competitive Scenario

13.2. Market Positioning/Share Analysis

13.3. Mergers and Acquisitions Analysis

14. Company Profiles

14.1. F. Hoffmann-La Roche Ltd*

14.1.1. Company Overview

14.1.2. Product Portfolio and Description

14.1.3. Financial Overview

14.1.4. Key Developments

14.2. Abbott

14.3. Hologic, Inc

14.4. Danaher Corporation

14.5. Bio-Rad Laboratories, Inc

14.6. Revvity

14.7. Siemens Healthcare Private Limited

14.8. Thermo Fisher Scientific Inc.

14.9. Illumina, Inc.

14.10. Sysmex Corporation

LIST NOT EXHAUSTIVE

15. Appendix

15.1. About Us and Services

15.2. Contact Us

*** 体外診断用医薬品(IVD)の世界市場に関するよくある質問(FAQ) ***

・体外診断用医薬品(IVD)の世界市場規模は?

→DataM Intelligence社は2023年の体外診断用医薬品(IVD)の世界市場規模を862億米ドルと推定しています。

・体外診断用医薬品(IVD)の世界市場予測は?

→DataM Intelligence社は2031年の体外診断用医薬品(IVD)の世界市場規模を1398.3億米ドルと予測しています。

・体外診断用医薬品(IVD)市場の成長率は?

→DataM Intelligence社は体外診断用医薬品(IVD)の世界市場が2024年~2031年に年平均6.9%成長すると展望しています。

・世界の体外診断用医薬品(IVD)市場における主要プレイヤーは?

→「F. Hoffmann-La Roche Ltd、Abbott、Hologic, Inc.、Danaher Corporation、Bio-Rad Laboratories, Inc.、Revvity、Siemens Healthcare Private Limited、Thermo Fisher Scientific Inc.、Illumina, Inc.、Sysmex Corporationなど ...」を体外診断用医薬品(IVD)市場のグローバル主要プレイヤーとして判断しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、最終レポートの情報と少し異なる場合があります。

*** 免責事項 ***

https://www.globalresearch.co.jp/disclaimer/