1. 調査手法および範囲

1.1. 調査手法

1.2. 調査目的およびレポートの範囲

2. 定義および概要

3. エグゼクティブサマリー

3.1. 製品種類別抜粋

3.2. 用途別抜粋

3.3. 技術別抜粋

3.4. エンドユーザー別抜粋

3.5. 地域別抜粋

4. ダイナミクス

4.1. 影響要因

4.1.1. 推進要因

4.1.1.1. 技術的進歩の増加

4.1.1.2. XX

4.2. 阻害要因

4.2.1. 正確性と信頼性の限界

4.3. 機会

4.3.1. 影響分析

5. 産業分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 規制分析

6. 製品種類別

6.1. はじめに

6.1.1. 市場規模分析および前年比成長率(%)分析、製品種類別

6.1.2. 市場魅力度指数、種類別

6.2. ウェアラブルバイオセンサ*

6.2.1. はじめに

6.2.2. 市場規模分析および前年比成長率分析(%)

6.3. 非ウェアラブルバイオセンサ

7. 用途別

7.1. はじめに

7.1.1. 用途別市場規模分析および前年比成長率(%)

7.1.2. 用途別市場魅力度指数

7.2. 診断*

7.2.1. はじめに

7.2.2. 市場規模分析および前年比成長率(%)

7.3. モニタリング

7.4. 治療

7.5. 患者モニタリング

7.6. 在宅ケア

8. 技術別

8.1. はじめに

8.1.1. 技術別市場規模分析および前年比成長率(%)

8.1.2. 技術別市場魅力度指数

8.2. 電気化学バイオセンサ*

8.2.1. はじめに

8.2.2. 市場規模分析および前年比成長率分析(%)

8.3. 光バイオセンサ

8.4. 熱バイオセンサ

8.5. 圧電バイオセンサ

9. エンドユーザー別

9.1. はじめに

9.1.1. エンドユーザー別市場規模分析および前年比成長率分析(%)

9.1.2. 市場魅力度指数、エンドユーザー別

9.2. 病院および診療所*

9.2.1. はじめに

9.2.2. 市場規模分析および前年比成長率分析(%)

9.3. 在宅医療

9.4. 研究施設

9.5. 外来外科センター

10. 地域別

10.1. はじめに

10.1.1. 市場規模分析および前年比成長率分析(%)、地域別

10.1.2. 市場魅力度指数、地域別

10.2. 北米

10.2.1. はじめに

10.2.2. 地域特有の主な動向

10.2.3. 市場規模分析および前年比成長率分析(%)、製品種類別

10.2.4. 用途別市場規模分析および前年比成長率(%)

10.2.5. 技術別市場規模分析および前年比成長率(%)

10.2.6. エンドユーザー別市場規模分析および前年比成長率(%)

10.2.7. 国別市場規模分析および前年比成長率(%)

10.2.7.1. 米国

10.2.7.2. カナダ

10.2.7.3. メキシコ

10.3. ヨーロッパ

10.3.1. はじめに

10.3.2. 主要地域別の動向

10.3.3. 市場規模分析および前年比成長率分析(%)、製品種類別

10.3.4. 用途別市場規模分析および前年比成長率(%)

10.3.5. 技術別市場規模分析および前年比成長率(%)

10.3.6. エンドユーザー別市場規模分析および前年比成長率(%)

10.3.7. 国別市場規模分析および前年比成長率(%)

10.3.7.1. ドイツ

10.3.7.2. 英国

10.3.7.3. フランス

10.3.7.4. スペイン

10.3.7.5. イタリア

10.3.7.6. ヨーロッパのその他地域

10.4. 南アメリカ

10.4.1. はじめに

10.4.2. 主要地域別の動向

10.4.3. 市場規模分析および前年比成長率分析(%)、製品種類別

10.4.4. 市場規模分析および前年比成長率分析(%)、用途別

10.4.5. 市場規模分析および前年比成長率分析(%)、技術別

10.4.6. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

10.4.7. 市場規模分析および前年比成長率分析(%)、国別

10.4.7.1. ブラジル

10.4.7.2. アルゼンチン

10.4.7.3. 南米その他

10.5. アジア太平洋

10.5.1. はじめに

10.5.2. 主要地域別の動向

10.5.3. 市場規模分析および前年比成長率分析(%)、製品種類別

10.5.4. 市場規模分析および前年比成長率分析(%)、用途別

10.5.5. 市場規模分析および前年比成長率分析(%)、技術別

10.5.6. 市場規模の分析と前年比成長率の分析(%)、エンドユーザー別

10.5.7. 市場規模の分析と前年比成長率の分析(%)、国別

10.5.7.1. 中国

10.5.7.2. インド

10.5.7.3. 日本

10.5.7.4. 韓国

10.5.7.5. アジア太平洋地域その他

10.6. 中東およびアフリカ

10.6.1. はじめに

10.6.2. 地域特有の主な動向

10.6.3. 製品種類別市場規模分析および前年比成長率分析(%)

10.6.4. 用途別市場規模分析および前年比成長率分析(%)

10.6.5. 市場規模の分析および前年比成長率(%)、技術別

10.6.6. 市場規模の分析および前年比成長率(%)、エンドユーザー別

11. 競合状況

11.1. 競合シナリオ

11.2. 市場ポジショニング/シェア分析

11.3. 合併・買収分析

12. 企業プロフィール

Abbott Laboratories

Bio-Rad Laboratories Inc

Biosensors International Group, Ltd

DuPont Biosensor Materials

Ercon, Inc

Johnson & Johnson

Koninklijke Philips N.V

LifeScan, Inc

Medtronic

Molex LLC

(リストは網羅的ではありません)

13. 付録

13.1. 当社およびサービスについて

13.2. お問い合わせ

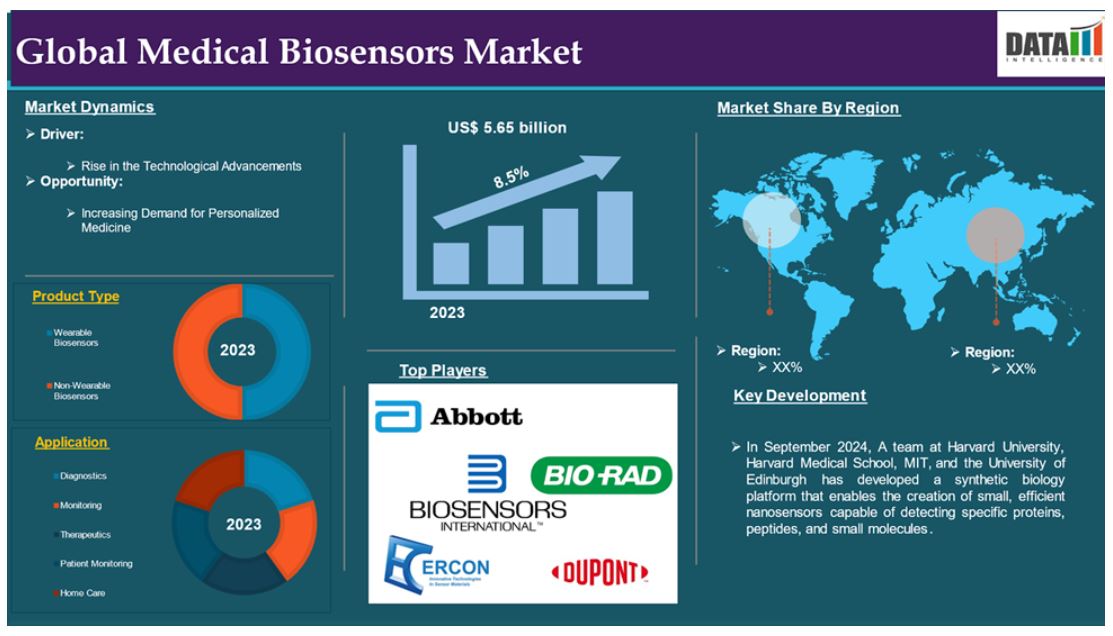

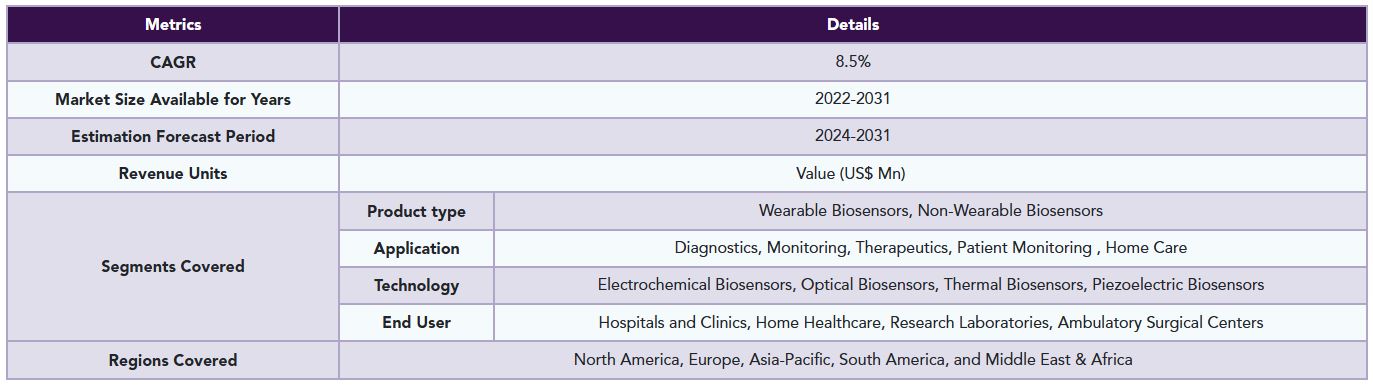

The global medical biosensors market reached US$ 5.65 billion in 2023 and is expected to reach US$ 10.90 billion by 2031, growing at a CAGR of 8.5% during the forecast period 2024-2031.

A biosensor is an analytical device that combines biological detecting elements like a sensor system and a transducer to convert a biological response into an electrical signal. It works by communicating with the analyte being tested and converting the response into an electrical signal by the transducer. Medical biosensors play a significant role in medical diagnostics and patient monitoring, as they are uniquely suited to real-time detection challenges due to their use of biological molecules, tissues, and organisms. Glucose biosensors are widely used in clinical applications for diabetes diagnosis, accounting for 85% of the world market. The biosensor field has expanded into various types, including immunosensors and thermal biosensors.

Market Dynamics: Drivers & Restraints

Rise in the Technological Advancements

Technological advancements are driving the growth of the global medical biosensors market by improving the precision, functionality, and accessibility of these devices. Nanotechnology innovations have enhanced the sensitivity and specificity of biosensors, enabling early disease diagnosis. Artificial intelligence and machine learning algorithms have transformed biosensors into smart diagnostic tools, providing real-time data analysis, predictive insights, and personalized health recommendations.

Flexible and wearable biosensors have expanded their applications beyond clinical settings, enabling continuous health monitoring and remote patient care. Wireless communication technologies like Bluetooth and NFC have enabled seamless connectivity between biosensors and digital health platforms. Miniaturization and biocompatible materials have made biosensors more user-friendly, making them indispensable tools in modern healthcare systems.

For instance, in October 2024, STMicroelectronics has introduced a new medical bio-sensing chip, the ST1VAFE3BX, for healthcare wearables like smart watches, sports bands, connected rings, and smart glasses. The chip uses high-accuracy biopotential input and inertial sensing, ensuring faster performance with lower power consumption.ST's biosensor has enabled the development of precise athlete performance monitoring systems, including ECG analysis in chest bands or small patches. The combination of analog signal from the vAFE with motion data from the acceleration sensor in a compact package allows for precise and context-aware data analysis, supporting AI algorithms directly on the sensor.

Accuracy and Reliability Limitations

Although biosensors have advanced significantly, the ability to maintain accuracy and reliability under varying conditions has always been a challenge. Such variation includes environmental conditions, user variability, and sensor deterioration. All these factors affect the performance of the device and thus lead to misleading readings. In critical areas of healthcare applications, such as glucose monitoring in diabetic management, slight inaccuracies can even be fatal. Such high-quality performance and dependability usually require advanced technology and frequent calibrations, which increase costs and maintenance requirements. With these, many applications restrict the usability of biosensors for accuracy and reliability in the ongoing market.

Segment Analysis

The global medical biosensors market is segmented based on product type, application, technology, end user and region.

Product type:

Wearable Biosensors segment is expected to dominate the medical biosensors market share

The wearable biosensors segment holds a major portion of the medical biosensors market share and is expected to continue to hold a significant portion of the medical biosensors market share during the forecast period.

Wearable biosensors are revolutionizing the medical biosensors market by providing real-time health monitoring and diagnostic capabilities in a non-invasive manner. These devices, such as smartwatches, patches, and fitness bands, measure biomarkers like glucose levels, heart rate, blood pressure, and oxygen saturation. The rise in chronic diseases and demand for personalized medicine has driven the adoption of wearable biosensors. They are also used in remote patient monitoring, telehealth applications, and fitness tracking, especially during the COVID-19 pandemic. Advancements in sensor miniaturization, wireless connectivity, and AI-driven platforms are expected to further enhance the adoption and functionality of wearable biosensors, expanding their role in modern healthcare.

For instance, in June 2024, Trinity Biotech, a biotechnology company specializing in human diagnostics and diabetes management solutions, has launched its continuous glucose monitoring (CGM) microsite. The site will provide stakeholders with insights into the company's vision for the next generation of its CGM biosensor technology and AI-driven health analytics platform, as well as international commercialization of these solutions.

Application:

Diagnostics segment is the fastest-growing segment in medical biosensors market share

The diagnostics segment is the fastest-growing segment in the medical biosensors market share and is expected to hold the market share over the forecast period.

Diagnostics are a crucial segment of the global medical biosensors market, utilizing biosensor technology for accurate, rapid, and sensitive disease detection. These sensors are increasingly used in point-of-care diagnostics for conditions like diabetes, infectious diseases, cancer, and cardiovascular ailments, offering convenience and speed over traditional laboratory methods. They detect specific biological markers through electrochemical, optical, and piezoelectric methods, ensuring high precision and reliability. Advancements in portable and miniaturized biosensors have extended their use into home diagnostics, empowering individuals to self-monitor their health and reducing healthcare facility burden. The growing focus on personalized and preventive medicine and increasing incidence of chronic and infectious diseases highlight the importance of diagnostics in the biosensors market.

Geographical Analysis

North America is expected to hold a significant position in the medical biosensors market share

North America holds a substantial position in the medical biosensors market and is expected to hold most of the market share due to well-established healthcare infrastructure, advanced technological capabilities, and willingness to adopt innovative medical devices. In the U.S., chronic diseases have a higher prevalence, creating enormous opportunities for biosensors in hospitals or home care. Moreover, investments in healthcare research and reimbursement policies promote the exceptional adoption of biosensors for diagnosis and monitoring. Further, the contributions of Canada towards North America's market growth are significant; it is rapidly adopting wearable biosensors in its elderly population.

For instance, in November 2024, A new variant of human mpox has claimed the lives of 5% of people with reported infections in the Democratic Republic of the Congo since 2023, many of them children. The outbreak has spread to several other countries, leading to the World Health Organization declaring it a Public Health Emergency of International Concern. A different, rarely fatal mpox variant has caused an outbreak in over 100 countries since 2022. Researchers from the University of California School of Medicine and Boston University have developed an optical biosensor that can rapidly detect monkeypox, the virus that causes mpox, allowing clinicians to diagnose the disease at the point of care.

Moreover, in November 2023, A Malmö University researcher has developed a wireless biosensor that allows early detection of infections through smart catheters, diapers, or wound dressings. The technology has potential applications in health monitoring and disease monitoring. However, it requires reliable, user-friendly sensors that don't require traditional integrated circuits or bulky batteries.

Europe is growing at the fastest pace in the medical biosensors market

Europe holds the fastest pace in the medical biosensors market and is expected to hold most of the market share due to its robust healthcare infrastructure, increasing prevalence of chronic diseases, and strong government support for innovative medical technologies. The aging population in Europe is driving demand for advanced diagnostic and monitoring devices, particularly wearable devices, for real-time health monitoring. The region's emphasis on personalized and preventive healthcare has accelerated the adoption of biosensors, particularly wearable devices. Europe is also investing in research and development, supported by regulatory frameworks and initiatives like the European Union's Horizon programs. The COVID-19 pandemic has further boosted demand for biosensors in home diagnostics and point-of-care applications. Technological advancements, including nanotechnology and AI, and IoT-enabled medical devices are also driving the market.

For instance, in October 2024, Bruker Corporation has acquired Dynamic Biosensors GmbH, a Munich-based biosensor development company, strengthening its biophysical portfolio for molecular interaction and kinetic analysis. Dynamic Biosensors offers deep insights into inter-molecular and molecule-single cell interactions, supporting drug discovery in pharma, biotech, and basic research.

Competitive Landscape

The major global players in the medical biosensors market include Abbott Laboratories, Bio-Rad Laboratories Inc, Biosensors International Group, Ltd, DuPont Biosensor Materials, Ercon, Inc, Johnson & Johnson, Koninklijke Philips N.V, LifeScan, Inc Medtronic, Molex LLC among others.

Emerging Players

The emerging players in the medical biosensors market include Biolinq, Nemaura Medical, GlySens Incorporated and among others

Key Developments

• In August 2024, Metropolis Healthcare Limited has launched two advanced diagnostic laboratories in Telangana, Warangal and Nizamabad, as part of its strategic plan to improve diagnostic services in Tier 2 and Tier 3 cities. The facilities, covering 1,200 sq. ft., can process over 15,000 samples per month and offer a range of tests from basic pathology to advanced molecular diagnostics. By integrating state-of-the-art technology, Metropolis aims to strengthen local healthcare infrastructure and increase access to high-quality diagnostics for residents in these regions.

• In October 2024, The Saudi Food and Drug Authority (SFDA) has launched an initiative to develop diagnostic laboratory equipment and advance 3D printing in hospitals. The initiative aims to foster innovation, research, and development while reducing costs for hospitals and medical laboratories. The equipment and reagents are provided for diagnostic and therapeutic use within hospitals and are not intended for commercial purposes. The initiative aligns with the SFDA's commitment to encouraging innovators, supporting national industries, and empowering investors regarding products under its oversight.

• In October 2024, The Krishna Institute of Medical Sciences (KIMS) has signed a memorandum of understanding (MoU) with Wipro GE Healthcare to procure medical technology and services worth up to Rs 700 crore. The MoU covers new products, replacements, and sewices for 12 KIMS hospitals and 4 upcoming hospitals over the next three years. The MoU covers a full suite of medical technology products designed by Wipro GE Healthcare.

Why Purchase the Report?

• Pipeline & Innovations: Insights into clinical trials, product pipelines, and upcoming advancements.

• Market Positioning: Analysis of product performance and growth potential for optimized strategies.

• Real-World Evidence: Integration of patient feedback for enhanced product outcomes.

• Physician Preferences: Insights into healthcare provider behaviors and adoption strategies.

• Regulatory & Market Updates: Coverage of recent regulations, policies, and emerging technologies.

• Competitive Insights: Analysis of market share, competitor strategies, and new entrants.

• Pricing & Market Access: Review of pricing models, reimbursement trends, and access strategies.

• Market Expansion: Strategies for entering new markets and forming partnerships.

• Regional Opportunities: Identification of high-growth regions and investment prospects.

• Supply Chain Optimization: Assessment of risks and distribution strategies.

• Sustainability & Regulation: Focus on eco-friendly practices and regulatory changes.

• Post-Market Surveillance: Enhanced safety and access through post-market data.

• Value-Based Pricing: Insights into pharmacoeconomics and data-driven R&D decisions.

The global medical biosensors market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2023

• Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

• Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

• Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

• Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

• Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

• Supply Chain: Distribution and Supply Chain Managers.

• Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

• Academic & Research: Academic Institutions.

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Product Type

3.2. Snippet by Application

3.3. Snippet by Technology

3.4. Snippet by End User

3.5. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Rise in the Technological Advancements

4.1.1.2. XX

4.2. Restraints

4.2.1. Accuracy and Reliability Limitations

4.3. Opportunity

4.3.1. Impact Analysis

5. Industry Analysis

5.1. Porter’s Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Regulatory Analysis

6. By Product type

6.1. Introduction

6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product type

6.1.2. Market Attractiveness Index, By Product type

6.2. Wearable Biosensors*

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.3. Non-Wearable Biosensors

7. By Application

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

7.1.2. Market Attractiveness Index, By Application

7.2. Diagnostics*

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.3. Monitoring

7.4. Therapeutics

7.5. Patient Monitoring

7.6. Home Care

8. By Technology

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

8.1.2. Market Attractiveness Index, By Technology

8.2. Electrochemical Biosensors*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Optical Biosensors

8.4. Thermal Biosensors

8.5. Piezoelectric Biosensors

9. By End User

9.1. Introduction

9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

9.1.2. Market Attractiveness Index, By End User

9.2. Hospitals and Clinics*

9.2.1. Introduction

9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

9.3. Home Healthcare

9.4. Research Laboratories

9.5. Ambulatory Surgical Centers

10. By Region

10.1. Introduction

10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

10.1.2. Market Attractiveness Index, By Region

10.2. North America

10.2.1. Introduction

10.2.2. Key Region-Specific Dynamics

10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

10.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

10.2.7.1. U.S.

10.2.7.2. Canada

10.2.7.3. Mexico

10.3. Europe

10.3.1. Introduction

10.3.2. Key Region-Specific Dynamics

10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

10.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

10.3.7.1. Germany

10.3.7.2. U.K.

10.3.7.3. France

10.3.7.4. Spain

10.3.7.5. Italy

10.3.7.6. Rest of Europe

10.4. South America

10.4.1. Introduction

10.4.2. Key Region-Specific Dynamics

10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

10.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

10.4.7.1. Brazil

10.4.7.2. Argentina

10.4.7.3. Rest of South America

10.5. Asia-Pacific

10.5.1. Introduction

10.5.2. Key Region-Specific Dynamics

10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

10.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

10.5.7.1. China

10.5.7.2. India

10.5.7.3. Japan

10.5.7.4. South Korea

10.5.7.5. Rest of Asia-Pacific

10.6. Middle East and Africa

10.6.1. Introduction

10.6.2. Key Region-Specific Dynamics

10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

10.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

11. Competitive Landscape

11.1. Competitive Scenario

11.2. Market Positioning/Share Analysis

11.3. Mergers and Acquisitions Analysis

12. Company Profiles

12.1. Abbott Laboratories*

12.1.1. Company Overview

12.1.2. Product Portfolio and Description

12.1.3. Financial Overview

12.1.4. Key Developments

12.2. Bio-Rad Laboratories Inc

12.3. Biosensors International Group, Ltd

12.4. DuPont Biosensor Materials

12.5. Ercon, Inc

12.6. Johnson & Johnson

12.7. Koninklijke Philips N.V

12.8. LifeScan, Inc

12.9. Medtronic

12.10. Molex LLC (LIST NOT EXHAUSTIVE)

13. Appendix

13.1. About Us and Services

13.2. Contact Us

*** 医療用バイオセンサの世界市場に関するよくある質問(FAQ) ***

・医療用バイオセンサの世界市場規模は?

→DataM Intelligence社は2023年の医療用バイオセンサの世界市場規模を56.5億米ドルと推定しています。

・医療用バイオセンサの世界市場予測は?

→DataM Intelligence社は2031年の医療用バイオセンサの世界市場規模を109億米ドルと予測しています。

・医療用バイオセンサ市場の成長率は?

→DataM Intelligence社は医療用バイオセンサの世界市場が2024年~2031年に年平均8.5%成長すると展望しています。

・世界の医療用バイオセンサ市場における主要プレイヤーは?

→「Abbott Laboratories、Bio-Rad Laboratories Inc、Biosensors International Group, Ltd、DuPont Biosensor Materials、Ercon, Inc、Johnson & Johnson、Koninklijke Philips N.V、LifeScan, Inc、Medtronic、Molex LLCなど ...」を医療用バイオセンサ市場のグローバル主要プレイヤーとして判断しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、最終レポートの情報と少し異なる場合があります。

*** 免責事項 ***

https://www.globalresearch.co.jp/disclaimer/