1. 調査手法および対象範囲

1.1. 調査手法

1.2. 調査目的およびレポートの対象範囲

2. 定義および概要

3. エグゼクティブサマリー

3.1. 製品種類別抜粋

3.2. 用途別抜粋

3.3. エンドユーザー別抜粋

3.4. 地域別抜粋

4. ダイナミクス

4.1. 影響因子

4.1.1. 推進要因

4.1.1.1. 心血管疾患の増加

4.1.1.2. XX

4.1.2. 抑制要因

4.1.2.1. 機器の高コスト

4.1.3. 機会

4.1.4. 影響分析

5. 産業分析

5.1. ポーターのファイブフォース分析

5.2. サプライチェーン分析

5.3. 価格分析

5.4. 特許分析

5.5. 規制分析

5.6. SWOT分析

5.7. 未充足ニーズ

6. 製品タイプ別

6.1. はじめに

6.1.1. 種類別分析および前年比成長率(%)

6.1.2. 種類別市場魅力度指数

6.2. リードレスペースメーカー *

6.2.1. はじめに

6.2.2. 市場規模分析および前年比成長率(%)

6.3. 従来型ペースメーカー

6.3.1. シングルチャンバーペースメーカー

6.3.2. デュアルチャンバーペースメーカー

6.3.3. 両室ペーシング機能付きペースメーカー

6.4. マルチサイトペーシングシステム

6.5. その他

7. 用途別

7.1. はじめに

7.1.1. 用途別市場規模分析および前年比成長率(%)、用途別

7.1.2. 用途別市場魅力度指数

7.2. 徐脈*

7.2.1. はじめに

7.2.2. 市場規模分析および前年比成長率分析(%)

7.3. 心房細動

7.4. 心臓ブロック

7.5. その他

8. エンドユーザー別

8.1. はじめに

8.1.1. エンドユーザー別市場規模分析および前年比成長率(%)

8.1.2. エンドユーザー別市場魅力度指数

8.2. 病院*

8.2.1. はじめに

8.2.2. 市場規模分析および前年比成長率(%)

8.3. 専門クリニック

8.4. 外来外科センター

8.5. その他

9. 地域別

9.1. はじめに

9.1.1. 地域別市場規模分析および前年比成長率分析(%)

9.1.2. 地域別市場魅力度指数

9.2. 北米

9.2.1. はじめに

9.2.2. 地域特有の主な動向

9.2.3. 市場規模分析および前年比成長率分析(%)、製品種類別

9.2.4. 市場規模分析および前年比成長率分析(%)、用途別

9.2.5. 市場規模分析および前年比成長率分析(%)、エンドユーザー別

9.2.6. 市場規模分析および前年比成長率分析(%)、国別

9.2.6.1. 米国

9.2.6.2. カナダ

9.2.6.3. メキシコ

9.3. ヨーロッパ

9.3.1. はじめに

9.3.2. 主要地域別の動向

9.3.3. 市場規模分析および前年比成長率分析(%)、製品種類別

9.3.4. 用途別市場規模分析および前年比成長率(%)

9.3.5. エンドユーザー別市場規模分析および前年比成長率(%)

9.3.6. 国別市場規模分析および前年比成長率(%)

9.3.6.1. ドイツ

9.3.6.2. 英国

9.3.6.3. フランス

9.3.6.4. スペイン

9.3.6.5. イタリア

9.3.6.6. ヨーロッパのその他地域

9.4. 南アメリカ

9.4.1. はじめに

9.4.2. 主要地域特有の動向

9.4.3. 市場規模分析および前年比成長率分析(%)、製品種類別

9.4.4. 用途別市場規模分析および前年比成長率(%)

9.4.5. エンドユーザー別市場規模分析および前年比成長率(%)

9.4.6. 国別市場規模分析および前年比成長率(%)

9.4.6.1. ブラジル

9.4.6.2. アルゼンチン

9.4.6.3. 南米その他

9.5. アジア太平洋地域

9.5.1. はじめに

9.5.2. 主要地域特有の動向

9.5.3. 市場規模分析および前年比成長率分析(%)製品種類別

9.5.4. 市場規模分析および前年比成長率分析(%)用途別

9.5.5. エンドユーザー別市場規模分析および前年比成長率分析(%)

9.5.6. 国別市場規模分析および前年比成長率分析(%)

9.5.6.1. 中国

9.5.6.2. インド

9.5.6.3. 日本

9.5.6.4. 韓国

9.5.6.5. アジア太平洋地域その他

9.6. 中東およびアフリカ

9.6.1. はじめに

9.6.2. 主要地域特有の動向

9.6.3. 市場規模分析および前年比成長率(%)、製品種類別

9.6.4. 市場規模分析および前年比成長率(%)、用途別

9.6.5. エンドユーザー別市場規模分析および前年比成長率分析(%)

10. 競合状況

10.1. 競合シナリオ

10.2. 市場ポジショニング/シェア分析

10.3. 合併・買収分析

11. 企業プロフィール

Medtronic

Abbott Laboratories

Boston Scientific Corporation

BIOTRONIK

MicroPort Scientific Corporation

EBR Systems, Inc.

Lepu Medical Technology (Beijing) Co., Ltd.

Acutus Medical, Inc.

AED Brands

Zoll Medical

リストは網羅的なものではありません。

12. 付録

12.1. 当社およびサービスについて

12.2. お問い合わせ

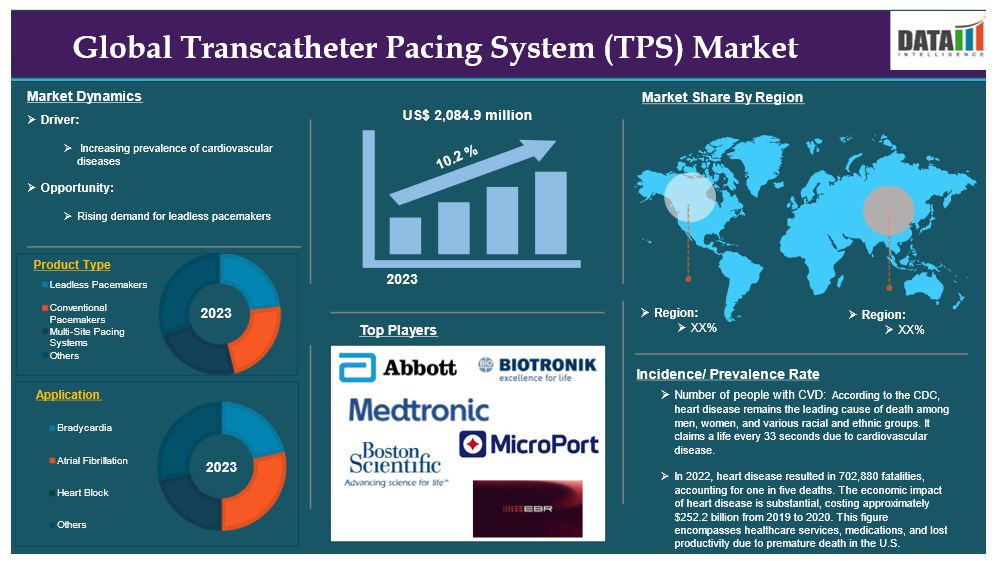

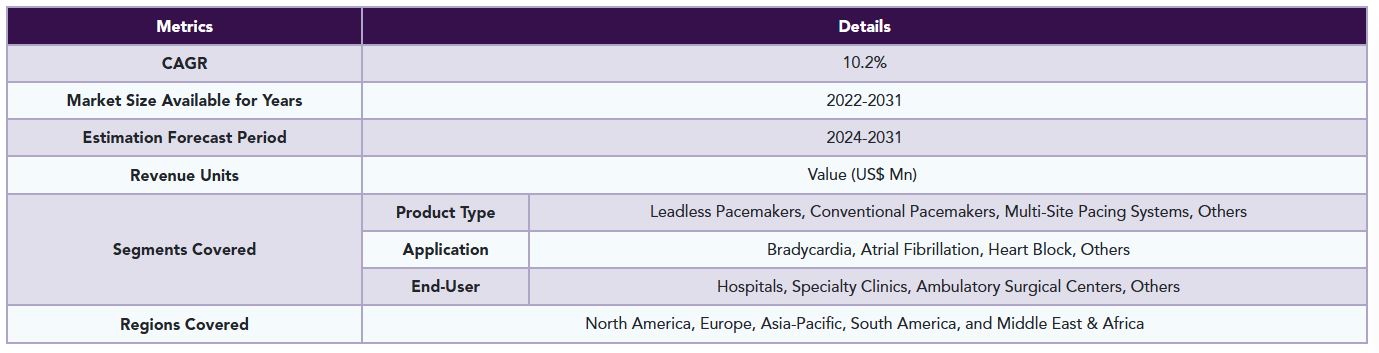

The global transcatheter pacing system (TPS) market reached US$ 2,084.9 million in 2023 and is expected to reach US$ 4,518.1 million by 2031, growing at a CAGR of 10.2 % during the forecast period 2024-2031.

A transcatheter pacing system (TPS) is a cutting-edge cardiac pacing technology that facilitates the direct implantation of a pacemaker into the heart using a catheter, thereby removing the necessity for surgical leads. This system is specifically engineered to deliver electrical impulses to the heart, ensuring it maintains an appropriate heart rate for patients experiencing various types of bradycardia.

Transcatheter pacing system (TPS) devices operate without leads, which significantly lowers the risk of complications such as infections and lead dislodgement. The implantation process is conducted via a catheter introduced through a vein, often leading to quicker recovery times and reduced patient discomfort. Devices such as the Micra TPS are notably smaller than traditional pacemakers, measuring under 2.5 cm in diameter, which simplifies the implantation process and enhances manageability within the body. These factors have driven the global transcatheter pacing system (TPS) market expansion.

Market Dynamics: Drivers & Restraints

Increasing Prevalence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases is significantly driving the growth of the global transcatheter pacing system (TPS) market and is expected to drive throughout the market forecast period.

The increasing incidence of heart-related conditions, especially atrioventricular (AV) block, is a significant factor driving the growth of the transcatheter pacing system (TPS) market. AV block occurs when the electrical signals that regulate the heart's chambers are disrupted, which can lead to inefficient heart function and serious health complications. As more individuals are diagnosed with AV block, the need for effective pacing solutions, such as advanced devices like the Micra AV, is on the rise.

The number of patients diagnosed with AV block is rising, largely due to an aging population and an increase in cardiovascular diseases. Conditions like hypertension, diabetes, and heart failure contribute significantly to the decline in electrical conduction within the heart. Reports indicate that bradyarrhythmias, including AV block, are particularly prevalent among older adults, affecting approximately 1 in every 600 individuals over the age of 65.

For instance, according to an NCBI research publication in February 2024, the exact prevalence of AV blocks is not well established, primarily because there are no comprehensive population-based studies that specifically examine their frequency. However, it is estimated that autoantibody-mediated congenital AV block occurs in about 1 in every 15,000 births. All these factors demand the transcatheter pacing system (TPS).

Furthermore, key players' strategies such as partnerships & collaborations, and product launches would drive this global transcatheter pacing system (TPS) market growth. For instance, In July 2021, MicroPort Cardiac Rhythm Management Limited, a subsidiary of MicroPort Scientific Corporation, announced a significant investment of US$150 million aimed at advancing the development of implantable devices and defibrillators. This investment underscores the company's commitment to innovation in cardiac care, particularly in the realm of heart rhythm management.

Also, in January 2021, Medtronic launched the Micra AV, the world's smallest pacemaker designed specifically for patients with atrioventricular (AV) block. This innovative device represents a significant advancement in cardiac pacing technology, offering a minimally invasive approach to treatment. All these factors demand the global transcatheter pacing system (TPS) market.

Moreover, the rising demand for leadless pacemakers contributes to the global transcatheter pacing system (TPS) market expansion.

High Costs of Devices

The high costs of devices will hinder the growth of the global transcatheter pacing system (TPS) market.

The high costs of devices represent a significant restraint within the global transcatheter pacing system (TPS) market, impacting both the adoption of these advanced technologies and their accessibility to patients in need of cardiac pacing solutions.

Procedural time could become a crucial factor for the costly devices in the market. Medtronic's Micra is estimated to be priced around $10,000, while traditional pacemakers typically average about $2,500. The assumption is that savings from reduced surgical costs would make the Micra a cost-effective option. Even minor reductions in procedural time could significantly influence the overall cost-effectiveness of these devices, highlighting the importance of efficiency in their adoption.

Many hospitals and clinics operate under strict budget constraints, particularly in areas with limited healthcare funding. The high costs associated with transcatheter pacing system (TPS)can restrict healthcare facilities' ability to acquire these devices, leading them to favor more traditional, cost-effective alternatives. The elevated costs associated with transcatheter pacing system (TPS) can create a divide in the market, where only wealthier patients or those in developed countries can afford these advanced technologies. This segmentation restricts the potential customer base for manufacturers and may slow overall transcatheter pacing system (TPS) market expansion, particularly in emerging markets where budget constraints are more pronounced.

Thus, the above factors could be limiting the global transcatheter pacing system (TPS) market's potential growth.

Segment Analysis

The global transcatheter pacing system (TPS) market is segmented based on product type, application, end-user, and region.

Product Type:

The leadless pacemakers segment is expected to dominate the global transcatheter pacing system (TPS) market share

The leadless pacemakers segment holds a major portion of the global transcatheter pacing system (TPS) market share and is expected to continue to hold a significant portion of the global transcatheter pacing system (TPS) market share during the forecast period.

Leadless pacemakers are advanced, compact devices engineered to deliver electrical impulses directly to the heart, ensuring it maintains a proper rhythm and rate. Unlike traditional pacemakers that rely on leads and external components, leadless pacemakers are self-contained units implanted directly into the heart. This innovation in cardiac care technology offers numerous significant advantages.

Leadless pacemakers are typically inserted through a catheter that is guided via a vein in the leg (usually the femoral vein). This approach greatly reduces the need for invasive surgical procedures associated with traditional pacemaker implantation, which often requires an incision in the chest and the placement of leads that connect to the heart. The catheter-based method minimizes surgical risks, such as infections and complications related to larger surgical wounds. Thus, all these factors demand the transcatheter pacing system (TPS).

Furthermore, key players in the industry have technological advancements and investments in leadless pacemakers that would drive this segment's growth in the global transcatheter pacing system (TPS) market. For instance, in February 2022, Abbott announced a significant advancement in cardiac pacing technology with the successful implantation of the AVEIR dual-chamber leadless pacemaker system as part of its AVEIR DR i2i pivotal clinical study. This milestone marks the world's first patient implants of a dual-chamber leadless pacemaker, representing a groundbreaking development in leadless pacing technology.

Also, in April 2022, Cairdac SAS successfully closed its first funding round, raising nearly $18.5 million to further develop its innovative autonomous leadless pacemaker system known as ALPS (Autonomous Leadless Pacing System). This funding round saw participation from five French private equity funds and banks, highlighting strong investor confidence in Cairdac's technology and its potential impact on cardiac care. These factors have solidified the segment's position in the global transcatheter pacing system (TPS) market.

Geographical Analysis

North America is expected to hold a significant position in the global transcatheter pacing system (TPS) market share

North America holds a substantial position in the global transcatheter pacing system (TPS) market and is expected to hold most of the market share.

The increasing prevalence of heart-related conditions, particularly bradyarrhythmia and atrioventricular (AV) block, is a major driver for the transcatheter pacing system (TPS) market. As the population ages and lifestyle-related health issues become more common, there is a heightened demand for effective cardiac pacing solutions to manage these conditions.

According to the CDC, heart disease remains the leading cause of death among men, women, and various racial and ethnic groups. It claims a life every 33 seconds due to cardiovascular disease. In 2022, heart disease resulted in 702,880 fatalities, accounting for one in five deaths. The economic impact of heart disease is substantial, costing approximately $252.2 billion from 2019 to 2020. This figure encompasses healthcare services, medications, and lost productivity due to premature death in the U.S.

Ongoing advancements in pacing technology, such as the introduction of leadless pacemakers and sophisticated algorithms for synchronized pacing, are enhancing the safety and effectiveness of transcatheter systems. These innovations attract healthcare providers and patients who are looking for modern treatment options that minimize complications associated with traditional pacemakers.

Moreover, in this region, a major number of key players' presence, well-advanced healthcare infrastructure, strong investment in research and development, favorable regulatory environment, and product launches & approvals help to propel this global transcatheter pacing system (TPS) market. For instance, in May 2023, Medtronic plc announced that it received U.S. Food and Drug Administration (FDA) approval for its next-generation leadless pacemakers, the Micra AV2 and Micra VR2. These devices represent a significant advancement in cardiac pacing technology, building on the success of the original Micra pacemaker, which was the first leadless device approved by the FDA.

Also, in July 2023, Abbott recently announced that the U.S. Food and Drug Administration (FDA) has approved its AVEIR dual chamber (DR) leadless pacemaker system, marking a significant milestone as it becomes the world's first dual chamber leadless pacing system. This innovative technology is designed to treat patients with abnormal or slow heart rhythms, particularly those who require pacing in both the right atrium and right ventricle of the heart.

Thus, the above factors are consolidating the region's position as a dominant force in the global transcatheter pacing system (TPS) market.

Asia Pacific is growing at the fastest pace in the global transcatheter pacing system (TPS) market

Asia Pacific holds the fastest pace in the global transcatheter pacing system (TPS) market and is expected to hold most of the market share.

The Asia-Pacific region is witnessing rapid population aging, with projections indicating that the number of individuals aged 60 and older will rise from 630 million in 2020 to approximately 1.3 billion by 2050. This demographic shift is expected to lead to a higher prevalence of age-related health issues, particularly cardiovascular diseases. As people age, they become more susceptible to conditions such as bradyarrhythmia and atrioventricular (AV) block, which are linked to the natural decline in cardiac function that occurs with aging. Consequently, there is an increasing demand for effective cardiac pacing solutions to manage these conditions.

For instance, according to The Lancet Regional Health - Western Pacific research publication in August 2024, between 2025 and 2050, crude cardiovascular mortality in Asia is projected to increase by 91.2%, despite a 23.0% decrease in the age-standardized cardiovascular mortality rate (ASMR). Ischaemic heart disease is expected to account for 115 deaths per 100,000 population, while stroke will contribute 63 deaths per 100,000 population, making them the leading causes of ASMR by 2050.

Central Asia will have the highest ASMR at 676 deaths per 100,000 population, which is over three times higher than the overall ASMR for Asia, estimated at 186 deaths per 100,000 population. In contrast, high-income regions within Asia will see an ASMR of only 22 deaths per 100,000. Throughout Asia, high systolic blood pressure will be the primary contributor to ASMR, resulting in 105 deaths per 100,000 population, except in Central Asia, where high fasting plasma glucose levels will dominate with 546 deaths per 100,000 population.

Furthermore, key players in the region product launches & approvals and government initiatives that would drive this global transcatheter pacing system (TPS) market growth. For instance, in January 2022, Medtronic plc announced that it had received approval from Japan's Ministry of Health, Labor, and Welfare for the sale and reimbursement of its Micra AV Transcatheter Pacing System (TPS). This approval is significant as it allows for the launch of the Micra AV, which is the world's smallest leadless pacemaker, in one of the largest medical markets globally.

Thus, the above factors are consolidating the region's position as the fastest-growing force in the global transcatheter pacing system (TPS) market.

Competitive Landscape

The major global players in the transcatheter pacing system (TPS) market include Medtronic, Abbott Laboratories, Boston Scientific Corporation, BIOTRONIK, MicroPort Scientific Corporation., EBR Systems, Inc., Lepu Medical Technology (Beijing) Co., Ltd., Acutus Medical, Inc., AED Brands, and Zoll Medical among others.

Key Developments

• In August 2024, MicroPort CRM achieved EU Medical Device Regulation (MDR) approval for three of its pacemakers ALIZEA, BOREA, and CELEA. This approval signifies that these devices meet the stringent safety and efficacy standards set by the European Union for medical devices.

Why Purchase the Report?

• Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

• Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

• Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

• Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

• Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

• Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

• Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

• Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

• Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

• Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

• Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

• Post-market Surveillance: Uses post-market data to enhance product safety and access.

• Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global transcatheter pacing system (TPS) market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2023

• Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

• Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

• Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

• Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

• Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

• Supply Chain: Distribution and Supply Chain Managers.

• Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

• Academic & Research: Academic Institutions.

1. Methodology and Scope

1.1. Research Methodology

1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

3.1. Snippet by Product Type

3.2. Snippet by Application

3.3. Snippet by End-User

3.4. Snippet by Region

4. Dynamics

4.1. Impacting Factors

4.1.1. Drivers

4.1.1.1. Increasing Prevalence of Cardiovascular Diseases

4.1.1.2. XX

4.1.2. Restraints

4.1.2.1. High Costs of Devices

4.1.3. Opportunity

4.1.4. Impact Analysis

5. Industry Analysis

5.1. Porter’s Five Force Analysis

5.2. Supply Chain Analysis

5.3. Pricing Analysis

5.4. Patent Analysis

5.5. Regulatory Analysis

5.6. SWOT Analysis

5.7. Unmet Needs

6. By Product Type

6.1. Introduction

6.1.1. Analysis and Y-o-Y Growth Analysis (%), By Product Type

6.1.2. Market Attractiveness Index, By Product Type

6.2. Leadless Pacemakers *

6.2.1. Introduction

6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

6.3. Conventional Pacemakers

6.3.1. Single-Chamber Pacemaker

6.3.2. Dual-Chamber Pacemaker

6.3.3. Biventricular Pacemaker

6.4. Multi-Site Pacing Systems

6.5. Others

7. By Application

7.1. Introduction

7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

7.1.2. Market Attractiveness Index, By Application

7.2. Bradycardia*

7.2.1. Introduction

7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

7.3. Atrial Fibrillation

7.4. Heart Block

7.5. Others

8. By End-User

8.1. Introduction

8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

8.1.2. Market Attractiveness Index, By End-User

8.2. Hospitals*

8.2.1. Introduction

8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

8.3. Specialty Clinics

8.4. Ambulatory Surgical Centers

8.5. Others

9. By Region

9.1. Introduction

9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

9.1.2. Market Attractiveness Index, By Region

9.2. North America

9.2.1. Introduction

9.2.2. Key Region-Specific Dynamics

9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.2.6.1. U.S.

9.2.6.2. Canada

9.2.6.3. Mexico

9.3. Europe

9.3.1. Introduction

9.3.2. Key Region-Specific Dynamics

9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.3.6.1. Germany

9.3.6.2. U.K.

9.3.6.3. France

9.3.6.4. Spain

9.3.6.5. Italy

9.3.6.6. Rest of Europe

9.4. South America

9.4.1. Introduction

9.4.2. Key Region-Specific Dynamics

9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.4.6.1. Brazil

9.4.6.2. Argentina

9.4.6.3. Rest of South America

9.5. Asia-Pacific

9.5.1. Introduction

9.5.2. Key Region-Specific Dynamics

9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

9.5.6.1. China

9.5.6.2. India

9.5.6.3. Japan

9.5.6.4. South Korea

9.5.6.5. Rest of Asia-Pacific

9.6. Middle East and Africa

9.6.1. Introduction

9.6.2. Key Region-Specific Dynamics

9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

9.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10. Competitive Landscape

10.1. Competitive Scenario

10.2. Market Positioning/Share Analysis

10.3. Mergers and Acquisitions Analysis

11. Company Profiles

11.1. Medtronic*

11.1.1. Company Overview

11.1.2. Product Portfolio and Description

11.1.3. Financial Overview

11.1.4. Key Developments

11.2. Abbott Laboratories

11.3. Boston Scientific Corporation

11.4. BIOTRONIK

11.5. MicroPort Scientific Corporation.

11.6. EBR Systems, Inc.

11.7. Lepu Medical Technology (Beijing) Co., Ltd.

11.8. Acutus Medical, Inc.

11.9. AED Brands

11.10. Zoll Medical

LIST NOT EXHAUSTIVE

12. Appendix

12.1. About Us and Services

12.2. Contact Us

*** 経皮ペーシングシステム(TPS)の世界市場に関するよくある質問(FAQ) ***

・経皮ペーシングシステム(TPS)の世界市場規模は?

→DataM Intelligence社は2023年の経皮ペーシングシステム(TPS)の世界市場規模を20億8490万米ドルと推定しています。

・経皮ペーシングシステム(TPS)の世界市場予測は?

→DataM Intelligence社は2031年の経皮ペーシングシステム(TPS)の世界市場規模を45億1810万米ドルと予測しています。

・経皮ペーシングシステム(TPS)市場の成長率は?

→DataM Intelligence社は経皮ペーシングシステム(TPS)の世界市場が2024年~2031年に年平均10.2%成長すると展望しています。

・世界の経皮ペーシングシステム(TPS)市場における主要プレイヤーは?

→「Medtronic、Abbott Laboratories、Boston Scientific Corporation、BIOTRONIK、MicroPort Scientific Corporation、EBR Systems, Inc.、Lepu Medical Technology (Beijing) Co., Ltd.、Acutus Medical, Inc.、AED Brands、Zoll Medicalなど ...」を経皮ペーシングシステム(TPS)市場のグローバル主要プレイヤーとして判断しています。

※上記FAQの市場規模、市場予測、成長率、主要企業に関する情報は本レポートの概要を作成した時点での情報であり、最終レポートの情報と少し異なる場合があります。

*** 免責事項 ***

https://www.globalresearch.co.jp/disclaimer/