1. 調査手法および対象範囲

1.1. 調査手法

1.2. 調査目的およびレポートの対象範囲

2. 定義および概要

3. エグゼクティブサマリー

3.1. 製品種類別抜粋

3.2. 技術別抜粋

3.3. 流通チャネル別抜粋

3.4. 地域別抜粋

4. 動向

4.1. 影響因子

4.1.1. 推進要因

4.1.1.1. 慢性疾患の増加

4.1.1.2.

4.1.2. 抑制要因

4.1.2.1. 機器の高コスト

4.1.3. 機会

4.1.4. 影響分析

5. 産業分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 規制分析

5.5. 償還分析

5.6. 特許分析

5.7. SWOT分析

5.8. DMI意見

6. 製品種類別

6.1. はじめに

6.1.1. 市場規模分析および前年比成長率(%) 製品種類別

6.1.2. 市場魅力度指数 製品種類別

6.2. 血糖値モニター*

6.2.1. はじめに

6.2.2. 市場規模分析および前年比成長率(%)

6.3. 血圧モニター

6.4. 体温モニター

6.5. パルスオキシメーター

6.6. 吸入器およびネブライザー

6.7. フィットネスモニタリングトラッカー

7. 技術別

7.1. はじめに

7.1.1. 技術別市場規模分析および前年比成長率(%)

7.1.2. 技術別市場魅力度指数

7.2. ミニチュア化技術*

7.2.1. はじめに

7.2.2. 市場規模分析および前年比成長率分析(%)

7.3. 人工知能(AI)

7.4. Bluetoothおよびワイヤレス接続

7.5. 遠隔医療統合

8. 流通チャネル別

8.1. はじめに

8.1.1. 流通チャネル別市場規模分析および前年比成長率分析(%)

8.1.2. 流通チャネル別市場魅力度指数

8.2. 病院薬局*

8.2.1. はじめに

8.2.2. 市場規模分析および前年比成長率分析(%)

8.3. 薬局

8.4. オンライン薬局

9. 地域別

9.1. はじめに

9.1.1. 市場規模分析および前年比成長率分析(%)、地域別

9.1.2. 市場魅力度指数、地域別

9.2. 北米

9.2.1. はじめに

9.2.2. 主な地域特有の動向

9.2.3. 市場規模分析および前年比成長率(%)製品種類別

9.2.4. 市場規模分析および前年比成長率(%)技術別

9.2.5. 市場規模分析および前年比成長率(%)流通チャネル別

9.2.6. 市場規模分析および前年比成長率(%)国別

9.2.6.1. 米国

9.2.6.2. カナダ

9.2.6.3. メキシコ

9.3. ヨーロッパ

9.3.1. はじめに

9.3.2. 主要地域別の動向

9.3.3. 市場規模分析および前年比成長率分析(%)、製品種類別

9.3.4. 市場規模分析および前年比成長率(%)、技術別

9.3.5. 市場規模分析および前年比成長率(%)、流通チャネル別

9.3.6. 市場規模分析および前年比成長率(%)、国別

9.3.6.1. ドイツ

9.3.6.2. 英国

9.3.6.3. フランス

9.3.6.4. イタリア

9.3.6.5. スペイン

9.3.6.6. ヨーロッパのその他地域

9.4. 南アメリカ

9.4.1. はじめに

9.4.2. 主要地域別の動向

9.4.3. 市場規模分析および前年比成長率分析(%)、製品種類別

9.4.4. 市場規模分析および前年比成長率(%)、技術別

9.4.5. 市場規模分析および前年比成長率(%)、流通チャネル別

9.4.6. 市場規模分析および前年比成長率(%)、国別

9.4.6.1. ブラジル

9.4.6.2. アルゼンチン

9.4.6.3. 南米その他

9.5. アジア太平洋地域

9.5.1. はじめに

9.5.2. 主要地域別の動向

9.5.3. 製品種類別市場規模分析および前年比成長率分析(%)

9.5.4. 技術別市場規模分析および前年比成長率分析(%)

9.5.5. 流通チャネル別市場規模分析および前年比成長率分析(%)

9.5.6. 国別市場規模分析および前年比成長率分析(%)

9.5.6.1. 中国

9.5.6.2. インド

9.5.6.3. 日本

9.5.6.4. 韓国

9.5.6.5. アジア太平洋地域その他

9.6. 中東およびアフリカ

9.6.1. はじめに

9.6.2. 主要地域特有の動向

9.6.3. 市場規模分析および前年比成長率(%)、製品種類別

9.6.4. 市場規模分析および前年比成長率(%)、技術別

9.6.5. 流通チャネル別市場規模分析および前年比成長率分析(%)

10. 競合状況

10.1. 競合シナリオ

10.2. 市場ポジショニング/シェア分析

10.3. 合併および買収分析

11. 企業プロフィール

Johnson & Johnson Services, Inc.

Medtronic

Abbott

Bayer

Koninklijke Philips N.V.

GE HealthCare

F. Hoffmann-La Roche Ltd

ResMed

OMRON Healthcare

Baxter

リストは網羅的なものではありません

12. 付録

12.1. 当社およびサービスについて

12.2. お問い合わせ

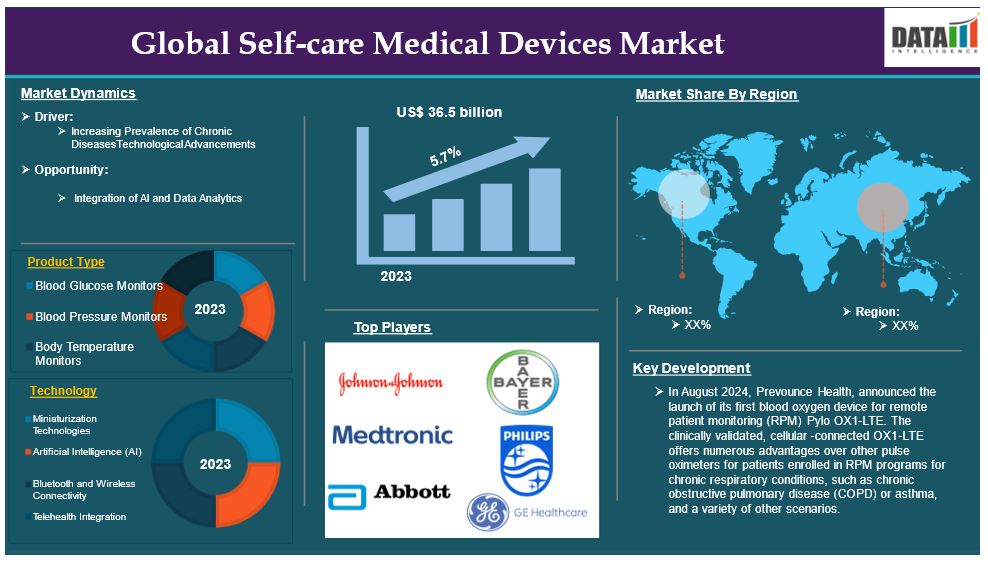

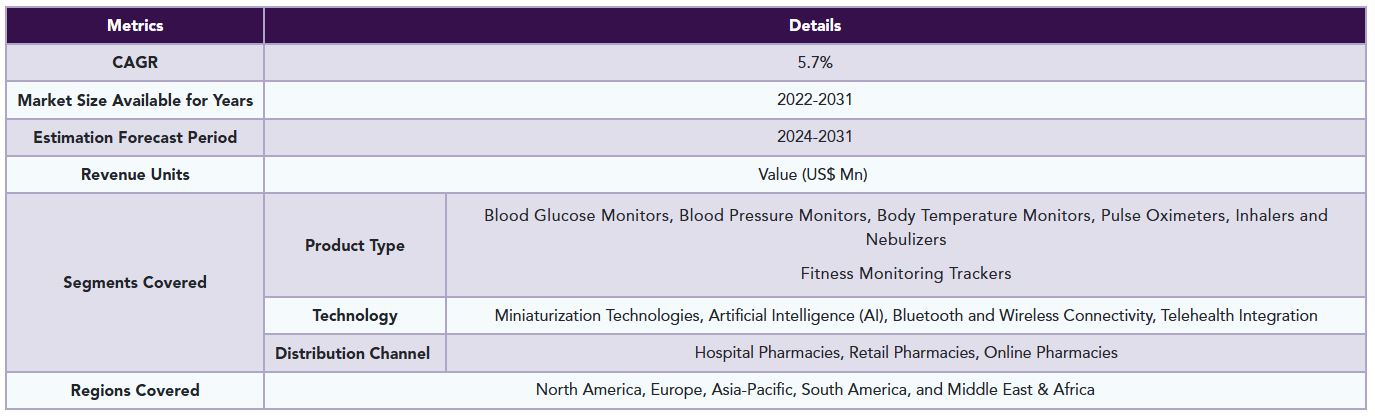

The global self-care medical devices market reached US$ 23.5 billion in 2023 and is expected to reach US$ 36.5 billion by 2031, growing at a CAGR of 5.7% during the forecast period 2024-2031.

Self-care medical devices are devices that enable people to monitor and manage their health issues on their own accord, usually at home. These devices aid in self-care by allowing users to monitor critical health parameters, promoting proactive health management and early detection of potential health issues. Self-care medical devices include a wide range of products that help people check their health and cure medical issues without the constant supervision of healthcare professionals. These devices are distinguished by their mobility, user-friendly interfaces, and capacity to produce rapid results, making them suitable for everyday use.

The increasing prevalence of chronic diseases is the driving factor that drives the market over the forecast period. For instance, according to the International Diabetes Federation, By 2045, IDF projections show that 1 in 8 adults, approximately 783 million, will be living with diabetes, an increase of 46%. Over 90% of people with diabetes have type 2 diabetes, which is driven by socio-economic, demographic, environmental, and genetic factors. Due to the increasing number of chronic diseases, the demand for medical devices that are used in the management of chronic diseases increases, which results in the growth of the market during the forecast period.

Market Dynamics: Drivers & Restraints

Increasing prevalence of chronic diseases

The increasing prevalence of chronic diseases is expected to be a significant factor in the growth of the global self-care medical devices market. The rising prevalence of chronic diseases is a key driver of growth in the global self-care medical device market. Chronic diseases like diabetes, hypertension, cancer, and cardiovascular ailments necessitate constant management and monitoring to avoid complications and enhance patient outcomes. As these disorders become more widespread as a result of causes such as aging populations, sedentary lifestyles, and insufficient nutrition, there is a corresponding increase in demand for self-care medical devices that allow people to take control of their health.

For instance, according to the National Institute of Health, in 2023, the United States is expected to see 1,958,310 new cancer cases and 609,820 cancer deaths. Prostate cancer incidence climbed by 3% every year from 2014 to 2019, after two decades of reduction, resulting in an additional 99,000 new cases. The annual cancer incidence rate is 440.5 per 100,000 men and women (based on cases from 2017 to 2021). The cancer death rate (cancer mortality) is 146.0 per 100,000 men and women annually (based on deaths from 2018-2022). In 2024, a projected 14,910 children and adolescents between the ages of 0 and 19 will be diagnosed with cancer, with 1,590 deaths from the condition.

Moreover, according to the National Institute of Health, approximately 462 million individuals were affected by type 2 diabetes corresponding to 6.28% of the world’s population. For instance, according to the Centers for Disease Control and Prevention, approximately 38.4 million individuals of all ages, representing 11.6% of the U.S. population, were diagnosed with diabetes. Among adults aged 18 and older, this figure rose to 38.1 million, accounting for 14.7% of all U.S. adults. Due to the increasing number of chronic diseases like cancer, the demand for medical devices that are used in the management of chronic diseases increases, which results in the growth of the market during the forecast period.

In order to offer solutions for the increasing prevalence of chronic diseases, organizations are entering into strategic partnerships, inculcating the latest technology, and launching new products that help in disease monitoring and management. For instance, in September 2024, Beta Bionics, an innovative leader in advanced diabetes management solutions, collaborated to combine Abbott’s glucose sensing technology with the iLet Bionic Pancreas automated insulin administration system.

High Costs of Devices

Factors such as the high costs of devices are expected to hamper the global self-care medical devices market. While these devices are beneficial for managing health issues and promoting preventative care, their cost remains a significant barrier for many potential users. The initial cost of advanced self-care gadgets might be prohibitively expensive, especially for those without adequate insurance coverage or in lower-income groups. This financial burden may discourage customers from investing in these critical technologies, limiting their accessibility and widespread use. For instance, according to Forbes Health, continuous glucose monitoring costs average $100 to $300 a month, which is $1,200 to $3,600 annually.

Segment Analysis

The global self-care medical devices market is segmented based on product type, technology, distribution channel and region.

Blood glucose monitors segment is expected to dominate the global self-care medical devices market share

The blood glucose monitors segment is expected to dominate the global self-care medical devices market due to a number of compelling factors, including the growing demand for improved diabetes control. Diabetes is becoming a more common health condition around the world, thus there is a greater need for dependable and user-friendly monitoring systems. Blood glucose monitors, which include both classic self-monitoring devices and advanced continuous glucose monitoring systems, are critical tools for patients managing their disease. Patients can use these devices to conveniently and accurately track their blood sugar levels, enabling timely adjustments to their treatment plans.

The increasing prevalence of diabetes is one of the major reasons making blood glucose monitors the dominant segment. Due to the increasing prevalence of diabetes, the demand for devices used for monitoring and management of diabetes increases making blood glucose monitors the dominating segment. For instance, according to the Centers for Disease Control and Prevention, in 2021, approximately 38.4 million individuals of all ages, representing 11.6% of the U.S. population, were diagnosed with diabetes. Among adults aged 18 and older, this figure rose to 38.1 million, accounting for 14.7% of all U.S. adults.

In recent times, there have been new launches that use the latest technology, acquisitions, and partnerships in this segment making it the most dominating one. For instance, in November 2024, Oura announced a strategic partnership with medical device maker Dexcom to integrate data from glucose biosensors with the Oura Ring, which tracks sleep, heart rate, and activity. Oura was granted a $75 million fund from Dexcom in a series D funding round, valuing the company at more than $5 billion.

Geographical Analysis

North America is expected to hold a significant position in the global self-care medical devices market share

North America is expected to hold a significant portion of the global self-care medical devices market. North America is expected to maintain the dominant position in the worldwide self-care medical devices market, owing to a number of variables that improve the region's healthcare landscape. The key reason for this supremacy is the presence of a highly developed healthcare infrastructure, which includes advanced medical facilities a strong supply chain for medicinal items, and an increasing prevalence of chronic diseases. This infrastructure enables the easy adoption of self-care medical devices, giving customers access to a diverse selection of goods geared for personal health management. The region's commitment to medical innovation and technology helps to support the incorporation of these technologies into routine healthcare procedures.

The rising prevalence of chronic diseases such as diabetes, cardiovascular disease, and cancer is fuelling the need for IVDs in North America. For instance, according to the CDC, approximately 38.4 million individuals of all ages, representing 11.6% of the U.S. population, were diagnosed with diabetes. Among adults aged 18 and older, this figure rose to 38.1 million, accounting for 14.7% of all U.S. adults.

In this region, there are recent launches, acquisitions, and strategic partnerships in the self-care medical devices market making this region hold the highest market share. For instance, in June 2024, Prevounce Health, a prominent provider of remote care management software, devices, and services, announced the introduction of their first remote blood glucose monitoring device, Pylo GL1-LTE. The blood glucose meter is scientifically verified and links to various cellular networks to provide dependable data transmission across the United States. The GL1-LTE is compatible with the Prevounce remote care management platform and can interface with other health software through the Pylo cloud API. Prevounce's range of Pylo cellular-connected products encompasses blood pressure monitors and weight scales.

Asia Pacific is growing at the fastest pace in the global self-care medical devices market

Asia Pacific is experiencing the fastest growth in global self-care medical devices owing to the increasing incidence of chronic diseases and technological advancements in the region. For instance, according to the National Institute of Health, the expected number of cancer cases in India for 2022 is 14,61,427 (crude rate: 100.4 per 100,000). In India, one out of every nine people is likely to develop cancer over his or her lifetime. Males and females were most likely to develop lung and breast cancer, respectively. Due to the increasing number of chronic diseases like cancer, the demand for monitoring and management devices is increasing in this region, making it the most significant region in this market.

Competitive Landscape

The major global players in the global self-care medical devices market include Johnson & Johnson Services, Inc., Medtronic, Abbott, Bayer, Koninklijke Philips N.V., GE HealthCare, F. Hoffmann-La Roche Ltd, ResMed, OMRON Healthcare, Baxter among others.

Emerging Players

Genomtec, QuantiLight, and GeneSys Bio among others

Key Developments

• In November 2023, DuPont announced that DuPon Liveo Healthcare Solutions is collaborating with STMicroelectronics, a global leader in semiconductor technology serving customers across the spectrum of electronics applications, to develop a new smart wearable device concept for remote biosignal monitoring.

• In August 2024, Prevounce Health, announced the launch of its first blood oxygen device for remote patient monitoring (RPM) Pylo OX1-LTE. The clinically validated, cellular-connected OX1-LTE offers numerous advantages over other pulse oximeters for patients enrolled in RPM programs for chronic respiratory conditions, such as chronic obstructive pulmonary disease (COPD) or asthma, and a variety of other scenarios.

Why Purchase the Report?

• Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

• Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

• Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

• Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

• Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

• Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

• Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

• Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

• Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

• Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

• Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

• Post-market Surveillance: Uses post-market data to enhance product safety and access.

• Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global self-care medical devices market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2023

• Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

• Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

• Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

• Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

• Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

• Supply Chain: Distribution and Supply Chain Managers.

• Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

• Academic & Research: Academic Institutions.

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Product Type

3.2. Snippet by Technology

3.3. Snippet by Distribution Channel

3.4. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Increasing Prevalence of Chronic Diseases

4.1.1.2.

4.1.2. Restraints

4.1.2.1. High Costs of Devices

4.1.3. Opportunity

4.1.4. Impact Analysis

5. Industry Analysis

5.1. Porter's Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Regulatory Analysis

5.5. Reimbursement Analysis

5.6. Patent Analysis

5.7. SWOT Analysis

5.8. DMI Opinion

6. By Product Type

6.1. Introduction

6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

6.1.2. Market Attractiveness Index, By Product Type

6.2. Blood Glucose Monitors*

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.3. Blood Pressure Monitors

6.4. Body Temperature Monitors

6.5. Pulse Oximeters

6.6. Inhalers and Nebulizers

6.7. Fitness Monitoring Trackers

7. By Technology

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

7.1.2. Market Attractiveness Index, By Technology

7.2. Miniaturization Technologies*

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.3. Artificial Intelligence (AI)

7.4. Bluetooth and Wireless Connectivity

7.5. Telehealth Integration

8. By Distribution Channel

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

8.1.2. Market Attractiveness Index, By Distribution Channel

8.2. Hospital Pharmacies*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Retail Pharmacies

8.4. Online Pharmacies

9. By Region

9.1. Introduction

9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

9.1.2. Market Attractiveness Index, By Region

9.2. North America

9.2.1. Introduction

9.2.2. Key Region-Specific Dynamics

9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

9.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.2.6.1. The U.S.

9.2.6.2. Canada

9.2.6.3. Mexico

9.3. Europe

9.3.1. Introduction

9.3.2. Key Region-Specific Dynamics

9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

9.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.3.6.1. Germany

9.3.6.2. UK

9.3.6.3. France

9.3.6.4. Italy

9.3.6.5. Spain

9.3.6.6. Rest of Europe

9.4. South America

9.4.1. Introduction

9.4.2. Key Region-Specific Dynamics

9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

9.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.4.6.1. Brazil

9.4.6.2. Argentina

9.4.6.3. Rest of South America

9.5. Asia-Pacific

9.5.1. Introduction

9.5.2. Key Region-Specific Dynamics

9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

9.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.5.6.1. China

9.5.6.2. India

9.5.6.3. Japan

9.5.6.4. South Korea

9.5.6.5. Rest of Asia-Pacific

9.6. Middle East and Africa

9.6.1. Introduction

9.6.2. Key Region-Specific Dynamics

9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

9.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

10. Competitive Landscape

10.1. Competitive Scenario

10.2. Market Positioning/Share Analysis

10.3. Mergers and Acquisitions Analysis

11. Company Profiles

11.1. Johnson & Johnson Services, Inc.*

11.1.1. Company Overview

11.1.2. Product Portfolio and Description

11.1.3. Financial Overview

11.1.4. Key Developments

11.2. Medtronic

11.3. Abbott

11.4. Bayer

11.5. Koninklijke Philips N.V.

11.6. GE HealthCare

11.7. F. Hoffmann-La Roche Ltd

11.8. ResMed

11.9. OMRON Healthcare

11.10. Baxter

LIST NOT EXHAUSTIVE

12. Appendix

12.1. About Us and Services

12.2. Contact Us

*** セルフケア用医療機器の世界市場に関するよくある質問(FAQ) ***

・セルフケア用医療機器の世界市場規模は?

→DataM Intelligence社は2023年のセルフケア用医療機器の世界市場規模を235億米ドルと推定しています。

・セルフケア用医療機器の世界市場予測は?

→DataM Intelligence社は2031年のセルフケア用医療機器の世界市場規模を365億米ドルと予測しています。

・セルフケア用医療機器市場の成長率は?

→DataM Intelligence社はセルフケア用医療機器の世界市場が2024年~2031年に年平均5.7%成長すると展望しています。

・世界のセルフケア用医療機器市場における主要プレイヤーは?

→「Johnson & Johnson Services, Inc.、Medtronic、Abbott、Bayer、Koninklijke Philips N.V.、GE HealthCare、F. Hoffmann-La Roche Ltd、ResMed、OMRON Healthcare、Baxterなど ...」をセルフケア用医療機器市場のグローバル主要プレイヤーとして判断しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、最終レポートの情報と少し異なる場合があります。

*** 免責事項 ***

https://www.globalresearch.co.jp/disclaimer/